Corporate Travel Insurance Policies A Comprehensive Guide

Corporate travel insurance policies are essential for businesses sending employees on trips. They provide critical coverage for medical emergencies, trip disruptions, and lost baggage, protecting both the employee and the company’s investment. This guide explores the different types of coverage, key features, selection factors, and administration processes for robust and cost-effective policies.

Understanding the various levels of coverage (basic, standard, premium) is crucial for tailoring policies to specific employee needs and travel situations. Factors like company size, industry, and travel frequency play a vital role in policy selection. The guide also covers cost analysis, documentation requirements, and claim procedures, ensuring a comprehensive understanding of this vital aspect of business travel management.

Overview of Corporate Travel Insurance Policies

Corporate travel insurance policies provide comprehensive protection for employees traveling on business. These policies safeguard companies from significant financial and operational disruptions stemming from unforeseen events during employee travel. They offer a critical layer of security, ensuring smooth operations and employee well-being during trips.

These policies typically encompass various aspects of travel, ensuring a company’s employees are protected from unexpected issues, including medical emergencies, trip disruptions, and lost belongings. The importance of such policies is paramount for businesses operating globally. They offer peace of mind, enabling employees to focus on their work and the company to operate without undue stress.

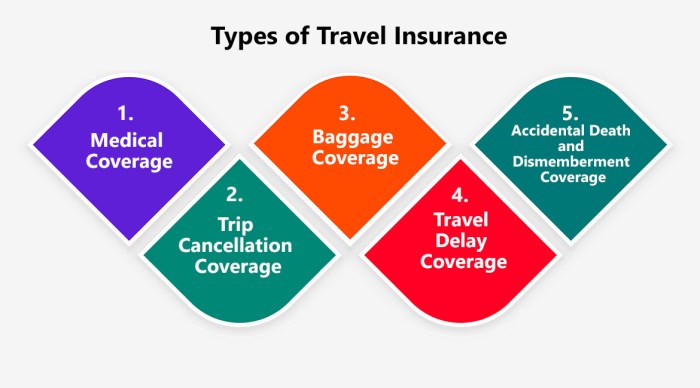

Types of Coverage

Corporate travel insurance policies offer a range of protections to mitigate risks associated with business travel. These policies are tailored to address diverse needs and are structured to provide comprehensive protection. A crucial aspect is the variety of coverage options.

- Medical coverage: This component of the policy ensures financial support for medical expenses incurred during a trip, such as hospitalizations, surgeries, and emergency treatments. This is vital in case of unexpected medical events while traveling.

- Trip interruption coverage: This addresses unforeseen circumstances that may force a traveler to cut their trip short. It covers costs associated with returning home prematurely, such as non-refundable travel expenses.

- Baggage coverage: This portion of the policy protects travelers from the loss or damage of their personal belongings during travel. It provides reimbursement for lost or damaged luggage, including essential work materials or personal items.

- Emergency evacuation coverage: This provision is often part of comprehensive policies and covers the cost of emergency evacuation to a safe location in the event of a natural disaster or other critical incident.

Importance for Businesses

Robust corporate travel insurance policies are essential for maintaining business continuity and protecting employee well-being. These policies provide a safety net for companies operating globally and are essential for preventing significant financial and operational disruption.

- Reduced financial risk: These policies help to mitigate financial exposure from unforeseen medical emergencies or trip disruptions that could negatively impact operations.

- Improved employee morale and productivity: Knowing that employees are protected during travel fosters a sense of security and trust. This can lead to improved employee morale and productivity.

- Enhanced operational continuity: These policies help maintain business continuity, especially in situations involving unforeseen circumstances or crises.

- Legal compliance: In certain industries or jurisdictions, travel insurance may be a legal requirement or highly recommended practice.

Benefits of Corporate Travel Insurance Policies

These policies provide several advantages for businesses and employees. They are designed to facilitate business travel smoothly.

