Business Travel Insurance Quotes Your Guide

Business travel insurance quotes are crucial for protecting your ventures. Navigating the complexities of travel insurance can be daunting, but this guide provides a comprehensive overview of the process. From understanding the risks and types of policies to comparing quotes and evaluating specific policies, we’ll cover everything you need to make informed decisions. Understanding the claims process and negotiation strategies will help you secure the best possible coverage for your business trips.

This resource will walk you through the various aspects of securing business travel insurance, providing insights into factors influencing quote costs and the process of obtaining quotes online. We’ll also explore the importance of understanding policy terms and conditions, as well as strategies for effectively negotiating premiums and understanding the claims process.

Understanding the Need for Business Travel Insurance Quotes

Business travel, while crucial for expanding networks and driving growth, often exposes professionals to unforeseen circumstances. Proper planning, including securing appropriate insurance coverage, is essential to mitigating potential risks and ensuring a smooth and secure trip. This section will delve into the diverse risks inherent in business travel, the significance of insurance, different policy types, influencing factors, and common exclusions.

Business travel presents a multitude of potential challenges, from unexpected medical emergencies and flight disruptions to lost luggage and theft of personal belongings. These risks can quickly escalate into significant financial burdens if not adequately addressed. The peace of mind and financial protection offered by business travel insurance are invaluable assets for any business traveler.

Risks Associated with Business Travel

Various risks can impact business travelers, from the common to the unforeseen. These risks encompass a broad spectrum, including medical emergencies, trip cancellations, delays, and lost or damaged belongings. The consequences of these events can range from significant personal distress to substantial financial losses.

Importance of Insurance Coverage

Securing adequate business travel insurance is paramount for mitigating these risks. Insurance policies provide financial protection against unforeseen events, allowing travelers to focus on their business objectives without undue worry about potential financial liabilities. This protection ensures that a traveler can address medical issues, reschedule trips, or replace lost or damaged belongings without incurring significant personal financial strain.

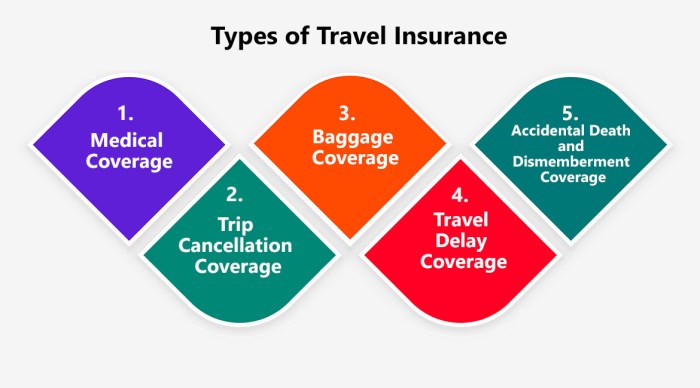

Types of Business Travel Insurance Policies

Business travel insurance policies come in various forms, each tailored to specific needs. Comprehensive plans typically encompass medical expenses, trip cancellations, baggage loss, and liability protection. Other plans might concentrate on specific aspects like medical emergencies or flight disruptions. Choosing the right policy depends on the individual traveler’s needs and the nature of their business trips.

- Medical Expense Coverage: This critical component of travel insurance provides financial assistance for unforeseen medical expenses incurred during the trip. It covers everything from emergency room visits to hospitalization costs, ensuring the traveler can receive necessary care without incurring exorbitant out-of-pocket expenses. Coverage amounts vary depending on the policy.

- Trip Cancellation/Interruption Insurance: This protects against financial losses resulting from unexpected cancellations or interruptions to a business trip. It covers costs associated with non-refundable travel arrangements, such as flights, accommodations, and tours, if the trip is canceled due to unforeseen circumstances.

- Baggage and Personal Effects Coverage: This covers the replacement cost of lost, stolen, or damaged belongings, such as laptops, clothing, and other personal effects. The policy typically stipulates limits on coverage amounts and may have exclusions, such as items specifically deemed high-value or fragile.

Factors Influencing the Cost of Business Travel Insurance

Several factors influence the price of a business travel insurance policy. These factors include the duration of the trip, the destination, the traveler’s age and health status, and the specific coverage included in the plan. Policies with broader coverage, higher benefit limits, and comprehensive inclusions will typically have a higher premium.

| Factor | Explanation |

|---|---|

| Trip Duration | Longer trips generally result in higher premiums due to the increased potential for unforeseen events. |

| Destination | Travel to high-risk areas or countries with limited healthcare access often necessitates higher premiums. |

| Traveler’s Health | Pre-existing medical conditions or a history of health issues may lead to higher premiums or exclusions. |

| Coverage Levels | Policies with more comprehensive coverage, higher benefit limits, and wider exclusions often command a higher price. |

Common Travel Insurance Exclusions and Limitations

It’s crucial to understand the limitations and exclusions of any travel insurance policy. Policies often exclude coverage for pre-existing conditions, intentional acts, and losses due to war or terrorism. Furthermore, specific activities like extreme sports or illegal activities may be excluded. Carefully reviewing the policy document is essential to understand the precise coverage and limitations.

