Corporate Travel Protection Plans A Comprehensive Guide

Corporate travel protection plans are crucial for businesses looking to safeguard their employees and mitigate risks during international travel. These plans offer a range of benefits, from medical emergencies to trip cancellations, ensuring smooth and secure journeys. Understanding the different types of coverage, associated costs, and claim procedures is essential for informed decision-making. This guide provides a thorough overview of corporate travel protection plans, helping businesses make the right choices for their employees.

This guide will explore the intricacies of various corporate travel protection plans, including medical, trip cancellation, and baggage delay coverage. It will also examine the advantages of implementing these plans, covering employee benefits, risk mitigation for companies, and the cost-effectiveness of these plans compared to the risks of not having them. Further, we will analyze the claims process, pricing models, legal considerations, and how to select the right plan for your company’s specific needs.

Overview of Corporate Travel Protection Plans

Corporate travel protection plans are designed to safeguard businesses and their employees against unforeseen circumstances during business trips. These plans offer a range of coverage options, mitigating potential financial losses and ensuring employee well-being while traveling for work. They act as a vital safety net, providing peace of mind for both the company and its traveling staff.

Comprehensive corporate travel protection plans address a multitude of potential issues, from unexpected medical emergencies to lost luggage. These plans are increasingly important in today’s globalized business environment, where employees frequently travel for work. By offering comprehensive coverage, these plans enable companies to maintain productivity and minimize disruptions caused by travel-related incidents.

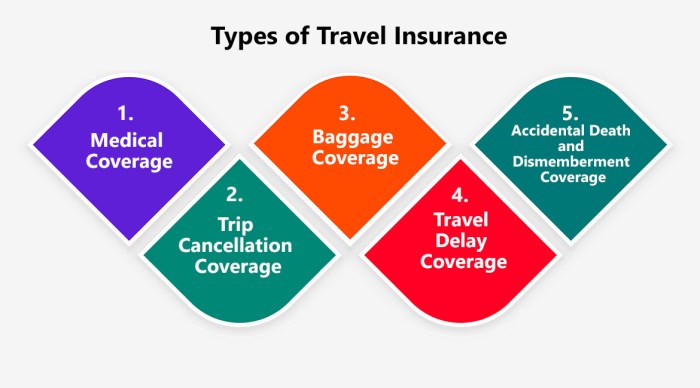

Types of Corporate Travel Protection Plans

Corporate travel protection plans encompass various types of coverage, tailored to specific needs. These plans are typically categorized by the type of risk they address. A crucial element of these plans is their flexibility to be customized to suit the specific requirements of a business.

- Medical Protection: This component of a corporate travel protection plan covers medical expenses incurred during a trip, including emergency medical treatment, hospitalisation, and repatriation. It is essential for unforeseen medical events that can arise during travel, protecting both the employee and the company from significant financial burdens.

- Trip Cancellation/Interruption: This coverage reimburses expenses already incurred or compensates for cancelled or interrupted trips due to unforeseen circumstances such as natural disasters, severe illness, or travel advisories. This aspect is critical in protecting the company’s investment in employee travel and maintaining schedule consistency.

- Baggage Delay/Loss: This coverage compensates for lost or delayed baggage, providing reimbursements for essential items and travel necessities. It is a crucial component, especially for international travel where delays can significantly impact business continuity.

- Travel Accident Insurance: This coverage provides benefits for accidental injuries sustained during travel, including medical expenses and income replacement. This aspect ensures the protection of employees’ well-being and financial security during travel-related accidents.

Common Features and Benefits

These plans typically share several common features and benefits. These characteristics make them an attractive option for businesses and their employees.

- Flexibility: Plans can be tailored to the specific needs and budget of a company, offering a variety of options for different levels of coverage.

- Cost-Effectiveness: While coverage varies, these plans can often prove cost-effective compared to the potential losses from unforeseen travel incidents.

- Peace of Mind: They provide employees with the reassurance that their well-being and financial interests are protected during work-related travel, which improves morale and productivity.

- Enhanced Employee Retention: Offering comprehensive travel protection can be a powerful recruitment and retention tool, demonstrating a company’s commitment to its employees.

Examples of Companies Offering/Utilizing These Plans

Numerous companies offer or utilize corporate travel protection plans, recognizing their value in managing travel-related risks. Examples include large multinational corporations, travel agencies, and businesses with significant international travel operations.

