Custom Business Travel Insurance Tailored Protection

Custom business travel insurance offers a tailored approach to protecting your business on the road. Unlike standard policies, custom plans provide the exact coverage needed for specific business trips, risks, and employee profiles. This detailed look examines the specifics, benefits, and process behind creating a bespoke policy.

Understanding the intricacies of custom business travel insurance is crucial for businesses needing comprehensive protection. The planning process involves carefully considering various factors, from individual employee needs to potential liabilities. This exploration delves into the key components of a custom policy, outlining the crucial elements and benefits for businesses seeking optimal security.

Defining Custom Business Travel Insurance

Custom business travel insurance is a tailored insurance policy designed to meet the specific needs of a particular business or individual traveler. Unlike standard policies, which offer a broad range of coverage, custom plans can be meticulously crafted to address unique risks and exposures. This often involves premiums that are adjusted based on the specifics of the coverage needed.

Standard policies frequently provide a baseline level of coverage, but they may not fully address the intricacies of specific business travel situations. Custom plans offer a more comprehensive and precise approach, enabling businesses to mitigate potential risks more effectively. This often results in better value for money and a more efficient risk management strategy.

Key Differences Between Standard and Custom Policies

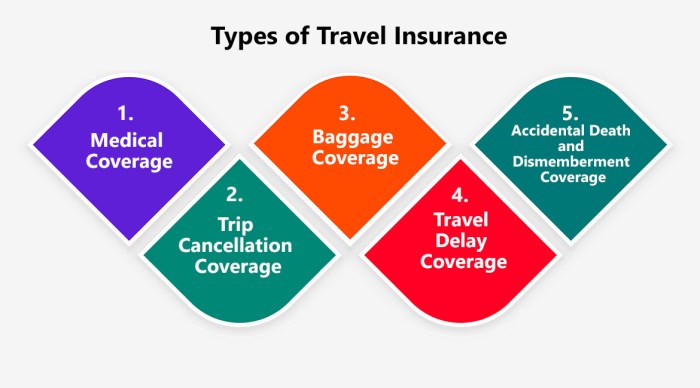

Standard business travel insurance policies offer a one-size-fits-all approach, covering common risks like trip cancellations, medical emergencies, and lost baggage. Custom policies, however, allow for detailed specifications of coverage, tailoring the policy to specific needs and situations. This often includes additional coverages or exclusions that are not typically found in standard plans. For example, a custom plan might include specialized coverage for specific industry-related risks, or specific types of lost equipment, while a standard policy would not.

Examples of Situations Requiring Custom Insurance

Custom insurance is crucial in situations where standard policies fall short. For example, a construction company deploying a team to a remote location might need specialized coverage for equipment damage, worksite accidents, or liability for third-party injury. Similarly, a tech firm sending employees on international assignments might require specific coverage for data breaches or cybersecurity incidents, as these risks are often not comprehensively addressed in standard plans.

Types of Businesses Benefiting from Custom Plans

Several types of businesses could benefit significantly from custom business travel insurance. Companies operating in high-risk industries like construction, energy, or healthcare, or those with extensive international operations, often require customized plans. Furthermore, businesses with employees traveling frequently or to unusual locations would find that custom plans provide the best protection. Also, businesses involved in high-value projects might need a custom plan that accounts for the risk of project delays or equipment loss. Small businesses, too, may benefit from a custom plan that fits their particular budget and needs.

Factors Influencing Custom Policy Design

Several key factors influence the design of a custom business travel insurance policy. These include the specific industry of the business, the nature of the business trips, the destinations, the number of employees traveling, the duration of trips, and the value of assets or equipment being transported. Moreover, factors such as the potential for liability, legal regulations in different countries, and specific risks associated with the industry or projects also influence the design of a custom policy. The risk profile of the business is a significant factor in determining the scope and cost of the insurance coverage.

