Corporate Travel Coverage Plans A Comprehensive Guide

Corporate travel coverage plans are crucial for businesses seeking to protect their employees and maintain a positive company image. These plans offer a range of benefits, from medical emergencies to trip interruptions, ensuring peace of mind for both employees and employers. This comprehensive guide explores the essential elements of these plans, covering everything from defining different types of coverage to managing claims and legal considerations. It also examines the latest technological advancements and successful implementations in various industries.

Understanding the nuances of corporate travel coverage plans is vital for companies to make informed decisions. This guide will help businesses assess their needs, compare various plans, and ultimately select the best solution to optimize their travel programs and enhance employee well-being.

Defining Corporate Travel Coverage Plans

Corporate travel coverage plans are essential for businesses and their employees traveling for work. These plans provide a safety net, ensuring financial protection and peace of mind in case of unforeseen events during a business trip. They encompass various types of insurance to address potential issues ranging from medical emergencies to lost luggage.

These plans are crucial for maintaining a positive and productive work environment. They reduce the financial burden on employees in the event of unexpected issues, thereby promoting employee satisfaction and reducing anxiety associated with travel. Furthermore, robust travel coverage plans reflect a company’s commitment to employee well-being and demonstrate a professional approach to travel management.

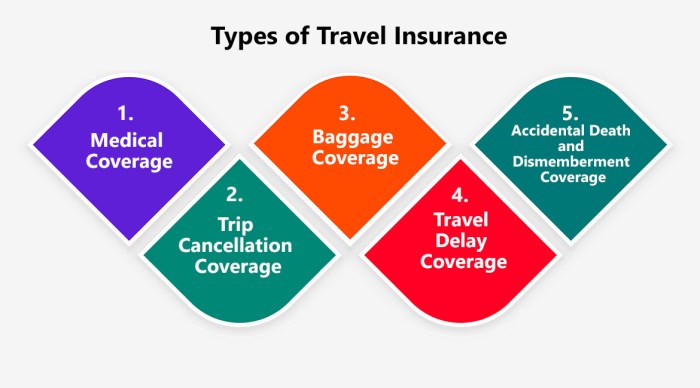

Types of Corporate Travel Coverage

Corporate travel coverage plans often include a suite of benefits to address diverse potential issues. A comprehensive plan typically includes provisions for medical emergencies, trip interruptions, baggage loss, and even liability protection. Understanding these different types of coverage is essential for businesses to choose the right plan for their employees’ needs.

Key Components of Corporate Travel Coverage Plans

The key components typically included in corporate travel coverage plans are designed to provide comprehensive protection. These include, but are not limited to, medical expenses, trip interruption insurance, baggage and personal effects insurance, and liability coverage for the employee. The specific components may vary based on the company’s size, the nature of the employee’s work, and the destination of travel.

Elements of a Comprehensive Plan

A well-designed corporate travel coverage plan should encompass various critical elements. These typically include coverage for medical expenses during trips, provisions for trip interruption due to unforeseen circumstances, and protection against loss or damage of personal belongings. The plan should also address any potential liability issues related to the employee’s travel activities. Furthermore, it’s beneficial for the plan to include a 24/7 assistance service, enabling employees to access help quickly in emergencies.

Detailed Coverage Breakdown

| Coverage Type | Description | Example Benefit |

|---|---|---|

| Medical Expenses | Covers medical expenses incurred during a trip, including emergency care, hospitalization, and repatriation. | Reimbursement for medical bills incurred during a sudden illness or accident while traveling. |

| Trip Interruption | Covers expenses if a trip is interrupted due to unforeseen circumstances, such as natural disasters or flight cancellations. | Reimbursement for non-refundable travel costs if the trip is canceled due to a natural disaster. |

| Baggage Loss or Delay | Covers loss or damage to baggage and personal belongings during transit. | Compensation for lost or damaged luggage, including replacement of essential items. |

| Liability Protection | Protects the employee from potential liability issues related to their travel activities. | Coverage for incidents where the employee may be held responsible for causing damage to property or injuring someone. |

| Emergency Assistance | Provides access to 24/7 assistance services for medical emergencies, lost documents, or other issues. | Immediate access to medical professionals, legal advice, or assistance in finding accommodation in case of an emergency. |

Benefits and Advantages

Corporate travel coverage plans offer substantial advantages for both employees and the company. These plans are increasingly vital in today’s globalized business environment, ensuring employee well-being and financial security while optimizing travel budgets. A robust plan can foster a positive company image and contribute to long-term cost savings.