- Travel agencies often include travel protection plans as part of their packages, helping clients manage risks and ensuring smoother travel experiences.

- Large corporations such as tech companies, financial institutions, and consulting firms often provide comprehensive travel protection plans to their employees, which is often a part of employee benefits packages.

Comparison of Plan Types

The table below highlights key inclusions and exclusions of different plan types.

| Plan Type | Key Inclusions | Key Exclusions |

|---|---|---|

| Medical Protection | Emergency medical treatment, hospitalisation, repatriation | Pre-existing conditions (unless specifically covered), routine check-ups |

| Trip Cancellation/Interruption | Refunds for non-refundable trip elements, accommodation costs, etc. | Personal reasons, voluntary cancellations, changes in plans without a pre-defined reason |

| Baggage Delay/Loss | Compensation for lost or delayed baggage, replacement of essential items | Items not declared, items with high-value, intentional damage to luggage |

| Travel Accident Insurance | Medical expenses, income replacement for injuries | Pre-existing injuries, self-inflicted injuries |

Benefits and Advantages

Implementing corporate travel protection plans offers significant advantages for both employees and the company. These plans safeguard employees during their travels, mitigating potential risks and liabilities for the organization while fostering a positive work environment. The cost-effectiveness of these plans often outweighs the potential financial and reputational damage of unforeseen events.

Protecting employees during business trips not only enhances their safety and security but also boosts morale and productivity, ultimately benefiting the company’s bottom line. Companies that prioritize employee well-being often see increased loyalty and engagement.

Employee Protection and Peace of Mind

Corporate travel protection plans provide a crucial safety net for employees traveling for business. Comprehensive coverage includes medical emergencies, lost or stolen belongings, and trip disruptions. This proactive approach ensures employees feel secure and supported during their journeys, minimizing stress and anxieties associated with travel. Knowing they are protected allows employees to focus on their work and responsibilities, maximizing their productivity.

Mitigation of Risks and Liabilities

Travel protection plans directly address potential risks associated with business travel. These risks include medical emergencies, lost or stolen documents, and unexpected trip cancellations. The plans help companies to minimize potential financial liabilities arising from such events. Furthermore, a well-structured plan safeguards the company’s reputation by demonstrating a commitment to employee well-being and operational continuity.

Financial and Reputational Benefits

The financial benefits of travel protection plans are significant. These plans cover medical expenses, lost baggage, trip interruptions, and other unforeseen circumstances. This coverage protects the company from substantial financial losses. Reputational benefits are equally crucial. A company that demonstrates a commitment to employee safety and well-being through comprehensive travel protection plans enhances its image and strengthens its employer brand. Employees are more likely to remain loyal and engaged in a supportive environment. For example, a company known for providing robust travel protection is often perceived as more responsible and trustworthy, attracting top talent.

Cost-Effectiveness Analysis

The cost-effectiveness of travel protection plans should be evaluated in the context of potential risks and liabilities. While there is a premium for these plans, the potential financial losses from medical emergencies, trip cancellations, or legal issues related to employee safety can be significantly higher. Comprehensive plans often include options tailored to the specific needs of the organization, making them a cost-effective investment. The proactive nature of the plan is crucial. For example, a company experiencing a high rate of medical emergencies among employees traveling abroad might see significant savings in the long run with a comprehensive travel protection plan.

Enhanced Employee Morale and Productivity

Employee morale and productivity are intrinsically linked to a sense of security and well-being. Travel protection plans contribute to a positive work environment by reassuring employees that the company cares about their safety and welfare. Employees who feel valued and supported are more likely to be engaged and productive, ultimately impacting the company’s success. A proactive approach to employee well-being leads to improved performance and increased retention. For instance, a company with a strong travel protection plan might experience a reduction in employee absenteeism during travel periods.

Coverage and Exclusions

Understanding the specifics of coverage and exclusions is crucial for effectively utilizing corporate travel protection plans. A thorough review allows businesses to anticipate potential financial liabilities and ensure employees are adequately protected during their journeys. Knowing what is and isn’t covered helps in making informed decisions regarding travel arrangements and potential risks.