“Understanding the fine print of your insurance policy is critical to avoiding unpleasant surprises when unforeseen events arise.”

Comparing Business Travel Insurance Quotes

Obtaining multiple business travel insurance quotes is crucial for securing the best possible coverage at the most competitive price. A thorough comparison process allows you to evaluate different policy features and tailor your coverage to your specific travel needs and budget. This process ensures you’re not overpaying for unnecessary coverage or missing essential protection.

Different Insurance Providers

Various insurance providers offer business travel insurance, each with its own set of strengths and weaknesses. Understanding the strengths and weaknesses of different providers can help you make an informed decision. Some providers might specialize in specific industries or offer unique add-ons, while others might have broader coverage but less personalized service.

Key Factors to Consider

Evaluating different quotes requires careful consideration of several key factors. The coverage details, premiums, and exclusions are critical components of any insurance policy. Additionally, consider the provider’s reputation, customer service, and claims handling process. Reviewing testimonials and online reviews can offer valuable insights.

Coverage Comparison

- Coverage scope varies greatly between providers. Some may provide broader coverage encompassing medical emergencies, trip cancellations, baggage loss, and even liability protection. Others might offer more tailored coverage, potentially focusing on specific industry needs or high-value travel situations.

- Consider the extent of medical expenses covered, including emergency medical evacuation, repatriation, and hospitalization. Policies may differ significantly in the maximum payout amounts and the conditions under which they are applicable.

- Assess the coverage for lost or damaged baggage. Policies often differ in the amount covered and the types of items included. Review the details to determine if the coverage aligns with your needs.

Premium Comparison

- Premiums are influenced by several factors, including trip duration, destination, travel style, and pre-existing medical conditions. Consider the specific coverage you need and compare premiums accordingly.

- A detailed breakdown of the premium components can help you understand the factors contributing to the overall cost. Compare the costs of different policies while considering the coverage they offer.

- Consider the premium as a measure of the value of the coverage provided. A lower premium does not necessarily mean inferior coverage, but it’s essential to evaluate the coverage provided to ensure it aligns with your travel needs.

Exclusions Comparison

- Exclusions are conditions or circumstances where coverage may not apply. These are crucial to understand to avoid unexpected gaps in coverage.

- Understand the specific exclusions related to pre-existing medical conditions, specific activities, or destinations. These details are vital to ensure the policy aligns with your travel plans.

- Compare the exclusions carefully to identify potential limitations and ensure they don’t impact your specific travel requirements. Thorough scrutiny of the exclusions is essential for a suitable policy.

Example Comparison Table

| Feature | Provider A | Provider B | Provider C |

|---|---|---|---|

| Coverage (Medical) | $500,000 | $1,000,000 | $750,000 |

| Coverage (Trip Cancellation) | 75% of trip cost | 100% of trip cost | 50% of trip cost |

| Premium (Annual) | $300 | $450 | $350 |

| Exclusions (Pre-existing Conditions) | Excludes conditions diagnosed within 6 months | Excludes conditions diagnosed within 1 year | Excludes conditions diagnosed within 3 months |

Note: This is a sample table. Actual coverage, premiums, and exclusions will vary between providers.

Efficient Quote Comparison Process

A systematic approach to comparing quotes is essential. Compile a list of your travel requirements and potential providers. Use comparison websites to obtain quotes from multiple providers. Compare the coverage, premiums, and exclusions. Ensure the coverage aligns with your travel needs.

Criteria for Policy Selection

Select the policy that best suits your travel needs and budget. Factors to consider include the level of medical coverage, trip cancellation protection, and baggage coverage. The most suitable policy balances the cost and the breadth of coverage you require.

Factors Influencing Business Travel Insurance Quotes

Understanding the nuances of business travel insurance pricing is crucial for securing appropriate coverage. Different factors play a significant role in determining the cost of a policy, impacting both the premium and the extent of the coverage. These factors are not always straightforward, so careful consideration is essential when evaluating quotes.

Several elements contribute to the variability in business travel insurance premiums. The destination, duration of the trip, traveler profile, type of business activity, and pre-existing medical conditions are all pivotal considerations. A thorough understanding of these factors empowers businesses to make informed decisions about their insurance needs and effectively manage potential risks associated with international travel.

Destination Impact on Insurance Quotes

Travel destinations significantly impact insurance costs and coverage requirements. Countries with complex healthcare systems or political instability may necessitate broader and more comprehensive coverage, increasing the premium. For example, traveling to a country with limited medical facilities might require supplemental medical evacuation coverage, which can substantially increase the cost. Conversely, traveling to a familiar and stable destination with readily accessible medical care will typically result in a lower premium.