A well-structured travel coverage plan acts as a safety net for employees during unexpected events, such as trip cancellations, medical emergencies, or lost luggage. It promotes peace of mind, enabling employees to focus on their work and responsibilities without worrying about potential financial burdens. This translates to increased productivity and a more positive work environment.

Employee Well-being and Satisfaction

Comprehensive travel coverage plans significantly contribute to employee well-being and satisfaction. Employees feel secure knowing they are protected against unforeseen circumstances, reducing stress and anxiety associated with travel. This peace of mind enhances their overall job satisfaction, leading to higher morale and potentially lower employee turnover. Insurance coverage often includes assistance services, such as medical evacuation, which further enhances the plan’s value to the employee.

Cost Savings

Implementing a corporate travel coverage plan can lead to substantial cost savings for the company. By mitigating potential financial risks associated with employee travel, the company avoids costly payouts for unforeseen circumstances. For example, a plan covering medical emergencies abroad can prevent significant financial burdens for both the employee and the company. Careful selection of providers and tailored plans can further optimize cost-effectiveness.

Comparison of Travel Coverage Plans

Different providers offer various travel coverage plans, each with unique features and benefits. A key difference lies in the scope of coverage, which can vary from basic trip interruption insurance to comprehensive plans that include medical, evacuation, and repatriation coverage. Consider the frequency and nature of employee travel when choosing a plan. Another key consideration is the level of assistance services included, such as 24/7 emergency assistance and lost baggage support.

| Provider | Key Feature 1 | Key Feature 2 | Cost (per employee per year) |

|---|---|---|---|

| Company A | Comprehensive medical coverage | Extensive assistance services | $150 |

| Company B | Focus on trip interruption | Basic medical coverage | $100 |

| Company C | Tailored plans for specific industries | Excellent customer service | $125 |

A comparison table, like the one above, highlights the key differences between various plans and helps in making an informed decision. Careful consideration of individual needs and budgets is essential.

Impact on Company Reputation

A robust travel coverage plan demonstrates a company’s commitment to employee well-being and care. This can positively impact the company’s reputation, attracting and retaining talent. Employees are more likely to be loyal and satisfied when they feel valued and protected, leading to positive word-of-mouth referrals. Furthermore, a company perceived as caring about employee safety and security during travel is likely to have a stronger reputation within the industry. Companies that proactively address potential risks associated with employee travel are perceived as more responsible and professional.

Cost Considerations and Factors

Understanding the factors that influence corporate travel insurance costs is crucial for businesses seeking optimal coverage without overspending. This section delves into the interplay between plan coverage, employee demographics, and different coverage levels and durations. Furthermore, it explores strategies for reducing costs without sacrificing essential protections.

Determining the appropriate insurance plan involves a careful evaluation of various cost-driving elements. A comprehensive understanding of these factors allows businesses to tailor their plans to meet specific needs and budget constraints.

Factors Influencing Plan Costs

Several factors contribute to the overall cost of a corporate travel insurance plan. These factors range from the scope of coverage to the characteristics of the employee base.

- Coverage Scope: The breadth of coverage directly impacts the premium. Comprehensive plans encompassing medical emergencies, trip cancellations, lost baggage, and other potential issues typically have higher costs than plans with limited coverage.

- Destination Risk Assessment: Destinations with higher safety risks, political instability, or specific health concerns command higher premiums. Travel to countries with limited healthcare infrastructure or those experiencing natural disasters will often have higher insurance costs. For example, travel insurance for employees going to a region with a history of civil unrest or a known outbreak of a contagious disease would likely cost more.

- Employee Demographics: The age, health status, and travel habits of employees significantly affect plan costs. Plans covering a higher proportion of older or pre-existing health conditions tend to be more expensive than those primarily covering younger, healthier employees.

- Travel Frequency and Duration: Employees who frequently travel or have extended trips generally require more comprehensive coverage, thus leading to higher costs. A company with employees undertaking multiple business trips throughout the year will typically have higher insurance premiums compared to a company whose employees only travel occasionally.

