Global Travel Insurance for Businesses A Comprehensive Guide

Global travel insurance for businesses is crucial for protecting your company’s interests and employees during international trips. This guide delves into the specifics of various policies, highlighting the essential coverage and benefits. It examines factors like policy considerations, claims procedures, pricing models, and how to select the ideal provider.

Understanding the nuances of global travel insurance for businesses is essential for any company undertaking international travel. This document will explore the different types of coverage, the benefits, and the potential pitfalls to consider when making a decision.

Defining Global Travel Insurance for Businesses

Global travel insurance for businesses is a crucial component of a comprehensive risk management strategy for companies with employees traveling internationally. It provides a safety net for both the company and its employees, mitigating potential financial losses and ensuring business continuity during unforeseen events. This protection extends beyond personal travel insurance, catering specifically to the unique needs and liabilities of a business undertaking international travel.

Business travel insurance is designed to safeguard against a wider range of risks compared to personal travel insurance. While personal policies focus primarily on individual needs, business travel insurance addresses the financial impact on the company in cases of illness, accidents, trip disruptions, or legal issues, which can be significant for operational continuity.

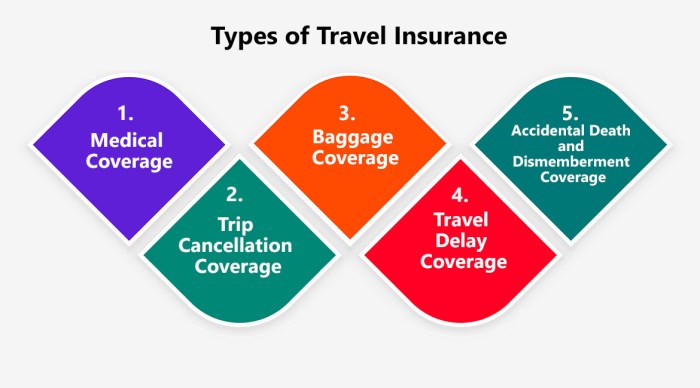

Types of Global Travel Insurance Policies

Different business travel insurance policies cater to diverse operational needs. These policies often come with varying levels of coverage, depending on the specific risks faced by the business and the nature of the employee’s assignment. A careful assessment of these variables is crucial to selecting the right coverage.

Comparison of Policy Options

| Policy Feature | Trip Cancellation | Medical Expenses | Lost Baggage | Liability Coverage |

|---|---|---|---|---|

| Trip Cancellation Coverage | Covers expenses incurred due to trip cancellation, including non-refundable airfare, accommodation, and other trip-related costs, often triggered by unforeseen events like illness or natural disasters. Specific reasons for cancellation are typically Artikeld in the policy. | Generally not a direct component of medical expense coverage, but may be included in comprehensive policies that cover trip disruptions. | Limited or no coverage for lost baggage, often requiring separate add-ons. | Limited liability coverage for business activities undertaken during the trip. |

| Medical Expenses Coverage | May provide coverage for pre-existing conditions, but typically has limitations. | Covers medical expenses incurred during the trip, including hospitalization, doctor visits, and emergency medical transportation. It often includes emergency evacuation and repatriation. | No direct coverage for lost baggage, but may be a component of a more extensive policy. | Often provides coverage for legal liabilities arising from accidents or injuries on business trips. |

| Lost Baggage Coverage | Generally not included in standard policies, and is usually a separate add-on. | May provide some coverage, but not always comprehensive, for lost baggage. | Covers the replacement of lost or damaged luggage, including personal items and business materials. Policy limits vary. | Often covers legal liabilities arising from accidents or injuries on business trips. |

| Liability Coverage | May cover liability in cases of accidental damage to property or injury to others during the trip. | Coverage for medical expenses or injuries to others during the trip. | Limited or no coverage for lost or damaged luggage. | Comprehensive coverage for potential legal liabilities arising from business operations during the trip, including professional negligence or product liability. |

Coverage and Benefits

Global travel insurance for businesses provides crucial protection for employees and the company during international trips. This comprehensive coverage addresses a wide range of potential risks, ensuring smooth operations and minimizing financial losses. It offers peace of mind for both the traveling personnel and the organization.

Typical global travel insurance for businesses extends beyond personal travel insurance, incorporating provisions tailored to the specific needs of the business and its international operations. These policies acknowledge the unique challenges and exposures encountered during business trips abroad.