Key Components of a Custom Policy

Custom business travel insurance policies go beyond the standard offerings, providing tailored coverage to address the unique needs of a specific business and its employees. This individualized approach is crucial, as the risks and liabilities faced by a company during business travel can vary significantly. Understanding the key components is essential for making informed decisions about protecting your employees and your business.

Key Components of a Custom Policy: A Summary

A well-structured custom business travel insurance policy carefully considers various potential risks, offering comprehensive protection. A table outlining the core components of such a policy, along with coverage details, is provided below.

| Component | Description | Coverage Details |

|---|---|---|

| Medical Expenses | Covers medical expenses incurred during the trip, including hospitalization, doctor visits, and emergency medical transportation. | Includes pre-existing conditions coverage, emergency evacuation, and repatriation. Custom policies can specify limits for specific medical procedures or conditions, often based on the nature of the business travel and employee profiles. |

| Trip Interruptions | Covers expenses associated with unexpected trip interruptions, such as flight cancellations or natural disasters. | Custom policies can define specific triggering events that lead to coverage, such as political instability in a travel destination or severe weather conditions. This component can include reimbursement for unused travel arrangements, accommodation, and other pre-booked expenses. |

| Lost or Delayed Baggage | Covers the loss or significant delay of checked baggage, reimbursing expenses for replacement of essential items. | Covers a range of potential losses, from total loss to delays exceeding a specific timeframe. Custom policies can define the limits for replacement of personal items and business-related equipment. |

| Liability Protection | Provides protection against legal liabilities arising from incidents during the trip. | This often includes coverage for injuries to third parties or damage to property, covering legal defense costs and settlements. Customized policies can define specific limits for liability based on the nature of the business activities. |

| Emergency Assistance | Offers assistance services in case of medical emergencies, lost documents, or other issues. | Covers 24/7 assistance for lost travel documents, arranging alternative transportation, and providing emotional support. This can be highly customized to specific needs. |

| Travel Delay and Cancellation | Covers losses due to flight delays or cancellations. | Covers expenses for meals, accommodations, and other costs incurred during delays or cancellations. |

| Accidental Death and Dismemberment | Provides financial protection in case of death or disability due to an accident. | Offers benefits to dependents or beneficiaries in the event of a covered incident. Custom policies can be tailored to specific amounts and coverage for various situations. |

Customized Coverage Areas

Several key areas are often customized in business travel insurance policies to cater to specific needs. These areas include medical expenses, trip interruptions, and lost baggage. A business operating in a high-risk region, for example, may require enhanced medical coverage, potentially including coverage for rare diseases.

Examples of Customized Coverage

Custom policies often address unique risks and liabilities. For instance, a company organizing a conference abroad might need coverage for potential disruptions to their event due to unforeseen circumstances, such as severe weather. A construction company sending employees to a remote location would require comprehensive medical coverage, potentially including coverage for helicopter evacuation.

Comparison of Coverage Options

Different coverage options for medical expenses, trip interruptions, and lost baggage can be tailored to specific circumstances. For medical expenses, policies can offer coverage for pre-existing conditions, or specific types of medical procedures. Trip interruption coverage might include options for trip extension or assistance with finding alternative arrangements. Lost baggage coverage could offer varying limits for replacement or reimbursement. A company sending employees to a developing country may opt for a higher medical coverage limit to account for potentially longer hospital stays or higher costs of treatment.

Benefits of Custom Business Travel Insurance

Tailored business travel insurance offers significant advantages over generic policies, providing a more comprehensive and protective approach. A custom policy, specifically designed to address the unique needs and risks of a particular business or individual, can often mitigate financial losses and safeguard reputation.

A standard policy, while offering some protection, might not fully account for all potential scenarios. This is where a customized solution shines. By meticulously assessing the specific requirements of a business’s travel activities, a tailored plan can minimize vulnerabilities and ensure a higher level of security. This proactive approach to risk management translates into enhanced peace of mind for all involved.