Relationship Between Plan Coverage and Cost, Corporate travel coverage plans

The cost of a corporate travel insurance plan is directly related to the level of coverage provided. A plan with broader coverage, including more comprehensive medical benefits, trip interruption, and baggage loss protection, will generally have a higher premium. Conversely, a plan with limited coverage, often focusing only on medical emergencies, will have a lower premium. Companies need to strike a balance between adequate coverage and cost-effectiveness.

Impact of Employee Demographics on Plan Costs

Employee demographics play a pivotal role in determining the cost of a travel insurance plan. Older employees with pre-existing medical conditions might require higher coverage and more extensive medical care, resulting in a higher premium compared to younger, healthier employees. Also, companies with employees traveling to high-risk areas or with a high frequency of travel will likely pay more for the same coverage.

Comparison of Coverage Levels and Durations

Different coverage levels and durations affect the cost. A higher level of coverage for a longer duration of travel will typically result in a higher premium. It’s crucial to assess the needs of employees and the risks associated with different travel destinations to determine the appropriate level of coverage. For example, a 10-day trip to a relatively safe European city might require a lower level of coverage compared to a 3-month assignment in a developing country.

Strategies for Reducing Costs Without Compromising Coverage

Reducing costs without compromising coverage involves careful planning and negotiation. Companies can implement various strategies to optimize their travel insurance plans:

- Negotiating with Insurance Providers: Larger companies often enjoy better negotiation power, allowing them to secure favorable rates for their travel insurance. Bulk purchasing of insurance policies can often lead to discounts.

- Selecting Appropriate Coverage Levels: Careful assessment of employee travel patterns and destinations allows businesses to select coverage that aligns with their specific needs, avoiding unnecessary expenses. A tailored plan, encompassing only the necessary protections, can result in substantial cost savings.

- Utilizing Pre-Trip Risk Assessments: Evaluating the risks associated with specific destinations and employee travel profiles helps to determine the appropriate coverage levels and reduce unnecessary costs. This personalized approach can lower the premium without sacrificing critical protection.

- Employee Education: Educating employees about the importance of following travel guidelines and emergency protocols can help reduce the likelihood of claims and lower insurance costs. This includes understanding the coverage limits and knowing how to contact the insurance provider in case of an emergency.

Plan Selection and Implementation

Selecting the right corporate travel coverage plan is crucial for minimizing financial risks and maximizing employee benefits. A well-chosen plan ensures smooth travel operations and protects the company’s interests. Implementing this plan effectively requires careful consideration of various factors and a clear communication strategy.

Implementing a comprehensive corporate travel coverage plan necessitates a structured approach, encompassing plan selection, provider evaluation, and internal implementation. This involves careful planning, clear communication, and a focus on the specific needs of the company and its employees.

Steps in Selecting a Corporate Travel Coverage Plan

Understanding the specific needs of the company is the first step in selecting a suitable travel coverage plan. This involves assessing the volume of travel, typical destinations, and employee profiles. Analyzing the current travel policies and procedures is essential for identifying potential gaps and areas for improvement. A thorough review of potential providers’ offerings is equally vital, examining the coverage levels, cost structures, and service features. Thorough due diligence on potential providers is critical, including an analysis of their financial stability and reputation.

Factors to Consider When Choosing a Provider

Evaluating potential providers requires careful consideration of several factors. Coverage adequacy is paramount; ensuring sufficient protection against unforeseen circumstances is critical. Claims handling procedures are essential; quick and efficient claims processing is crucial for minimizing disruption. Provider reputation and financial stability are equally important; a financially stable provider can offer greater assurance of consistent service. The provider’s level of customer service should also be assessed; a responsive and helpful service team can be a significant asset. Finally, cost-effectiveness is a crucial consideration, as it directly impacts the overall budget.

Checklist of Important Questions to Ask Potential Providers

To effectively evaluate potential providers, it is important to develop a comprehensive list of pertinent questions. These should focus on specific coverage levels, claim handling procedures, and service standards. Crucially, potential providers should be questioned about their experience with similar companies, their customer support systems, and their financial stability. This includes requesting detailed information on their claims handling process, including the typical timeframe for resolution.