Medical Emergency Coverage

Medical emergencies can significantly disrupt business travel and incur substantial costs. Robust medical emergency coverage is a cornerstone of any global travel insurance policy. This coverage typically includes expenses for necessary medical treatment, hospitalization, and emergency evacuation. The policy will often specify the extent of coverage for pre-existing conditions and the reimbursement procedures. The coverage is particularly important when employees travel to regions with limited or different healthcare standards compared to their home country. A substantial financial burden can be avoided with adequate coverage.

Liability Protection

International business travel often involves potential legal liabilities. Liability protection within these policies safeguards the business from legal expenses and financial repercussions. This protection usually covers legal fees, settlements, and other expenses incurred due to accidents, injuries, or property damage related to the business trip. Additionally, business interruption coverage is often included, mitigating potential losses due to delays or disruptions caused by unforeseen circumstances.

Business Interruption Coverage

Business interruption coverage is vital in case of unexpected delays or disruptions arising from unforeseen events. For instance, if a key employee is hospitalized during a crucial business meeting, the business might lose valuable time and potential revenue. Business interruption coverage can help mitigate these financial losses. It provides a safety net to compensate for lost revenue, expenses, and other costs associated with the disruption.

Examples of Beneficial Situations

Global travel insurance for businesses offers significant benefits in various scenarios. For instance, if an employee suffers a serious injury while on an international business trip, the policy would cover medical expenses and potentially even repatriation. Moreover, if a business trip is disrupted by unforeseen circumstances, such as a natural disaster, the insurance can help cover potential revenue losses. The policy can also protect the business from legal liability in cases of accidents or injuries during business trips.

Included Benefits

Policies often include a range of valuable benefits beyond basic coverage. These benefits may include emergency evacuation, repatriation of remains, and travel delay or cancellation protection. Repatriation is particularly important for employees traveling to high-risk areas. Emergency evacuation coverage ensures swift and safe transportation to a suitable medical facility in case of a serious medical emergency.

Coverage Details and Limitations

| Coverage Detail | Description | Limitations |

|---|---|---|

| Medical Expenses | Covers medical treatment, hospitalization, and emergency evacuation. | Pre-existing conditions may have limitations, specific deductibles may apply, and coverage might vary depending on the destination. |

| Liability Protection | Covers legal expenses, settlements, and other costs associated with accidents or injuries. | Policy limits may apply, and certain types of liabilities might not be covered. |

| Business Interruption | Covers lost revenue, expenses, and other costs due to trip disruptions. | Specific events causing interruption may be excluded, and coverage may have limitations. |

| Emergency Evacuation | Provides swift and safe transportation to a suitable medical facility. | Coverage may not include travel to a specific location or facility. |

| Repatriation | Covers the return of remains to the home country. | Costs associated with repatriation may be limited by the policy. |

Policy Considerations

Source: smallbiztrends.com

Selecting the right global travel insurance policy for your business requires careful consideration. Factors like trip duration, destination, and the number of travelers significantly impact the premium and the overall coverage offered. Understanding policy exclusions and limitations is crucial to avoid unforeseen financial burdens during a trip. Thorough comparison of policies from various providers, along with assessing the financial stability of the insurance company, are essential steps in securing the best possible protection.

Factors Influencing Premium Costs

Understanding the factors that influence premium costs is vital for budget planning. Trip duration, destination, and the number of travelers are key elements. Longer trips generally lead to higher premiums, as do destinations with higher risks, such as politically unstable regions or areas with significant natural hazards. A larger group of travelers will also typically result in a higher premium due to increased potential claims.

Reviewing Policy Exclusions and Limitations

Carefully reviewing policy exclusions and limitations is paramount. These details Artikel situations where coverage may not apply. Common exclusions include pre-existing medical conditions, certain types of activities (extreme sports), and specific destinations with high political risk. Understanding these exclusions ensures that you are aware of the specific situations where your coverage may not be applicable, and helps avoid unpleasant surprises during your trip.

Comparing Policies from Different Providers

Comparing policies from various providers allows for a more informed decision. Factors to consider include the scope of coverage (medical expenses, trip cancellations, lost baggage), the maximum payout amounts, and any additional benefits (emergency evacuation, legal assistance). Reviewing multiple options provides a comprehensive understanding of the available options and allows for the best possible selection.