- Financial protection: The policies provide a financial safety net in case of unforeseen events such as medical emergencies or trip interruptions.

- Peace of mind for employees: Knowing that they are protected can alleviate stress and anxiety during travel, allowing them to focus on their work.

- Reduced administrative burden: Insurance companies handle claims and reimbursements, reducing the administrative burden on the company.

- Improved employee relations: Providing travel insurance demonstrates the company’s concern for employee well-being, which can foster better employee relations.

Scenarios Requiring Corporate Travel Insurance

Travel insurance is crucial in various scenarios. Companies should consider these scenarios when determining if travel insurance is necessary.

- Medical emergencies: Unexpected illnesses or injuries during travel can lead to substantial medical expenses. Insurance can help cover these costs.

- Trip cancellations or interruptions: Natural disasters, political instability, or unforeseen circumstances can lead to trip cancellations or interruptions. Insurance can help with the financial implications.

- Lost or damaged baggage: Personal belongings and essential business materials can be lost or damaged during travel. Insurance can provide compensation for these losses.

- Emergency evacuation: In case of natural disasters or other critical events, emergency evacuation is crucial. Insurance can cover the associated costs.

Policy Features and Benefits

Comprehensive corporate travel insurance policies offer a vital safety net for businesses sending employees on trips. These policies go beyond basic personal travel insurance, addressing specific needs and liabilities associated with business travel. Understanding the different coverage levels and features is crucial for selecting the most appropriate policy for your company’s unique requirements.

Careful consideration of the various policy features, benefits, and associated costs is essential for ensuring that the chosen policy effectively mitigates risks and protects your organization. The varying levels of coverage cater to diverse needs and budgets, allowing businesses to tailor their insurance to specific situations.

Coverage Levels

The key features and benefits of a comprehensive corporate travel insurance policy are contingent upon the chosen coverage level. These levels, generally categorized as basic, standard, and premium, differ significantly in the scope of protection offered.

- Basic Coverage: This level typically provides fundamental protection against unforeseen circumstances, including trip cancellations, medical emergencies, and lost baggage. However, coverage amounts and limitations are often less extensive than in higher tiers. For example, basic coverage may not include extensive travel assistance services or coverage for pre-existing medical conditions.

- Standard Coverage: This level builds upon basic coverage, offering broader protection. Standard plans frequently include features like emergency medical evacuation, enhanced trip cancellation protection, and more comprehensive baggage coverage. Consider a situation where a business trip is disrupted due to unexpected natural disasters. Standard coverage may provide better financial support than basic coverage in such scenarios.

- Premium Coverage: The highest tier, premium coverage, provides the most comprehensive protection. It usually includes substantial coverage for pre-existing conditions, extensive travel assistance services, and a broader range of trip interruption circumstances. Premium plans often offer greater flexibility and customization, catering to the specialized needs of high-risk or high-value business trips. Examples might include extensive coverage for critical illnesses or specific types of adventure travel.

Inclusions and Exclusions

The specifics of inclusions and exclusions vary significantly across different policy options and coverage levels. Understanding these elements is critical for a thorough assessment of the policy’s suitability.

| Coverage Level | Typical Inclusions | Typical Exclusions |

|---|---|---|

| Basic | Trip cancellation, medical emergencies (limited), lost baggage (limited), emergency assistance | Pre-existing conditions, high-risk activities, certain medical treatments, extensive travel delays |

| Standard | Trip cancellation (extended), medical emergencies (enhanced), lost baggage (increased), emergency medical evacuation, travel delays (increased) | Certain pre-existing conditions (specific exclusions apply), high-value items, war or acts of terrorism (specific exclusions apply) |

| Premium | Comprehensive trip cancellation, extensive medical coverage (including pre-existing conditions), emergency evacuation (wide range), extensive travel assistance, high-value item coverage | Specific high-risk activities (e.g., extreme sports), intentional self-harm, damage due to negligence |

Policy Options

Businesses have various policy options available, tailored to their unique needs and risk profiles. The selection process should consider factors like the industry, employee roles, and frequency of travel. A policy for a software company that frequently sends developers to international conferences would differ significantly from a policy for a construction firm that sends project managers on short-term assignments.