Common Coverage Areas

Corporate travel protection plans often include a range of coverage areas to safeguard employees against unforeseen events. These plans frequently cover medical expenses incurred during the trip, including emergency medical evacuation and repatriation. Trip interruption or cancellation due to unforeseen circumstances is also commonly addressed. Furthermore, plans often provide coverage for lost or damaged baggage, as well as for personal liability in certain situations.

Typical Exclusions

It is equally important to understand the limitations of the coverage. Typical exclusions in corporate travel protection plans often include pre-existing medical conditions. Activities deemed high-risk, such as extreme sports or participation in dangerous events, are often excluded. Coverage may also be limited for certain pre-existing conditions, or conditions that arise during the trip due to an individual’s own negligence or reckless behavior. The policy details should be thoroughly reviewed to ensure clear understanding of the excluded situations.

Importance of Understanding Coverage and Exclusions

Comprehending both the coverage and exclusions is paramount to effective risk management. This knowledge allows businesses to proactively address potential issues and ensure their employees are adequately protected. Understanding the plan’s specifics empowers informed decisions about travel arrangements, reducing the potential for financial hardship or unforeseen liabilities. A comprehensive understanding of both aspects prevents disputes and clarifies responsibilities.

Examples of Coverage and Non-Coverage

Consider these examples:

- An employee experiences a sudden, severe illness requiring hospitalization during a business trip. The plan likely covers the medical expenses incurred during the trip, including hospitalization, and potential repatriation.

- An employee cancels a business trip due to a family emergency. The plan likely covers the cancellation of the trip, if the policy terms Artikel the reason for cancellation.

- An employee sustains an injury while participating in a high-risk activity during a business trip (such as rock climbing). The plan likely will not cover this incident, as these types of activities are often explicitly excluded.

- An employee loses their luggage due to a flight delay. The plan likely covers lost or damaged baggage up to a certain amount, depending on the policy details.

Scenario-Based Coverage Analysis

This table provides a simplified illustration of potential coverage scenarios. It’s crucial to note that these are illustrative examples and the actual coverage will depend on the specific policy terms.

| Scenario | Coverage (Likely) | Explanation |

|---|---|---|

| Employee suffers a heart attack during a business trip requiring immediate medical intervention. | Yes | Medical expenses and potential repatriation are usually covered for unforeseen medical emergencies. |

| Employee’s flight is delayed due to severe weather, leading to missed meetings and resulting in a financial loss. | Likely No | Trip delays or missed meetings, as well as any financial losses, are usually not covered unless explicitly stated in the policy. |

| Employee’s luggage is lost during a flight. | Yes (to a certain limit) | Lost or damaged baggage is typically covered up to a specified amount, as detailed in the policy. |

| Employee sustains an injury while participating in a skiing trip, which is not part of the business trip itinerary. | Likely No | Activities not directly related to the business trip are often excluded, as these fall outside the scope of the policy. |

Claims and Procedures

Navigating the claims process smoothly is crucial for travelers and companies. A clear understanding of procedures, timelines, and required documentation can significantly expedite the reimbursement process, minimizing disruption to travel plans. This section Artikels the standard procedures for filing a claim under a corporate travel protection plan.

The claims process is designed to be straightforward and efficient. Following the steps meticulously and ensuring all necessary documents are provided promptly will significantly expedite the claim approval and payment. The insurance provider strives to process claims fairly and efficiently, upholding the terms and conditions of the travel protection plan.

Standard Procedures for Filing a Claim

A well-defined process ensures a smooth and timely resolution of claims. Travelers should be familiar with the specific steps Artikeld in their corporate travel protection plan documents.

- Initial Contact: Contact the insurance provider’s claims department as soon as possible after the event that triggered the claim. Early notification allows the provider to initiate the claim process promptly and potentially assist in mitigating further damages.

- Gathering Documentation: Comprehensive documentation is critical. This includes the original policy, details of the event (including dates, times, and locations), supporting evidence (such as medical bills, police reports, or receipts for lost luggage), and contact information for all relevant parties.

- Claim Form Submission: The insurance provider will typically provide a claim form, which must be completed accurately and submitted in a timely manner. This form usually Artikels specific information required to process the claim.

Typical Timeframe for Processing Claims

The time taken to process a claim varies depending on the complexity of the claim and the availability of supporting documentation. Insurance providers aim to process claims within a reasonable timeframe.