Custom Policies and Risk Mitigation

A custom policy allows for a proactive approach to risk management. By carefully evaluating the nature of the business, the types of travel, and the locations involved, a custom plan can identify and address specific vulnerabilities. This targeted approach leads to a significant reduction in potential financial losses and liabilities.

For example, a company frequently sending employees to remote or high-risk areas might require specialized coverage for medical emergencies, evacuation, and even political instability. A standard policy might not adequately address these nuances. A customized policy, however, can include specific provisions to cover these risks, ensuring the company and its employees are protected in a wider range of circumstances.

Enhanced Coverage and Tailored Protection

A custom policy allows for a significant expansion of coverage beyond the scope of a standard policy. This is because the specific needs of a business, or an individual, can be addressed more precisely. The tailored nature of a custom policy ensures that travelers are shielded from a wider array of risks.

A tailored policy might include coverage for specialized equipment, unique professional liability exposures, or even specific travel arrangements. For instance, a construction company sending teams across different continents may require insurance for heavy machinery, specialized tools, or project-related risks. A custom policy can account for these complexities, ensuring that the business is shielded against unforeseen incidents that might disrupt operations.

Increased Peace of Mind for Travelers

Knowing that they have comprehensive protection can significantly enhance the peace of mind of business travelers. A custom policy goes beyond simply providing coverage; it proactively addresses potential issues, allowing travelers to focus on their work rather than worrying about unforeseen circumstances.

Consider a company that frequently sends executives on international business trips. A custom policy could include features such as enhanced medical evacuation coverage, travel delay provisions, and even provisions for loss of business opportunities due to unforeseen delays. This comprehensive protection allows travelers to feel secure and confident, fostering productivity and reducing stress during their travels.

The Process of Creating a Custom Policy

Tailoring business travel insurance to specific needs is crucial for comprehensive protection. A customized policy addresses unique risks and ensures coverage aligns perfectly with the client’s travel plans and business objectives. This meticulous process requires a collaborative approach between the client and the insurance provider.

The development of a custom business travel insurance policy involves several key steps, from initial consultation to final policy issuance. This structured approach guarantees a comprehensive and accurate insurance solution.

Steps Involved in Policy Development

Understanding the client’s specific travel patterns, potential risks, and desired coverage is paramount in crafting an effective custom policy. This often involves multiple stages.

- Initial Consultation and Risk Assessment: The insurance provider engages with the client to discuss their travel schedule, destinations, and potential hazards. This includes identifying specific business activities, potential liabilities, and pre-existing conditions. This initial phase establishes the groundwork for a tailored policy.

- Policy Design and Customization: Based on the gathered information, the insurer designs a policy that addresses the client’s unique needs and preferences. This step often involves reviewing various coverage options, deductibles, and exclusions. The design should reflect the level of risk associated with the client’s business operations and travel plans. Examples of customization could involve adjusting daily coverage limits, adding specific medical evacuation benefits, or extending coverage for unexpected business disruptions.

- Policy Review and Approval: The client carefully reviews the proposed policy document, ensuring all aspects of coverage and exclusions are clearly understood. This crucial step allows for adjustments and clarifications before final approval.

- Policy Issuance and Ongoing Support: Once the client approves the policy, the insurer issues the official document. The provider provides ongoing support and guidance throughout the policy term, addressing any questions or concerns that may arise.

Flowchart of Policy Creation

[A flowchart illustrating the stages of policy creation would visually depict the steps described above. It would show the sequential process from initial consultation to policy issuance. The flowchart would be clear, concise, and easy to understand. This visual representation aids in understanding the process and the key decision points at each stage.]