Critical Aspects of a Robust Policy

A robust corporate travel insurance policy should prioritize clarity and transparency in its terms and conditions. The policy should be readily understandable to ensure employees can make informed decisions about their coverage. Furthermore, the policy should be flexible enough to accommodate various types of business travel.

“A well-structured corporate travel insurance policy is a valuable investment, safeguarding your business against potential financial and operational disruptions associated with employee travel.”

Factors Affecting Policy Selection

Choosing the right corporate travel insurance policy is crucial for protecting employees and minimizing financial risks associated with business trips. Several key factors influence the optimal policy selection, and understanding these factors allows businesses to tailor coverage to their specific needs and mitigate potential liabilities. Careful consideration of these factors ensures comprehensive protection and cost-effectiveness.

A well-structured policy considers various elements, from the size and industry of the company to the demographics of its workforce and the nature of the business trips. This proactive approach not only safeguards employees but also promotes a positive perception of the company’s commitment to their well-being.

Business Size and Industry

Different business sizes and industries present varying levels of risk and travel frequency. Smaller companies may require more affordable and streamlined policies, while larger corporations with extensive global operations may need comprehensive, multi-faceted coverage. Similarly, industries with high-risk travel, such as construction or oil exploration, require more extensive coverage than industries with less hazardous travel activities. Understanding the specific industry risks allows for the customization of the policy.

Travel Frequency and Destinations

The frequency of employee travel significantly impacts policy selection. Frequent travelers benefit from policies with higher coverage limits and more comprehensive benefits. Conversely, companies with occasional travel may find less extensive coverage sufficient. The destinations of travel also play a critical role, with high-risk areas requiring enhanced coverage for medical emergencies, security incidents, and evacuation services. Consideration of potential political instability or natural disaster risks in destination countries is essential for appropriate coverage.

Trip Duration and Employee Demographics

Trip duration influences the necessity of certain policy features. Longer trips may require more extensive medical coverage and emergency assistance. The demographics of employees, including age, health conditions, and travel experience, also influence the required level of protection. Policies should consider potential health issues that might affect employees during trips and tailor coverage accordingly. Offering various levels of coverage to cater to diverse employee needs is a practical approach. For example, a policy for younger employees might focus more on adventure travel activities, whereas a policy for older employees might prioritize pre-existing health conditions.

Tailoring Policies to Specific Employee Needs

Tailoring the policy to specific employee needs is paramount. Consider factors like individual travel styles, destinations, and any pre-existing medical conditions. A policy that considers these individual nuances can prevent unnecessary gaps in coverage and ensures that all employees are adequately protected. Flexible and adjustable policies allow for modifications as travel needs evolve, offering a dynamic approach to employee protection. This proactive approach ensures employees are aware of the coverage they have and how to use it.

Policy Administration and Management

Source: itilite.com

Effective administration of corporate travel insurance policies is crucial for maximizing benefits and minimizing operational complexities. A well-structured process ensures seamless claims handling, transparent communication with employees, and efficient monitoring of policy utilization. This section Artikels key aspects of policy administration and management.

A robust system for administering corporate travel insurance policies streamlines the entire process, from initial employee notification to claims resolution. This ensures compliance with policy terms, facilitates efficient claim processing, and ultimately enhances the overall travel experience for employees.

Policy Administration Process

A well-defined policy administration process is critical for managing corporate travel insurance effectively. This involves establishing clear procedures for policy activation, employee notification, and ongoing management of policy details. The procedures should include a standardized method for documenting all policy-related activities.

- Policy Activation: Upon policy purchase, a detailed activation process is initiated. This includes verifying the policy’s terms and conditions and activating it within the designated insurance platform. This step ensures all necessary information is correctly recorded and available to employees and claim administrators.