- Standard Processing Time: The typical timeframe for processing claims ranges from 10 to 30 business days, although this can vary depending on the insurance provider and the specifics of the claim.

- Urgent Claims: For urgent or critical situations, such as medical emergencies, the provider may have expedited claim processing procedures. Contact the insurance provider directly for details.

- Complex Claims: Claims involving extensive documentation, such as a significant medical expense claim, might require more time for thorough review and verification.

Necessary Documentation for a Claim

Proper documentation is essential for a successful claim. This typically includes supporting evidence that substantiates the event and its associated costs.

- Policy Information: The policy number, policyholder name, and the effective dates of the policy are crucial for identifying the covered claim.

- Event Details: A detailed description of the event (e.g., date, time, location) should be provided to support the claim.

- Supporting Evidence: Supporting evidence could include medical bills, police reports, receipts, and any other relevant documentation that proves the event occurred and the related expenses.

Role of the Insurance Provider in the Claims Process

The insurance provider acts as a facilitator in the claims process. Their role involves reviewing documentation, assessing the claim’s validity, and processing payments according to the policy terms.

- Reviewing Documentation: The provider reviews the submitted documentation to verify the claim’s legitimacy against the policy terms.

- Assessing the Claim: The provider evaluates the claim to determine coverage under the policy.

- Processing Payments: Once the claim is approved, the provider processes the payment according to the agreed-upon terms.

Step-by-Step Procedure for a Traveler to File a Claim

This step-by-step guide will assist travelers in navigating the claims process efficiently.

- Gather Necessary Documents: Compile all required documents, including the policy details, event description, and supporting evidence.

- Contact the Claims Department: Reach out to the claims department as soon as possible to report the claim and initiate the process.

- Complete the Claim Form: Carefully complete the claim form provided by the insurance provider, ensuring all required information is accurate and complete.

- Submit Documentation: Submit all supporting documentation to the insurance provider through the designated channel.

- Follow Up: Regularly follow up with the claims department to track the progress of the claim.

Cost and Pricing Models

Corporate travel protection plans vary significantly in their pricing structures, reflecting the diverse needs and budgets of different organizations. Understanding these models is crucial for businesses to select plans that offer optimal value for their investment. Different pricing models cater to various business travel scenarios and risk profiles.

Pricing structures for corporate travel protection plans are complex, but transparency is essential. Factors such as coverage levels, destination risks, and policy specifics play a critical role in determining the premium costs. Businesses must carefully weigh the cost against the potential benefits to make informed decisions.

Pricing Model Variations

Different pricing models reflect the varied needs and complexities of corporate travel. Common models include per-trip, per-employee, and per-policy annual premiums. Per-trip plans typically charge a fee for each trip, while per-employee plans impose a fixed annual fee regardless of the number of trips taken. Per-policy annual plans provide a single annual premium covering all employee travel for the year.

Factors Influencing Plan Costs

Several factors influence the overall cost of a corporate travel protection plan. Coverage levels are a primary determinant; higher levels of coverage, including comprehensive medical and evacuation benefits, generally lead to higher premiums. Destination-specific risks also play a role. Countries with higher healthcare costs or political instability often command higher premiums. Furthermore, the inclusion of specific add-on coverages, such as trip cancellation or baggage loss protection, directly impacts the cost.

Relationship Between Premiums and Coverage Value

The relationship between premium costs and the value of the coverage is not always straightforward. A higher premium doesn’t automatically equate to superior coverage. Businesses must meticulously analyze the plan’s inclusions and exclusions to determine the actual value proposition. For example, a plan with a high premium but limited coverage for specific events may not be the optimal choice.

Evaluating the Cost-Benefit Ratio

Businesses can effectively evaluate the cost-benefit ratio of various travel protection plans by comparing the premium costs to the potential losses they could incur without insurance. A thorough analysis should include the estimated frequency and severity of potential claims. Comparing different plans side-by-side, highlighting the specific coverage options and associated costs, is essential for making an informed decision.