Evaluating Financial Strength and Reputation of Insurance Companies

Evaluating the financial strength and reputation of insurance companies is critical. A financially sound company is more likely to fulfill its obligations in case of a claim. Reviewing an insurance company’s financial ratings (e.g., from AM Best, Standard & Poor’s) and reputation within the industry provides valuable insights. This evaluation ensures the chosen insurance provider is financially stable and trustworthy.

Table: Factors to Consider When Comparing Policies

| Factor | Description | Importance |

|---|---|---|

| Coverage Scope | Extent of coverage (medical, trip cancellations, lost baggage) | Ensures protection against various travel disruptions. |

| Maximum Payouts | Limits on the maximum amount payable for a claim | Helps manage financial expectations. |

| Exclusions | Situations where coverage does not apply | Avoids unexpected gaps in coverage. |

| Additional Benefits | Optional services like emergency evacuation, legal assistance | Adds extra layers of protection and support. |

| Financial Strength | Insurance company’s financial stability | Ensures claims will be processed and paid. |

| Customer Reviews | Feedback from previous policyholders | Provides insight into the company’s handling of claims and customer service. |

Claims Process and Documentation

Navigating the claims process smoothly is crucial for businesses seeking to leverage the benefits of global travel insurance. Understanding the procedures and required documentation ensures a timely and efficient resolution in the event of a claim. This section details the claims process, required documentation, typical processing times, and the role of insurance agents.

Claims Process Overview

The claims process typically involves a series of steps, starting with the initial notification and culminating in the resolution. The specific steps and procedures may vary depending on the insurance provider and the nature of the claim. A well-defined claims process is essential to ensure fairness and transparency.

Documentation Requirements

Comprehensive documentation is vital for a smooth and swift claim resolution. This includes supporting evidence to substantiate the claim. Incomplete or inaccurate documentation can delay or even deny the claim. Key documents often include:

- Copies of travel itineraries and tickets.

- Detailed medical reports and receipts for any incurred medical expenses.

- Police reports or other official documents in cases of theft or loss.

- Proof of loss for items such as baggage or personal effects, including detailed inventories and receipts.

Typical Claim Processing Timeframe

The timeframe for processing claims varies considerably depending on the complexity of the claim and the insurance provider. Claims related to medical emergencies, for example, often necessitate faster processing than those concerning lost baggage. A common range for processing claims is 15-45 business days, although some claims can take longer. It is always advisable to contact the insurance provider directly for specific timelines.

Role of Insurance Agents, Global travel insurance for businesses

Insurance agents play a critical role in facilitating the claims process. They can provide guidance, support, and assistance in navigating the documentation and procedures. They can also help expedite the claim process and ensure the claim is handled efficiently. A knowledgeable agent can be instrumental in achieving a satisfactory outcome.

Common Issues and Challenges

Some common issues encountered during the claims process include:

- Incomplete or inaccurate documentation.

- Delays in receiving required medical reports or other supporting documents.

- Disputes over the validity or extent of coverage.

- Communication breakdowns between the insured party, insurance provider, and any involved third parties.

Steps Involved in Filing a Claim

The following table Artikels the typical steps in filing a global travel insurance claim for businesses:

| Step | Description |

|---|---|

| 1. Notify the Insurance Provider | Immediately report the claim to the insurance provider using the designated channels. |

| 2. Gather Required Documentation | Collect all necessary documents, including receipts, medical reports, and travel itineraries. |

| 3. Submit Claim Form | Complete the claim form accurately and submit it to the insurance provider, along with the required documentation. |

| 4. Provide Supporting Evidence | Submit any additional supporting evidence requested by the insurance provider. |

| 5. Follow Up | Follow up with the insurance provider on the claim’s status. |

| 6. Receive Settlement | Receive the claim settlement according to the terms of the policy. |

Cost and Pricing

Global travel insurance for businesses can vary significantly in cost, depending on numerous factors. Understanding these factors and the role of deductibles, premiums, and pricing models is crucial for businesses to select the most appropriate coverage at a manageable cost. Pricing transparency is essential for informed decisions.