- Employee Notification: Clear and timely communication with employees is essential. This includes providing comprehensive information about the coverage details, policy limitations, and claiming procedures. A dedicated employee portal, email, or intranet announcement can be used to disseminate this information.

- Policy Updates: The system should be configured to automatically update policy details and coverage limits. Regular policy reviews and updates should be performed to reflect any changes in company needs or employee benefits.

Claims Filing and Processing

A streamlined claims filing and processing procedure is essential for timely resolution and minimizing employee disruption. A clear and user-friendly process reduces the time employees spend on paperwork and ensures a smooth experience.

- Claims Reporting: Employees should be guided on how to report claims. This may involve online portals, designated email addresses, or physical claim forms. Providing multiple options allows employees to file claims using the method most convenient for them. Examples include online portals for immediate reporting and documentation, and pre-filled forms that streamline the process.

- Claims Review: A designated team reviews submitted claims for accuracy and adherence to policy terms. This step involves verifying the validity of the claim, assessing the supporting documentation, and determining eligibility for coverage. Timely claims review minimizes delays in processing and ensures appropriate reimbursements.

- Claims Resolution: After review, the claim is either approved or denied. If approved, the insurer disburses the appropriate funds to the employee or company, following established procedures. Comprehensive communication is crucial throughout the claims process, keeping employees informed of the status of their claims. Example: Providing updates on the claim status via email or a dedicated online portal.

Employee Coverage Notification

Clear communication regarding employee coverage is critical for maximizing policy utilization. Employees should understand their coverage and how to access benefits.

- Policy Summary: Each employee receives a clear summary of their coverage. This summary should include essential details, such as the type of coverage, benefit limits, and exclusions. This ensures employees understand their rights and responsibilities.

- Training Sessions: Regular training sessions for employees can enhance their understanding of the policy. This includes demonstrations on how to access the policy documents, file claims, and understand the claims process.

- FAQ Documents: Provide detailed FAQs to answer common questions about the policy. This eliminates ambiguity and helps employees quickly find answers to their questions.

Travel Management Company (TMC) Role

The TMC plays a vital role in policy administration. They act as intermediaries between the employee, the insurance provider, and the company.

- Policy Communication: The TMC facilitates communication between the insurance provider and employees regarding policy details and claims procedures. This reduces administrative burden on the company and ensures consistent information dissemination.

- Claim Assistance: The TMC assists employees in filing claims, gathering necessary documentation, and tracking claim status. They provide a streamlined process for employees to access support and resolve issues quickly.

Policy Usage Tracking and Monitoring

Monitoring policy usage allows for insights into employee travel patterns, potential areas for improvement, and compliance with company travel policies.

- Data Analysis: Collected data can be analyzed to identify trends in employee travel, areas where coverage utilization is low, or areas where claims are frequently filed.

- Performance Evaluation: This data can help in evaluating the effectiveness of the policy and identifying areas for improvement in the travel program.

- Compliance Tracking: Monitoring policy usage can help ensure employees are traveling within the company’s policies and regulations.

Cost and Value Analysis

Source: bajajallianz.com

Understanding the financial implications of corporate travel insurance is crucial for informed decision-making. This section details the costs associated with various policies, assesses their cost-effectiveness, and highlights strategies for optimizing value without sacrificing essential coverage. A thorough evaluation of the return on investment (ROI) will also be presented.

The cost of corporate travel insurance varies significantly based on factors like the scope of coverage, the number of employees covered, and the destinations included. Policies tailored to specific industries or high-risk activities often command higher premiums. Analyzing these cost variations allows companies to select policies that align with their unique needs and budgets.

Policy Cost Breakdown

The premiums for corporate travel insurance are generally calculated based on a combination of factors. These include the number of travelers, the duration of the trip, the destinations, and the level of coverage desired. Specific types of coverage, such as medical emergencies or trip interruptions, can also influence the premium.