Factors Considered When Customizing a Policy

A variety of factors influence the customization of a business travel insurance policy. Careful consideration of these factors is crucial for a well-suited solution.

| Factor | Impact | Example |

|---|---|---|

| Travel Frequency and Duration | Impacts the required coverage period and amount. | A frequent traveler may need a more comprehensive policy with a higher daily limit. |

| Destinations and Activities | Different locations have varying levels of risk. | Travel to remote areas may require specialized coverage for medical emergencies or evacuation. |

| Pre-existing Conditions | Impacts medical coverage. | A client with a pre-existing condition might require a higher limit for medical expenses. |

| Industry and Job Responsibilities | Certain industries may be exposed to higher risks. | Construction workers might need additional coverage for work-related accidents. |

| Budget and Coverage Needs | Determines the policy’s financial aspects. | Clients with a tighter budget may opt for a policy with lower premiums and adjusted coverage amounts. |

| Specific Needs | Custom policies can address specialized risks. | A policy could include coverage for data breaches, loss of important documents, or legal liability arising from business travel. |

Importance of Communication and Collaboration

Open communication between the client and the insurer is essential for a successful policy creation process. Understanding the client’s needs and concerns is critical.

Clear and frequent communication facilitates the development of a policy that accurately reflects the client’s circumstances. This ensures the client feels comfortable and informed throughout the process.

Role of Risk Assessment

A comprehensive risk assessment is crucial in developing a tailored insurance policy. Understanding the potential risks associated with a client’s travel plans allows for appropriate coverage and cost adjustments.

Risk assessment considers various factors such as the destination’s safety record, potential political instability, and specific business activities. This careful evaluation helps the insurer determine the appropriate level of coverage and premium. A robust risk assessment ensures the client receives the protection they need.

Illustrative Scenarios and Examples

Tailoring business travel insurance to specific needs is crucial for comprehensive protection. Illustrative scenarios highlight how a custom policy can address unique risks and enhance peace of mind. These examples demonstrate how a bespoke approach surpasses the limitations of generic plans.

Hypothetical Business Trip Scenario

A mid-sized tech company, “InnovateTech,” sends a team of three engineers to a critical software development conference in Tokyo, Japan. The trip involves high-stakes negotiations for a potential partnership with a Japanese firm. The engineers are tasked with presenting a novel AI algorithm and securing a significant contract. The trip spans a week, encompassing travel, accommodation, and conference participation.

Risks Involved in the Scenario

The trip presents numerous potential risks. These include:

- Travel disruptions: Unexpected flight cancellations, delays, or adverse weather conditions could impact the team’s ability to attend the conference and negotiate effectively.

- Medical emergencies: The team members may face unexpected illnesses or injuries during the trip. This is especially pertinent given the time zone difference and potential exposure to unfamiliar illnesses in Japan.

- Loss or damage of essential equipment: The engineers carry laptops, presentation materials, and other crucial tools. Loss or damage during transit or while in Japan could severely disrupt the team’s work.

- Currency fluctuations: Changes in exchange rates could impact the budget allocated for the trip. Potential costs for accommodation, transportation, and meals could be impacted by unfavorable exchange rates.

- Security concerns: Travel to certain areas or activities might present security risks. Theft or other criminal activities during the trip could compromise the team’s safety and the success of the mission.

- Legal liabilities: Potential disputes or accidents involving the team members or the company could lead to legal liabilities. These liabilities could be significantly reduced with a custom insurance policy.

Coverage Provided by a Custom Policy

A custom policy designed for InnovateTech’s trip would address these risks with tailored coverage.

- Enhanced travel disruption coverage: This coverage extends beyond standard cancellations to include alternative transportation options, accommodation, and reimbursement for unforeseen expenses resulting from trip delays.

- Comprehensive medical expense coverage: This could include emergency medical evacuation, hospitalization, and repatriation, all tailored to the specific medical needs of the engineers.

- Equipment loss or damage coverage: A custom policy would provide specific coverage for laptops, presentation materials, and other essential tools, covering damage or theft during transit and while in Japan.

- Currency fluctuation protection: The policy would include provisions to safeguard against unfavorable currency fluctuations, offering flexibility in budget management.