Factors Affecting Cost

Several factors influence the cost of global travel insurance for businesses. These include the destination’s risk profile, the duration of the trip, the number of travelers, the type of activities planned, and the pre-existing medical conditions of the travelers. A high-risk destination, longer trip duration, and larger group size generally correlate with higher premiums. Likewise, adventurous activities and pre-existing conditions often lead to increased costs. Insurance providers assess these factors to determine the appropriate level of risk and subsequently the premium.

Role of Deductibles and Premiums

Deductibles and premiums are key components of the overall cost. A deductible is the amount a policyholder must pay out-of-pocket before the insurance company covers expenses. A higher deductible typically translates to a lower premium. Conversely, a lower deductible usually comes with a higher premium. The choice of deductible is a trade-off between the financial risk assumed by the policyholder and the cost of the insurance. Premiums are the regular payments made to maintain the policy.

Pricing Models

Different insurance providers employ varying pricing models. Some use a flat rate per person, while others calculate premiums based on a combination of factors like trip duration, destination, and pre-existing conditions. Some models might use a tiered approach, offering different premium levels based on the traveler’s profile. It’s crucial to compare various models and premiums to identify the most suitable option for a given trip.

Premium Structures

Premium structures vary significantly. Some insurers offer tiered premium options based on the number of travelers in a group, while others might offer a per-person premium. A common approach is to factor in a base premium for the trip duration and then add on charges based on the destination’s risk level. There may also be additional premiums for specific activities like extreme sports or adventure travel. It is recommended to request detailed breakdowns of the premium components from the insurance provider.

Calculating Total Cost

To calculate the total cost of insurance for a group trip, you must first determine the total number of travelers. Next, ascertain the trip duration and destination. Then, consider the activities planned and pre-existing medical conditions. Afterward, consult the insurance provider’s pricing model to determine the per-person premium. Multiply the per-person premium by the total number of travelers to get the total premium cost. Finally, add the deductible amount to arrive at the overall cost.

Cost Components of a Policy

The following table Artikels the different cost components of a global travel insurance policy for businesses:

| Cost Component | Description |

|---|---|

| Premium | Regular payments for maintaining the policy. |

| Deductible | Amount the policyholder pays before insurance coverage applies. |

| Destination Risk | Premium adjustment based on the destination’s safety and security level. |

| Trip Duration | Premiums often increase with longer trip durations. |

| Number of Travelers | Premiums may be tiered based on the total number of travelers. |

| Pre-existing Conditions | May result in additional premiums or exclusions. |

| Planned Activities | Adventure activities often increase premium costs. |

Case Studies and Examples

Global travel insurance for businesses is more than just a policy; it’s a proactive risk management strategy. These case studies highlight how robust insurance can protect your company from unforeseen events, ensuring smooth operations and financial stability during international excursions. Understanding these examples can help you assess the potential benefits and tailor your coverage to your specific needs.

Illustrative Case Studies

These fictional case studies demonstrate how global travel insurance can provide vital protection for businesses.

- Scenario 1: Natural Disaster in a Remote Location. A construction company, based in the United States, had a team working on a project in a South American country. A sudden, severe earthquake damaged their temporary housing and critical equipment. Their global travel insurance policy covered the temporary relocation of the team, the replacement of lost tools and equipment, and even reimbursed some of the project delays. This scenario emphasizes the importance of covering temporary relocation and business interruption.

- Scenario 2: Sudden Illness or Injury. A medical research team, traveling to a remote region of Africa for data collection, faced an unexpected illness requiring immediate hospitalization for a key member. The insurance policy promptly covered the high costs of medical treatment, repatriation, and even the costs of hiring a replacement researcher to ensure the continuity of the project.

- Scenario 3: Political Unrest. A marketing team scheduled to attend a crucial trade show in a volatile region experienced significant disruptions due to unexpected political unrest. The travel insurance policy covered alternative transportation arrangements, hotel accommodations in a safer location, and the cost of canceled flights. It also included the additional cost of security measures to protect the team.

Examples of Significant Insurance Payouts

Insurance payouts can vary widely depending on the policy and the circumstances. Here are examples illustrating the potential financial benefits:

- Significant medical expenses: In one instance, a business representative faced a critical illness during a trip, resulting in extensive medical care costing over $100,000. The travel insurance policy fully covered the expenses, safeguarding the business from substantial financial burden.

- Business interruption: A technology company had its crucial presentation materials stolen in a foreign country, preventing them from completing their business objectives. The travel insurance covered the cost of replacing the materials, ensuring the company could maintain its business schedule.