- Travelers’ Demographics: Age, pre-existing medical conditions, and the nature of the travel (e.g., leisure vs. business) are crucial elements in the calculation of premiums. Policies for younger, healthier travelers often have lower premiums than those for older individuals with pre-existing conditions.

- Trip Duration and Frequency: Longer trips and frequent travel typically result in higher premiums. Policies designed for frequent business trips or international travel often have higher premiums than those for occasional travel.

- Destination Risk Assessment: Policies for travel to destinations with higher risk factors (e.g., political instability, natural disasters) often come with increased premiums to account for the elevated risk of emergencies or cancellations.

- Coverage Options: Comprehensive coverage encompassing various aspects of travel, including medical expenses, trip cancellations, and baggage loss, leads to higher premiums compared to policies with limited coverage.

Cost-Effectiveness Comparisons

Different insurance providers and policy options offer varying levels of coverage at different price points. A critical aspect of cost-effectiveness is understanding the value proposition of each policy relative to its price. Comparing policies based solely on price can be misleading without considering the comprehensiveness of the coverage.

| Policy Option | Coverage Highlights | Estimated Annual Premium (per employee) |

|---|---|---|

| Basic | Essential coverage for medical emergencies and trip cancellations | $50 – $100 |

| Standard | Comprehensive coverage including medical, trip cancellations, lost luggage, and emergency evacuation | $100 – $200 |

| Premium | Extensive coverage with additional benefits such as accidental death and dismemberment, and enhanced baggage protection | $200+ |

Premium Calculation and Fees

Insurance premiums are calculated using actuarial models that take into account various factors, including the risks associated with travel and the expected claims. A significant portion of the premium goes towards covering potential claims and administrative costs.

Premium = (Risk Assessment Factor * Trip Duration * Coverage Amount) + Administrative Costs

Additional fees might be applicable for specific services or add-ons, such as emergency assistance or travel assistance.

Cost Reduction Strategies

Implementing strategies to minimize premiums without sacrificing necessary coverage is essential. A few examples include:

- Negotiating with Providers: Large corporations can often negotiate discounted premiums with insurance providers. This can be achieved by securing a large number of policies.

- Risk Assessment and Mitigation: Identifying and mitigating travel risks can reduce the likelihood of claims and thus potentially lower premiums. This involves conducting thorough due diligence on destinations and travel arrangements.

- Selecting Appropriate Coverage: Carefully evaluating the specific needs of employees and choosing a policy that aligns with their needs can minimize premiums. Avoid purchasing extensive coverage for routine travel.

- Implementing Travel Policies: Establishing clear travel guidelines and procedures can minimize risks and claims, potentially leading to lower premiums.

Return on Investment (ROI)

The ROI of corporate travel insurance can be evaluated by considering the potential costs of unforeseen events, such as medical emergencies, trip cancellations, or lost baggage, against the premium paid. The ROI is directly related to the level of coverage and the potential financial losses mitigated. For example, a medical emergency in a foreign country can easily cost thousands of dollars, significantly outweighing the premium cost of a comprehensive policy. A robust policy can protect against unforeseen events, ultimately leading to a high return on investment.

Insurance Policy Documentation: Corporate Travel Insurance Policies

Proper documentation of corporate travel insurance policies is crucial for smooth administration, effective claim processing, and compliance with regulations. Clear documentation ensures transparency and accountability, aiding in risk management and dispute resolution. A well-organized system streamlines the process of verifying coverage and entitlements, reducing potential misunderstandings between the company and its employees.

Policy Comparison Table

This table provides a comparative overview of different corporate travel insurance policy types. Understanding the coverage, premiums, and exclusions is essential for businesses to select the most appropriate policy.

| Policy Name | Coverage Type | Premium | Exclusions |

|---|---|---|---|

| Example Policy 1 | Comprehensive | $500 | Lost Luggage (above $1000) |

| Example Policy 2 | Basic | $250 | Pre-existing medical conditions |

| Example Policy 3 | Premium | $750 | Trip cancellation within 24 hours of booking |

Required Policy Documents

Maintaining comprehensive records of policy details is vital for effective administration and compliance. The following documents are typically required:

- Policy contract: This document Artikels the terms and conditions of the insurance agreement, including coverage details, exclusions, and limitations.