Comparative Analysis of Pricing Models

| Pricing Model | Description | Potential Benefits |

|---|---|---|

| Per-Trip | Premiums are charged per trip. | Flexibility; only pay for trips taken. |

| Per-Employee | Fixed annual fee per employee. | Predictable annual cost; suitable for consistent travel patterns. |

| Per-Policy Annual | Single annual premium covering all employee travel. | Simpler administration; suitable for companies with extensive employee travel. |

Legal and Regulatory Considerations

Source: teddyslimo.com

Corporate travel protection plans are subject to a complex web of legal and regulatory frameworks. Understanding these frameworks is crucial for both insurers and policyholders to ensure compliance and mitigate potential risks. These considerations encompass various aspects, from the specific provisions of insurance policies to the broader regulatory landscape governing the insurance industry.

Navigating these legal complexities requires a meticulous approach. Insurers must carefully craft policies that comply with all applicable laws and regulations, while policyholders need to understand their rights and responsibilities within the contractual agreement. This section will explore the key legal and regulatory aspects that influence corporate travel protection plans.

Relevant Legal and Regulatory Frameworks

Various legal and regulatory frameworks impact corporate travel protection plans, impacting everything from policy design to claim handling. These frameworks vary significantly based on jurisdiction, and often include consumer protection laws, insurance regulations, and potentially specific legislation related to travel or tourism. For instance, in the United States, the Employee Retirement Income Security Act (ERISA) may apply to plans offered to employees, while state insurance departments regulate the conduct of insurance companies.

Potential Legal Liabilities

Several potential legal liabilities are associated with travel insurance coverage. Insurers can face legal challenges if they fail to honor legitimate claims or if their policies are deemed unfair or misleading. Furthermore, if the policy fails to meet the requirements of the relevant regulatory frameworks, it could lead to legal penalties or fines. Incorrect or incomplete policy disclosures could also result in legal action.

Legal Implications of Claims Disputes

Claims disputes are a common occurrence in the insurance industry, and travel insurance is no exception. Disputes can arise from disagreements over coverage, the extent of the loss, or the validity of the claim. Legal implications can range from the need to follow established procedures for dispute resolution to potential litigation in court. Clear policy wording, accurate documentation, and fair claim handling procedures are crucial to minimize disputes.

Role of Insurance Regulations

Insurance regulations play a vital role in maintaining the integrity and stability of the travel insurance market. These regulations typically Artikel requirements for policy disclosure, claim handling procedures, and the financial solvency of insurance companies. They also often address consumer protection issues to safeguard policyholders’ rights. Compliance with these regulations is essential for insurers to maintain their license and credibility.

Examples of Legal Cases Related to Travel Insurance

Numerous legal cases involving travel insurance have been documented, highlighting the complexity of the legal landscape. These cases often involve issues such as pre-existing medical conditions, unforeseen circumstances, or disputes over the interpretation of policy terms. The outcomes of these cases often set precedents for future claims and influence the development of insurance policies. Researching relevant court decisions in specific jurisdictions provides insight into the legal interpretation of insurance provisions and the potential liabilities involved.

Choosing the Right Plan

Selecting the optimal corporate travel protection plan is crucial for safeguarding employee well-being and minimizing financial risks during business trips. A carefully considered approach ensures comprehensive coverage tailored to the specific needs of the organization.

A well-structured selection process involves meticulous evaluation of various factors, from the scope of coverage to the financial capabilities of the plan provider. Understanding the nuances of different plans and providers empowers companies to make informed decisions that align with their budgetary constraints and operational requirements.

Factors to Consider in Plan Selection

Careful consideration of several factors is essential to selecting the appropriate corporate travel protection plan. These factors encompass coverage breadth, financial stability of providers, and alignment with company policies.

- Coverage Breadth: Evaluating the scope of coverage is paramount. The plan should encompass a wide range of potential risks, including medical emergencies, trip interruptions, lost baggage, and travel delays. The level of coverage should adequately address potential financial implications for employees and the company.

- Financial Stability of Providers: Assessing the financial strength and reputation of potential providers is critical. Companies should investigate the insurer’s financial rating, claims-handling history, and overall track record. A financially stable provider is essential to ensure prompt and efficient claim processing.

- Alignment with Company Policies: The chosen plan should seamlessly integrate with existing company policies. Consider factors such as employee benefits packages, travel guidelines, and expense reimbursement procedures.

- Cost-Effectiveness: While comprehensive coverage is important, the cost of the plan should align with the company’s budget. Compare premiums and deductibles across different plans to identify cost-effective options without compromising coverage.