- Security and legal liability coverage: This would encompass coverage for potential incidents of theft, injury, or legal disputes, providing protection for both the individuals and the company.

How the Policy Protects the Business

The custom policy safeguards InnovateTech in various ways:

- Ensuring project continuity: The policy addresses potential disruptions, ensuring the team can effectively complete their mission, regardless of unforeseen circumstances.

- Protecting financial investments: The policy covers potential losses associated with travel disruptions, equipment damage, or unexpected medical expenses, mitigating financial risks.

- Maintaining professional reputation: The policy protects the team’s ability to execute their responsibilities and maintain a professional image during the conference and negotiations, minimizing reputational damage.

Comparison of Standard and Custom Policy Coverage

| Scenario | Standard Policy | Custom Policy |

|---|---|---|

| Flight cancellation due to severe weather | Limited coverage for immediate expenses, potentially excluding alternate flights or accommodation. | Comprehensive coverage including alternative transportation, accommodation, and lost earnings. |

| Medical emergency requiring hospitalization in Japan | Basic medical coverage, potentially with high deductibles. | Comprehensive medical coverage tailored to the team’s needs, including emergency medical evacuation and repatriation. |

| Theft of laptops during conference | Limited coverage for lost or stolen items. | Specific coverage for professional equipment, including laptops, presentations, and other critical items. |

| Unforeseen currency fluctuations | No direct coverage. | Coverage to mitigate financial impacts of currency fluctuations. |

Cost Considerations and Comparisons

Source: paxes.com

Understanding the cost of business travel insurance is crucial for making informed decisions. Standard policies often offer a baseline level of protection, but they may not fully address the specific needs of a company or individual traveler. Custom policies, tailored to unique requirements, can provide a more comprehensive and cost-effective solution.

Comparing the costs of standard and custom policies requires a careful analysis of the coverage, inclusions, and exclusions. Factors such as trip duration, destination, and potential risks will all influence the premium.

Standard Policy Premiums

Standard business travel insurance policies typically offer a set package of coverages. These policies are generally more affordable than custom plans, but the breadth of coverage may be limited. The cost is often based on a fixed rate per traveler or a rate based on the total trip duration.

Factors Affecting Custom Policy Prices

Several factors influence the price of a custom business travel insurance policy. These factors include:

- Trip duration and frequency: Longer trips and more frequent trips generally lead to higher premiums due to the increased risk exposure.

- Destination risk assessment: Travel to high-risk destinations, particularly those with political instability or health concerns, will result in higher premiums.

- Pre-existing medical conditions: Coverage for pre-existing conditions can affect premium costs.

- Specific coverages desired: Custom policies often include tailored coverages, which may influence the premium.

- Policy add-ons: Coverage for specific needs such as baggage loss, trip cancellation, or medical evacuation will influence the premium.

Custom Policy Cost Breakdown

A detailed breakdown of the cost components for a custom business travel insurance plan is essential. The premium is not a single figure, but rather a sum of individual components. These components may include:

- Base premium: This is the foundation of the cost, reflecting the general risk of travel for the duration and destinations.

- Per-person premium: An amount added to the base premium for each individual traveler.

- Coverage for medical emergencies: Costs for this coverage will depend on the type of coverage and the level of medical assistance.

- Coverage for trip cancellations and interruptions: Costs for this coverage will depend on the terms and conditions of the policy.

- Coverage for lost or damaged baggage: This coverage will be factored into the premium.

- Coverage for liability incidents: Costs will vary based on the scope of the liability coverage.

Premium Determination

Premium costs are determined by a complex calculation process that considers numerous factors. Insurers use statistical models and actuarial data to assess the risk associated with different types of trips and destinations. This data is then combined with the specifics of the custom policy to arrive at the final premium.

“Risk assessment plays a significant role in the calculation of premiums, incorporating historical data and anticipated risk levels.”