- Policy summary: A concise overview of the policy’s key features, benefits, and coverage amounts. This aids in rapid comprehension by employees.

- Endorsements and amendments: Any modifications or additions to the original policy should be documented for accuracy and clarity.

- Claims procedures: A detailed description of the claims process, including necessary documentation and steps to follow in case of an incident.

Policy Clause Artikel

A clear understanding of policy clauses is essential for employees to understand their rights and responsibilities. This section details typical clauses.

| Clause Type | Description |

|---|---|

| Cancellation | Artikels circumstances under which a trip can be cancelled and the associated reimbursement or coverage limitations. |

| Medical | Details the extent of medical coverage, including expenses for emergency medical treatment, hospitalization, and repatriation. |

| Trip Interruption | Specifies coverage for situations where a trip is unexpectedly interrupted due to unforeseen circumstances. |

Importance of Proper Documentation

Thorough documentation safeguards the company’s interests and ensures a smooth claims process. Accurate records allow for efficient processing of claims, minimizing delays and potential disputes. Clear documentation also supports compliance with industry regulations and minimizes risks associated with inaccurate information.

Presenting Policy Information to Employees

Effective communication of policy details is vital for employees to understand their coverage. Consider these methods for presentation:

- Employee handbook: Include a dedicated section outlining the travel insurance policy, its benefits, and the claims process.

- Email notifications: Send regular reminders or updates about the policy’s terms and conditions, particularly when new clauses or coverage updates are introduced.

- Onboarding materials: Include policy information in employee onboarding packages, ensuring that new hires are promptly aware of the available coverage.

- Q&A sessions: Hold Q&A sessions to address any concerns or uncertainties employees might have about the policy.

Claims and Disputes

Navigating claims and potential disputes is a crucial aspect of corporate travel insurance. Understanding the claim process and dispute resolution mechanisms can mitigate stress and ensure smooth reimbursements for covered losses. A well-defined procedure is essential to protect both the insurance provider and the policyholder.

Claim Filing Process

The claim filing process is typically straightforward and Artikeld in the policy documents. Policyholders are encouraged to meticulously document all relevant details, including trip dates, incident descriptions, supporting documentation, and any relevant communication with the travel provider. This meticulous record-keeping is paramount to a swift and efficient claim resolution. Comprehensive documentation strengthens the claim and reduces potential delays.

Dispute Resolution Steps

Disputes, while less frequent, can arise in the process. A structured approach to dispute resolution is critical. The first step often involves contacting the insurance provider directly to express concerns and seek clarification on the denial or partial approval of a claim. If the initial contact is unsuccessful, the policyholder may then explore escalation procedures Artikeld in the policy documents. These procedures might involve appealing the decision or seeking mediation. The goal is to resolve the dispute through dialogue and adherence to the established protocol.

Common Claim Scenarios

Numerous scenarios can trigger claims. Examples include lost luggage, trip cancellations due to unforeseen events (e.g., natural disasters, illness), medical emergencies, and even delays in travel that exceed pre-defined limits. Claims related to travel delays are common, particularly if they lead to missed connections or significant disruptions to the itinerary. Accurately documenting these circumstances, with verifiable evidence, is crucial for successful claim processing.

Handling Denied Claims

A denied claim can be frustrating. The first step is to carefully review the denial letter to understand the specific reasons for the denial. Policyholders should ensure they understand the reasons for the denial, as this helps in addressing potential gaps in the documentation. The policyholder should then carefully review the policy document for any specific exclusions or limitations that might apply to the claim. Contacting the insurance provider for clarification is also recommended. Policyholders should not hesitate to ask for additional information or clarification if they are uncertain about the reasons for the denial.