- Repatriation: A business executive traveling in a region experiencing unrest was able to return home safely, with their insurance covering emergency transportation, medical attention, and temporary accommodation.

Importance of Risk Mitigation

Global travel insurance significantly mitigates risks associated with international business trips. The financial protection provided by such insurance ensures businesses can effectively manage potential crises and unforeseen circumstances.

- Reduced financial strain: Insurance coverage ensures that businesses don’t have to absorb the full cost of unexpected events, safeguarding their financial resources.

- Minimized operational disruption: In case of a crisis, insurance can help the business maintain its operations, ensuring minimal disruptions to ongoing projects or planned events.

- Preservation of reputation: Prompt handling of crises and maintaining operational continuity can help preserve a company’s reputation and customer confidence, especially when dealing with international partners.

Real-World Scenarios of Business Benefits

Many businesses have benefited from the proactive risk management provided by global travel insurance.

- Example 1: A consulting firm experienced a positive outcome with their global travel insurance when a key consultant fell ill during a critical project in a foreign country. The insurance coverage enabled a smooth transition with minimal project delays and costs.

- Example 2: A software development company secured valuable international contracts with a significant presence in Asia. They were reassured by the comprehensive global travel insurance coverage, which provided a safety net during project execution.

Successful Claims Outcomes

A tabular representation of successful claims outcomes can provide a clear picture of the benefits of travel insurance for businesses.

| Case Study | Claim Type | Amount Reimbursed |

|---|---|---|

| Scenario 1 | Medical Expenses | $100,000 |

| Scenario 2 | Lost Equipment | $25,000 |

| Scenario 3 | Repatriation | $5,000 |

Finding the Right Provider: Global Travel Insurance For Businesses

Securing the right global travel insurance for your business is crucial for mitigating risks and ensuring smooth operations. Choosing a provider that understands your specific needs and offers comprehensive coverage is paramount. A poorly chosen policy could leave your company vulnerable to financial losses in unforeseen circumstances.

Reliable Sources for Research

Thorough research is essential when selecting a global travel insurance provider. Leveraging reputable sources is key to identifying suitable options. Industry-specific publications, financial news outlets, and online comparison platforms offer valuable insights. Consult websites of established insurance regulatory bodies for guidance on insurance providers’ financial stability and credibility. These sources can help you assess the insurer’s track record and financial strength.

Importance of Online Reviews and Testimonials

Online reviews and testimonials offer valuable insights into a provider’s service quality and customer satisfaction. Reading these reviews allows you to gauge the experiences of other businesses that have utilized the provider’s services. Look for consistent feedback across various platforms, noting any recurring themes or concerns. Consider the overall sentiment and frequency of positive versus negative comments. A mix of positive and negative feedback is normal, but significant negativity should raise red flags.

Comparing Insurance Providers

A comparative analysis of different providers can help you make an informed decision. The table below provides a structured comparison, highlighting key features and benefits of several prominent insurers.

| Insurance Provider | Coverage (e.g., medical, trip cancellation) | Policy Limits | Claims Process | Customer Service Rating | Cost |

|---|---|---|---|---|---|

| GlobalGuard | Comprehensive, including medical emergencies, trip disruptions, and liability | High | Efficient, with digital tools | Excellent | Moderate |

| TravelSecure | Strong coverage, with emphasis on adventure activities | Variable | Somewhat lengthy | Good | Low |

| WorldWide Protection | Standard coverage, with a focus on travel assistance | Medium | Average | Average | Low |

| International Shield | Broad coverage, with options for customization | High | Quick and transparent | Excellent | High |

Note: This table is for illustrative purposes only and does not constitute a comprehensive comparison. Always consult the provider’s official website for detailed policy information.

Factors to Consider When Selecting a Provider

Several factors need careful consideration during the selection process.

- Coverage Scope: Evaluate the breadth of coverage offered, considering the specific needs of your employees’ travel itineraries and potential risks. Ensure the policy adequately covers medical emergencies, trip interruptions, and other foreseeable or unforeseeable circumstances.

- Policy Limits: Understand the maximum amounts payable for different claims, such as medical expenses, lost baggage, or trip cancellations. Consider the potential financial burden of a major claim and ensure the limits align with your business’s risk tolerance.