Policy Comparison Table, Custom business travel insurance

This table illustrates the potential cost differences between various policy options. Note that these are illustrative examples and actual premiums will vary based on individual circumstances.

| Policy Type | Premium (USD) | Coverage |

|---|---|---|

| Standard Policy (Basic) | $50-150 per person | Basic medical, trip cancellation (limited), baggage loss (limited) |

| Standard Policy (Enhanced) | $150-300 per person | Enhanced medical, trip cancellation, baggage loss, liability |

| Custom Policy (High-Risk) | $300-800+ per person | Comprehensive medical, trip cancellation, baggage loss, liability, evacuation, extended trip coverage |

| Custom Policy (Low-Risk) | $100-300 per person | Comprehensive medical, trip cancellation, baggage loss, liability |

Managing Claims and Procedures

The claims process for custom business travel insurance is designed to be straightforward and efficient, ensuring timely resolution of any covered incidents. A well-defined procedure is crucial for minimizing delays and maximizing the benefits for policyholders.

Understanding the specific procedures for different types of coverage is paramount for a smooth claim experience. This section Artikels the claims handling process and the necessary documentation required, providing policyholders with clear guidance to navigate the process effectively.

Claims Handling Process Overview

The claims process begins with a notification to the insurance provider, either through a dedicated online portal, phone, or email. This initial step is vital for initiating the claim procedure and ensuring the claim is logged promptly. Detailed information about the incident, including dates, locations, and supporting documentation, is crucial for accurate assessment.

Claim Handling for Different Coverage Types

Different types of coverage within a custom policy may necessitate different claim handling procedures. For example, medical expense claims may require submission of medical bills and receipts, while trip interruption claims may involve proof of booking confirmations and alternative arrangements. The specific documentation needed depends on the nature of the claim.

Steps Involved in Filing a Claim

The following steps Artikel the general process for filing a claim:

- Report the incident promptly to the insurance provider using the designated channels.

- Gather all necessary supporting documentation, including but not limited to receipts, invoices, and flight confirmations.

- Complete the claim form provided by the insurance provider, accurately providing all requested details.

- Submit the claim form and supporting documents to the insurance provider via the specified method.

- The insurance provider will review the claim and communicate the next steps, including any additional information required.

- The insurance provider will process the claim and notify the policyholder of the decision, including the amount of reimbursement.

Documentation Required for Various Claims

A well-organized approach to gathering documentation is key to a smooth claims process. The table below Artikels the common documentation required for different claim types.

| Claim Type | Required Documents | Procedure |

|---|---|---|

| Medical Expenses | Medical bills, receipts, doctor’s notes, pre-authorization forms | Insurance provider verifies medical necessity and coverage, then reimburses eligible expenses. |

| Trip Interruption | Flight tickets, hotel confirmations, itinerary, proof of alternative arrangements | Insurance provider assesses the validity of the interruption and reimburses expenses as per the policy terms. |

| Baggage Loss or Damage | Airline claim form, baggage tag, inventory list of lost or damaged items | Insurance provider assesses the validity of the claim and reimburses expenses for replacement or repair, if covered. |

| Emergency Evacuation | Medical records, evacuation documentation, flight confirmations, receipts | Insurance provider reviews documentation for coverage and reimburses the associated expenses, if applicable. |

| Travel Delay | Flight confirmations, receipts for accommodations and meals, evidence of delay | Insurance provider evaluates the delay’s impact and reimburses reasonable expenses incurred due to the delay, if covered. |

Final Thoughts: Custom Business Travel Insurance

In conclusion, custom business travel insurance provides a significant advantage for businesses navigating the complexities of global travel. By tailoring coverage to specific needs and risks, businesses can mitigate potential liabilities and enhance the peace of mind of their employees. The process, while detailed, ultimately empowers businesses to make informed decisions, safeguarding their interests and assets effectively. This protection is invaluable for organizations seeking a comprehensive approach to managing risks and liabilities during business travel.