Roles in Dispute Resolution

The insurance provider’s role in dispute resolution is to assess the validity of the claim and adhere to the terms and conditions of the policy. They are responsible for a fair and transparent evaluation process, ensuring that the claim is evaluated based on the policy provisions and supporting evidence. The policyholder’s role is to provide complete and accurate information, supporting documentation, and to engage in the dispute resolution process in a collaborative manner. Open communication and a willingness to provide additional evidence are crucial to a positive outcome.

Illustrative Examples of Coverage

Source: ajg.com

This section provides practical examples of how corporate travel insurance policies can protect employees during various travel scenarios. Understanding these examples will help companies and individuals assess the comprehensive nature of the coverage offered.

These examples are intended to illustrate potential benefits and should not be construed as a complete or exhaustive list of every possible situation. Actual coverage will depend on the specific policy terms and conditions.

Medical Coverage Benefits, Corporate travel insurance policies

A company employee traveling to a remote region for a business meeting experiences a sudden and severe illness requiring immediate hospitalization. The policy’s medical coverage will likely cover the cost of hospitalization, including room and board, medical procedures, and necessary medications. Further, the policy might cover repatriation if the employee’s condition necessitates immediate return to their home country.

Another example: A business traveler sustains a serious injury during a sporting activity in their destination. The policy’s medical coverage would likely cover the associated medical expenses, including emergency medical transportation, surgery, rehabilitation, and related therapies. The coverage may also extend to necessary physical therapy and other restorative care.

Trip Interruption and Delay Coverage

A critical component of a corporate travel policy is trip interruption and delay coverage. A sudden natural disaster in the employee’s destination city forces the cancellation of scheduled business meetings. The policy’s trip interruption coverage could reimburse the employee for non-refundable expenses, including flights, accommodation, and other business-related costs.

A severe weather event delays an employee’s flight, preventing them from attending a crucial business meeting on time. The policy’s trip delay coverage might compensate for reasonable additional expenses incurred due to the delay, such as hotel accommodations, meals, and other necessary arrangements.

Baggage Loss and Delay Coverage

A business traveler’s checked luggage is lost during a connecting flight. The policy’s baggage loss coverage will compensate for the value of lost or damaged items, including business clothing, essential equipment, and personal items. The coverage would likely reimburse the employee for the replacement cost of these items, up to the policy’s limit.

A similar situation arises where a traveler’s luggage is delayed, causing them to be without essential items during their business trip. The policy’s baggage delay coverage may cover the cost of renting or purchasing necessary items while waiting for the delayed luggage to arrive.

Emergency Situation Coverage

A critical emergency arises during a business trip, requiring immediate intervention and care. For instance, a company employee faces a sudden family emergency back home, demanding an urgent return. The policy’s emergency coverage could help with the cost of expedited travel arrangements to address the urgent family situation.

An employee experiences a sudden and severe illness or injury, requiring emergency medical evacuation to a hospital in a different location. The policy’s emergency medical evacuation coverage will likely reimburse the costs associated with such evacuation, ensuring the employee receives necessary medical attention.

Implications of Insufficient Coverage

Failing to have adequate corporate travel insurance can expose the employee and the company to substantial financial risks. A medical emergency abroad, requiring extensive treatment, without adequate coverage could lead to substantial out-of-pocket expenses.

A sudden trip cancellation due to unforeseen circumstances, without trip interruption coverage, can lead to a significant loss of investment in business-related travel arrangements. The employee may also face significant financial burdens from missed meetings and related costs.

Last Recap

In conclusion, implementing a well-structured corporate travel insurance policy is crucial for protecting employees and mitigating potential risks associated with business travel. By carefully considering policy features, cost-effectiveness, and administration processes, businesses can create a comprehensive plan that supports employee safety and financial security while optimizing their travel budget. The examples and comparisons within this guide provide practical insights into policy selection and management, allowing businesses to confidently navigate the complexities of corporate travel insurance.