Comprehensive Needs Assessment

A comprehensive needs assessment is fundamental to selecting the right plan. This assessment meticulously examines the specific requirements of the organization’s travel policies and the profile of its employees.

This process involves detailed analysis of factors such as the frequency and duration of employee travel, the geographical locations of destinations, and the potential risks associated with those locations. Identifying potential hazards and evaluating the company’s existing travel protocols will help tailor the plan to specific needs. For example, a company with employees traveling extensively to high-risk areas will require a plan with a higher level of medical coverage.

Evaluating Plan Providers

Evaluating plan providers requires a multi-faceted approach. Assessing their financial stability, claims-handling capabilities, and reputation is crucial.

- Financial Strength: Review the insurer’s financial rating and stability to gauge their ability to fulfill claims. A strong financial rating indicates a lower risk of insolvency, ensuring prompt claims processing.

- Claims-Handling Experience: Investigate the provider’s claims-handling history. A positive track record demonstrates efficiency and commitment to customer satisfaction, thus streamlining the claims process.

- Reputation and Customer Reviews: Examine the provider’s reputation and customer reviews to understand their service quality. Favorable reviews and a positive reputation suggest a reliable provider.

Comparing and Contrasting Plans

Comparing and contrasting different plans involves a systematic evaluation process. Careful analysis of various plans, considering their unique features and coverage, will help companies make informed decisions.

| Plan Feature | Plan A | Plan B |

|---|---|---|

| Medical Coverage | Comprehensive, including pre-existing conditions | Limited, excluding pre-existing conditions |

| Trip Interruption | Full reimbursement for unused portions | Partial reimbursement |

| Lost Baggage | High value coverage | Low value coverage |

Careful consideration of each plan’s details, such as coverage limits, exclusions, and claim procedures, is critical.

Flowchart for Selecting the Optimal Plan

A flowchart facilitates a structured approach to selecting the best corporate travel protection plan.

[A visual flowchart illustrating the steps involved in choosing a corporate travel protection plan, such as assessing needs, comparing plans, and selecting the best fit, is omitted here as requested.]

Emerging Trends and Innovations

The corporate travel protection landscape is constantly evolving, driven by technological advancements and changing employee expectations. This section explores key emerging trends and innovative approaches to risk management in corporate travel, showcasing how these factors are reshaping the future of travel insurance.

Modern travelers demand greater flexibility and control over their travel arrangements. Innovative travel protection plans are adapting to this need by offering more personalized and tailored coverage options, reflecting the evolving risk profile of different business journeys.

Technological Advancements in Travel Insurance

Technological advancements are significantly impacting corporate travel plans. Real-time data analysis allows for more accurate risk assessments and personalized pricing. Dynamic pricing models adjust premiums based on factors such as destination, travel dates, and the traveler’s specific itinerary, offering cost-effective solutions.

Personalized Risk Assessment and Pricing, Corporate travel protection plans

Travel insurance providers are increasingly utilizing data analytics to create highly personalized risk assessments. By analyzing factors such as destination security ratings, historical travel patterns, and individual health profiles, insurers can tailor coverage and pricing models to meet the specific needs of each traveler or group. This approach enhances the accuracy of risk assessment, reducing unnecessary coverage and optimizing costs for companies.

Predictive Analytics and Proactive Risk Management

Predictive analytics allows travel insurance providers to identify potential risks and proactively offer preventative measures. For example, analyzing historical flight delays and cancellations can predict potential disruptions and offer alternative travel solutions. Proactive measures such as providing travel advisories, secure communication channels, and emergency assistance services can further enhance risk management.

Mobile-First and Digital-Driven Solutions

The increasing reliance on mobile devices and digital platforms is driving the development of mobile-first travel insurance solutions. Mobile apps allow travelers to access and manage their policies, submit claims, and receive real-time support, improving the overall customer experience and operational efficiency. These digital solutions reduce administrative burdens and increase transparency for all stakeholders.

Integration with Corporate Travel Management Systems (CTMS)

Integration of travel insurance with corporate travel management systems (CTMS) provides a seamless and centralized experience for managing travel policies. This integration allows for automated policy issuance, risk assessment, and claims processing, streamlining the entire travel process. This integration improves the overall traveler experience, reduces administrative costs, and enhances data management.