Implementing a New Plan Within a Company

Implementing a new corporate travel coverage plan requires a phased approach. First, a detailed communication plan should be developed to educate employees about the new plan’s benefits and advantages. Next, the plan’s terms and conditions should be clearly communicated to ensure understanding and compliance. Training sessions can be beneficial for employees to fully understand the implications of the plan. Finally, establishing clear procedures for reporting travel expenses and handling claims is crucial for seamless plan implementation.

Best Practices for Communicating the Plan to Employees

Effective communication is key to successful plan implementation. The plan’s benefits and advantages should be highlighted clearly. A comprehensive document outlining the plan’s details and procedures should be provided. Furthermore, regular updates and Q&A sessions can help address employee concerns and promote understanding. Emphasizing the plan’s positive impact on employee well-being and the company’s travel policies is crucial.

Claims Process and Management: Corporate Travel Coverage Plans

A well-defined claims process is crucial for both employees and the company. It ensures timely and efficient resolution of travel-related issues, minimizing disruption and maximizing the benefits of the corporate travel coverage plan. A clear understanding of the process, common scenarios, and the company’s support role is vital.

The corporate travel coverage claims process is designed to be straightforward and supportive. Employees are guided through each step, while the company’s role is to facilitate a smooth and fair resolution. The plan’s terms and conditions are fundamental to this process.

Claims Process Overview

The claims process is a structured approach to handling travel-related incidents. It typically involves reporting the claim, providing supporting documentation, and receiving a resolution. The process is designed to minimize delays and ensure prompt reimbursements or other necessary assistance.

Common Claims Scenarios and Resolutions

- Lost or Damaged Luggage: Employees should report the loss or damage immediately to the airline and the travel insurance provider. Supporting documentation like flight details, baggage claim receipts, and police reports are crucial. The insurer will assess the claim based on the coverage limits and supporting evidence. Compensation may be provided for the value of lost or damaged items.

- Trip Cancellation or Interruption: If a trip is canceled or interrupted due to unforeseen circumstances, employees should promptly notify the travel agency and the insurance provider. Documentation such as flight confirmations, cancellation notices, and medical certificates (if applicable) are required. The insurer will determine eligibility for coverage based on the plan’s terms and conditions, and may offer reimbursement for non-refundable expenses like flights, accommodation, and prepaid tours.

- Medical Emergencies: In case of a medical emergency during travel, employees must immediately seek necessary medical attention and inform the insurer. Detailed medical records, including diagnoses and treatment costs, are crucial for processing the claim. The insurer will work with the employee to ensure timely reimbursement of eligible medical expenses, according to the plan’s terms.

Employee Claim Filing Steps

- Report the Claim: Employees should contact the designated claims contact person within the company or the insurer’s customer service line immediately after the incident.

- Gather Documentation: Collect all relevant supporting documents such as flight tickets, receipts, medical bills, police reports, and other supporting evidence.

- Complete Claim Form: Fill out the claim form provided by the insurer, ensuring accurate and complete information. This form will Artikel the required details for processing the claim.

- Submit Documentation: Submit the completed claim form and all supporting documents to the designated claims department.

- Follow Up: Employees should regularly follow up on the claim status with the claims department.

Company Support During the Claims Process

The company plays a vital role in supporting employees throughout the claims process. This involves providing clear instructions, access to relevant resources, and guidance on the required procedures. The designated claims contact person or department within the company acts as a liaison between the employee and the insurer.

Flowchart of the Claims Process

| Step | Action |

|---|---|

| 1 | Employee reports incident to company claims contact. |

| 2 | Employee gathers necessary documentation (e.g., receipts, medical records). |

| 3 | Employee submits claim form and documentation to company claims contact. |

| 4 | Company claims contact forwards claim to insurance provider. |

| 5 | Insurance provider assesses the claim and determines coverage. |

| 6 | Insurance provider notifies employee of claim status. |

| 7 | Insurance provider processes reimbursement or provides necessary support. |

Legal and Regulatory Aspects

Navigating the legal landscape surrounding corporate travel coverage plans is crucial for businesses. Understanding the relevant regulations and compliance requirements is paramount to avoiding potential legal issues and ensuring smooth operations. This section Artikels the key legal and regulatory considerations, including the implications of non-compliance.