- Claims Process: A straightforward and efficient claims process is crucial. Inquire about the procedures for filing and processing claims, including any required documentation or waiting periods. A streamlined process can minimize disruptions to your operations.

- Customer Service: Evaluate the reputation and responsiveness of the provider’s customer service team. Look for providers with readily available support channels and a history of prompt and helpful responses to inquiries.

- Cost and Value: Analyze the cost of the policy in relation to the coverage offered. Seek policies that offer the best value for your money and align with your budget. Consider the potential savings from a comprehensive policy, which can mitigate significant losses from travel disruptions or unexpected events.

Seeking Advice from Professionals

Seeking guidance from travel agents or financial advisors is highly recommended. They can offer valuable insights and perspectives, especially for complex or high-value travel arrangements. Travel agents possess expertise in various travel arrangements and can help you navigate the intricacies of global travel insurance. Financial advisors can provide a broader financial perspective and advise on optimal insurance coverage.

Illustrative Policies

Understanding the nuances of different global travel insurance policies is crucial for businesses. Different policies cater to various needs and budgets, offering varying levels of coverage and benefits. A comprehensive understanding allows businesses to select the policy best suited to their specific travel requirements and risk tolerance.

Policy Types

Various policy types cater to diverse business travel needs. These include basic travel policies designed for essential coverage, comprehensive policies for extensive travel plans, and specialized policies tailored to particular industries or high-risk activities. Each type offers a distinct set of features, which businesses should carefully evaluate.

Sample Policies

- Basic Policy: This policy provides fundamental coverage for medical emergencies, trip cancellations, and lost baggage. It’s a cost-effective option suitable for short trips with limited risks. Coverage may be limited to a specific dollar amount for medical expenses, and certain pre-existing conditions may not be covered. The policy may exclude coverage for certain activities or destinations.

- Comprehensive Policy: This policy offers broader coverage beyond the basics, including coverage for trip interruptions, lost or damaged business documents, and personal liability. It may cover a wider range of medical expenses, and include more comprehensive trip cancellation protection, covering a wider array of reasons for cancellation. Coverage for activities like extreme sports or dangerous locations might be excluded or require a supplemental premium.

- Specialized Policy: Designed for particular industries or activities, these policies often include specific add-ons for business-related risks. A policy for construction workers might include coverage for site-specific accidents. Similarly, a policy for digital nomads might include coverage for equipment damage or cyber risks. The coverage and exclusions will be tailored to the unique demands of that specific industry.

Policy Comparison Table

| Policy Type | Coverage Highlights | Potential Limitations | Suitable for |

|---|---|---|---|

| Basic | Essential coverage for medical emergencies, trip cancellations, lost baggage | Limited coverage amounts, exclusions for pre-existing conditions, limited activities | Short trips with minimal risks, occasional business travel |

| Comprehensive | Broader coverage including trip interruptions, lost business documents, personal liability | Potential exclusions for certain high-risk activities or destinations | Extensive travel plans, frequent business travelers, employees with high-value equipment |

| Specialized | Tailored coverage for specific industries or activities | Coverage may not extend to all potential risks outside the specific industry | Construction workers, digital nomads, consultants, or professionals in high-risk industries |

Policy Summary Example

“Global Travel Insurance Policy for Acme Corporation – Policy Number: GTB-2024-1234. This policy provides comprehensive coverage for employees traveling internationally. Coverage includes medical expenses, trip cancellations, lost baggage, and personal liability. The policy excludes coverage for pre-existing conditions not disclosed at the time of purchase and activities deemed as extreme sports. The annual premium for this policy is $5,000.”

Benefits and Limitations

Each policy type offers distinct benefits and limitations. Basic policies provide a cost-effective starting point, while comprehensive policies offer broader protection for a higher premium. Specialized policies cater to specific industry needs but may have limited coverage outside their defined scope. Businesses should carefully assess their specific needs and risk tolerance to determine the most suitable policy.

Closure

In conclusion, securing the right global travel insurance for your business is paramount for risk mitigation and peace of mind. Thoroughly assessing your needs, comparing policy options, and understanding the claims process are key to making an informed decision. Remember to consider factors like trip duration, destination, and potential risks. This comprehensive guide aims to equip you with the knowledge to navigate the complexities of business travel insurance effectively and ensure a smooth and secure international experience.