Examples of New Technologies in Travel Insurance

- Real-time flight tracking and disruption alerts: Insurers can provide real-time flight tracking and disruption alerts to travelers, allowing them to take preventative measures in case of delays or cancellations. This improves the proactive risk management approach.

- Automated claim processing: Automated claim processing systems reduce the time it takes to process claims, increasing efficiency and improving the customer experience. These automated systems reduce manual intervention and enhance speed of processing.

- AI-powered fraud detection: AI-powered systems are increasingly used to detect and prevent fraudulent claims, protecting both insurers and policyholders. This ensures that the claims process is efficient and trustworthy.

Impact of Technological Advancements on Corporate Travel Plans

Technological advancements are fundamentally changing the way corporate travel plans are designed and delivered. The use of data analytics, mobile apps, and integrated systems is transforming the efficiency and effectiveness of travel risk management. This leads to lower administrative costs, improved customer satisfaction, and greater cost-effectiveness for companies.

Future of Corporate Travel Protection Plans

The future of corporate travel protection plans will likely see a greater emphasis on personalized, proactive risk management. Technological advancements will continue to drive innovation, leading to more efficient claim processing, automated risk assessments, and personalized coverage options. Increased integration with corporate travel management systems and other tools will further enhance the overall traveler experience and reduce administrative burdens.

International Considerations

International travel presents unique challenges and opportunities for corporate travel protection plans. Navigating diverse legal frameworks, cultural nuances, and varying levels of medical infrastructure across different countries necessitates tailored coverage and robust procedures. This section delves into the specific considerations for international travel, emphasizing the importance of understanding local regulations and ensuring comprehensive coverage.

Unique Considerations for International Travel

International travel protection plans must account for a broader spectrum of risks than domestic plans. These risks include currency fluctuations, differing healthcare standards, varying emergency response times, and potential political instability. Understanding the potential challenges associated with international travel is critical for creating effective and comprehensive coverage.

Importance of Understanding Local Regulations

Understanding local regulations is paramount for effective international travel protection. Laws regarding medical treatment, emergency evacuation, and repatriation vary significantly across countries. Failing to comply with these regulations can lead to significant delays and complications in the event of an emergency. Thorough research and consultation with legal professionals specializing in international law are crucial.

Necessity of Specialized Coverage for Different Regions

Different regions present distinct health risks and safety concerns. A blanket international policy might not adequately address these disparities. For example, coverage for malaria-prone areas requires different provisions than those for countries with limited healthcare facilities. A tiered approach, with varying levels of coverage depending on the destination, is often necessary.

Comparison of International and Domestic Travel Protection Plans

International travel protection plans necessitate greater detail and flexibility compared to domestic plans. While domestic plans primarily address medical emergencies within a familiar legal and healthcare system, international plans must account for a broader range of potential issues, including repatriation, lost or stolen documents, and unforeseen political events.

Table Summarizing Key Differences in International Coverage

| Feature | International Coverage | Domestic Coverage |

|---|---|---|

| Medical Emergency Coverage | Coverage extends to a wider range of medical facilities, including those in less developed regions, and includes repatriation if necessary. | Coverage is primarily for medical care within the traveler’s home country or region. |

| Emergency Evacuation | Provides for evacuation to a designated safe location, potentially involving air or ground transport. This is often dependent on the severity of the situation and local conditions. | Emergency evacuation is usually limited to local or regional medical facilities. |

| Repatriation | Includes the cost of returning the traveler to their home country, often encompassing airfare, accommodation, and associated expenses. | Repatriation is less common and often not included in standard domestic policies. |

| Currency Fluctuations | Coverage is crucial to account for currency exchange rate fluctuations and ensure appropriate compensation in case of loss. | Currency fluctuations are often less of a concern for domestic travel. |

| Political Instability | Coverage often includes provisions for travel disruptions due to political unrest, including loss of income. | Political instability is rarely a concern for domestic travel. |

Ultimate Conclusion: Corporate Travel Protection Plans

Source: finoplus.in

In conclusion, carefully considering corporate travel protection plans is vital for businesses seeking to support their employees and safeguard their interests during travel. By understanding the various coverage options, costs, and procedures, companies can make informed decisions that align with their unique needs and budget. A comprehensive plan can significantly enhance employee morale, productivity, and overall well-being. Ultimately, a robust corporate travel protection plan provides a strong safety net for both employees and the company itself.