The provision of corporate travel insurance is subject to various legal and regulatory frameworks, often intertwined with national and international laws governing contracts, insurance, and consumer protection. Businesses must meticulously comply with these regulations to maintain trust and credibility with stakeholders.

Legal Frameworks Impacting Corporate Travel Plans

Various laws and regulations influence the structure and operation of corporate travel coverage plans. These include consumer protection laws, insurance regulations, and data privacy laws. Understanding these regulations is critical for ensuring the legality and ethical operation of the plan.

- Consumer Protection Laws: These laws often dictate the terms and conditions of insurance policies, ensuring fairness and transparency. They also provide consumers with recourse in case of disputes. For example, specific regulations may mandate clear disclosure of policy exclusions and limitations to consumers.

- Insurance Regulations: Insurance providers operate under strict regulatory frameworks. These frameworks specify the requirements for policy issuance, claim handling, and financial solvency. Non-compliance with these regulations can result in significant penalties.

- Data Privacy Laws: The handling of employee data, particularly personal information collected during travel, is subject to data privacy regulations like GDPR (General Data Protection Regulation). These laws dictate how data is collected, stored, and used.

Compliance Requirements for Businesses

Maintaining compliance with these regulations is essential for businesses offering corporate travel coverage plans.

- Policy Transparency: Clearly outlining policy terms, conditions, and exclusions in a transparent manner is critical for compliance. This includes making the policy easily accessible to employees.

- Documentation and Record-Keeping: Proper documentation of policy administration, claims handling, and communication with employees is essential. This ensures accountability and traceability in case of future disputes.

- Employee Training: Educating employees about the policy’s terms, conditions, and claim procedures is a critical aspect of compliance. This ensures they understand their rights and responsibilities under the plan.

Legal Implications of Non-Compliance

Failure to comply with legal and regulatory frameworks can have serious consequences.

- Financial Penalties: Insurance regulators may impose substantial fines for violations of regulations. These penalties can severely impact a company’s finances.

- Reputational Damage: Non-compliance can damage a company’s reputation and erode employee trust. This can lead to decreased morale and recruitment challenges.

- Legal Action: Individuals may pursue legal action against the company for non-compliance, resulting in costly litigation.

Dispute Resolution Procedures

Effective dispute resolution procedures are crucial for managing claims and preventing conflicts.

- Internal Grievance Mechanisms: Establish clear internal channels for employees to lodge complaints and seek resolution of issues. This includes a designated point of contact and a structured process.

- Mediation and Arbitration: In cases where internal resolutions fail, mediation or arbitration can be employed to resolve disputes outside of court. These methods are often quicker and less expensive than litigation.

- Compliance with Legal Requirements: Adherence to the legal frameworks governing dispute resolution processes is paramount. This ensures fairness and transparency in the handling of claims.

Technological Advancements and Innovations

Modern corporate travel coverage plans are increasingly leveraging technology to enhance efficiency, transparency, and the overall employee experience. This integration streamlines processes from claim submission to policy management, offering significant benefits for both companies and their travelers.

Technological advancements are fundamentally altering how corporate travel insurance is managed and accessed. This transformation is driven by a need for improved efficiency, reduced costs, and a better user experience. Innovative solutions are automating tasks, providing real-time data, and fostering a more proactive approach to managing risks associated with business travel.

Streamlining the Claims Process

Technological advancements have significantly streamlined the claims process, making it faster and more efficient. This improvement translates into a reduction in administrative burdens for both employees and the company. Automated systems expedite the processing of claims, reducing the time it takes for reimbursement. This enhanced efficiency translates into reduced administrative costs and faster payouts for travelers.

Digital Tools in Travel Insurance Management

Numerous digital tools are transforming how travel insurance is managed. Mobile applications allow employees to report claims, access policy details, and track reimbursement statuses. These applications offer a convenient and user-friendly experience. Cloud-based platforms centralize data, enabling real-time access and collaboration among stakeholders.

Enhancing Employee Experience with Travel Insurance

Technology can significantly enhance the employee experience with travel insurance. User-friendly mobile apps allow travelers to easily access and manage their policies. These applications offer real-time claim status updates and secure communication channels. These features minimize the stress and frustration often associated with travel insurance claims.

Optimizing Plan Management for Companies

Technological solutions can help optimize plan management for companies. Data analytics can provide insights into claim patterns and potential risks, allowing companies to tailor their policies and coverage to meet specific needs. This proactive approach can reduce costs and improve overall plan effectiveness. Reporting and dashboarding tools allow for clear and concise monitoring of plan utilization and costs, providing valuable data for informed decision-making. Furthermore, predictive modeling can anticipate potential claim spikes and help in proactive risk mitigation.

Case Studies and Examples

Source: com.au

Real-world implementations of corporate travel coverage plans offer valuable insights into successful strategies, highlighting the tangible benefits and challenges encountered. Understanding these examples allows companies to learn from past experiences and tailor their plans to specific needs and industry contexts. Analyzing successful implementations across diverse industries reveals common threads and key factors contributing to positive outcomes.

A robust corporate travel coverage plan can significantly impact employee satisfaction and productivity by providing a sense of security and streamlining the travel process. These plans, when implemented effectively, can reduce the administrative burden on employees, minimizing disruptions to work schedules and maximizing efficiency. Examining successful case studies provides practical examples to inform the design and implementation of a company’s own travel policy.

Successful Implementations in Different Industries

Implementing a well-structured corporate travel coverage plan can lead to numerous benefits across various industries. Analyzing successful implementations in diverse sectors offers a comprehensive perspective on effective strategies and the impact of these plans on different company environments.

- Technology Sector: Companies like Google and Microsoft, known for their extensive travel policies, demonstrate that robust coverage plans can improve employee well-being. These plans frequently include comprehensive insurance options, flexible travel booking platforms, and robust expense reporting systems, enabling employees to manage their travel effectively. Employee satisfaction and productivity often correlate with access to such streamlined travel management systems, and reduced administrative overhead.

- Finance Sector: Banks and investment firms often prioritize security and compliance in their travel policies. These plans frequently incorporate strict regulations for travel expense reporting and security measures for overseas travel, ensuring adherence to internal policies and external regulations. Robust coverage plans can enhance employee confidence in handling sensitive information during business trips.

- Retail Sector: Retailers frequently face challenges related to frequent travel for sales representatives or store managers. Effective travel coverage plans for these employees often focus on minimizing administrative burdens, providing transparent expense reimbursement procedures, and ensuring that employees have appropriate insurance. This can lead to reduced stress on employees and greater efficiency in managing travel expenses.

Impact on Employee Satisfaction and Productivity

A well-designed corporate travel coverage plan can positively influence employee satisfaction and productivity. The implementation of such a plan can be evaluated by its positive impact on employee satisfaction and productivity levels.

- Reduced Stress: A transparent and user-friendly travel policy can minimize employee stress related to travel arrangements and expenses. Clear guidelines and automated systems reduce the burden of administrative tasks, allowing employees to focus on their core responsibilities.

- Improved Efficiency: Streamlined travel booking and expense reporting processes enhance operational efficiency. Employees can spend less time on travel-related paperwork and more time on tasks directly contributing to business objectives.

- Enhanced Employee Morale: Comprehensive coverage plans often include benefits like health insurance and travel insurance, contributing to a sense of security and appreciation amongst employees. Employees who feel supported and protected during business trips tend to be more engaged and productive.

Key Lessons Learned from Implementations

Drawing lessons from successful corporate travel coverage plan implementations provides valuable insights. These implementations often demonstrate that careful planning, thorough communication, and ongoing evaluation are critical components of successful deployment.

- Customization is Key: A one-size-fits-all approach rarely works. Corporate travel plans should be tailored to the specific needs and culture of the organization and its employees.

- Technology Integration: Utilizing technology for travel booking, expense reporting, and risk management can significantly improve efficiency and accuracy.

- Continuous Improvement: Regularly reviewing and updating the travel policy ensures its relevance and effectiveness in a dynamic business environment.

Summary

In conclusion, corporate travel coverage plans are a vital component of a robust employee benefits package. By carefully considering factors like coverage types, cost considerations, and implementation strategies, businesses can create a comprehensive plan that protects their employees, minimizes potential risks, and strengthens their overall reputation. This guide has highlighted the importance of these plans and provided a framework for companies to navigate the complexities of planning, implementing, and managing them effectively. The key takeaway is that proactive planning and careful selection of a plan can translate into significant cost savings and a boost in employee morale and satisfaction.