Trip Duration and Insurance Premiums

The duration of the business trip is a key determinant in insurance policy pricing. Longer trips generally command higher premiums because the potential for unforeseen events increases with the length of time spent outside of familiar territory. This increased exposure to risk directly correlates with the higher cost of the insurance. For instance, a short, one-day business trip will have a substantially lower premium than a three-week international assignment.

Traveler Profile and Insurance Needs

Traveler profiles significantly affect insurance needs and, consequently, the cost of the policy. Solo travelers often require different coverage than families or groups. A solo traveler might benefit from enhanced emergency evacuation provisions, whereas a family might prioritize comprehensive medical coverage for all members. Insurance companies assess these diverse needs to tailor policies to specific profiles, affecting the price.

Business Activity and Policy Scope

The nature of the business activity influences the necessary coverage and, therefore, the premium. A business traveler attending a conference will likely require different coverage than a construction worker on a site visit. For instance, if the business activity involves potential risks, such as construction or hazardous material handling, a more comprehensive policy will be required, increasing the price.

Pre-existing Medical Conditions and Insurance Premiums

Pre-existing medical conditions can impact the cost of business travel insurance. Insurers typically assess these conditions to determine the risk associated with providing coverage. The severity and nature of the condition, along with the potential for complications during the trip, play a pivotal role in calculating the premium. Disclosure of any pre-existing medical condition is crucial for accurate pricing and appropriate coverage.

Factors Influencing Business Travel Insurance Quotes – Summary Table

| Factor | Description | Impact on Cost |

|---|---|---|

| Destination | Country’s healthcare system, political stability | Higher cost for unstable/complex destinations |

| Trip Duration | Length of the business trip | Longer trips generally lead to higher premiums |

| Traveler Profile | Solo, family, or group | Different needs and coverage requirements |

| Business Activity | Nature of work, potential risks | Specific risks may require comprehensive coverage, raising the cost |

| Pre-existing Conditions | Medical history | Premiums may increase depending on condition severity |

Accessing and Evaluating Business Travel Insurance Quotes Online

Finding the right business travel insurance can be a complex process. Fortunately, online resources streamline this task, providing numerous options and comparisons. This section details the practical steps to access and evaluate quotes effectively.

Online Insurance Provider Comparison

A crucial aspect of securing suitable coverage involves comparing quotes from various providers. This table presents a sample of online insurance providers, their coverage specifics, premiums, and contact information. Note that premiums and coverages are subject to individual circumstances and may vary.

| Provider | Coverage Details (Example) | Premium (Example – USD) | Contact Information |

|---|---|---|---|

| TravelGuard | Trip cancellation/interruption, medical expenses, emergency evacuation, lost baggage | $150-$300 | www.travelguard.com |

| World Nomads | Medical expenses, trip interruption, emergency assistance, and personal liability | $100-$250 | www.worldnomads.com |

| Allianz Global Assistance | Comprehensive coverage for medical emergencies, lost baggage, trip delays, and cancellations | $100-$200 | www.allianzglobalassistance.com |

| SafetyWing | Trip cancellation/interruption, medical emergencies, lost baggage, and travel delays | $80-$200 | www.safetywing.com |

| AXA Assistance | Worldwide medical coverage, trip delays, and personal liability protection | $120-$300 | www.axaassistance.com |

Utilizing Online Comparison Tools

Many websites offer comprehensive comparison tools for business travel insurance. These tools allow users to input their travel details, desired coverage, and other criteria to generate tailored quotes from multiple providers. This approach facilitates efficient comparison and selection.

Requesting Quotes from Multiple Providers

The process of obtaining quotes from multiple providers is straightforward. Typically, users fill out an online form with specific details regarding their trip, desired coverage, and personal information. The providers then generate a quote based on this data.

Examples of Online Quote Forms

Online quote forms often include fields for trip details (destination, dates, and duration), traveler information (names, ages, and occupations), and coverage preferences (medical expenses, trip interruption, and emergency evacuation). Some forms also include pre-existing medical conditions and specific travel activities. These details ensure accurate quote generation and personalized coverage.

Potential Pitfalls in Online Evaluation

Carefully reviewing the fine print and exclusions of each policy is crucial. Hidden costs, exclusions, and limitations can significantly impact the actual coverage offered. Thorough understanding of policy terms is vital to avoid potential pitfalls. Inaccurate information input can lead to incorrect quotes, necessitating a review and re-submission of the request. Moreover, relying solely on online tools without consulting a broker may limit options.

Evaluating Specific Business Travel Insurance Policies

Thorough review of the policy’s fine print is crucial for understanding its coverage and exclusions. Failing to meticulously examine the terms and conditions can lead to unexpected gaps in protection, potentially leaving you financially vulnerable during a trip. Understanding the specific language employed by the insurer is paramount to making informed decisions.

Careful consideration of policy details, including coverage limits, exclusions, and specific conditions, empowers businesses to select the best possible protection for their needs. This proactive approach ensures that the insurance policy effectively addresses potential risks and liabilities associated with business travel.

Understanding Policy Terms and Conditions

The policy’s terms and conditions dictate the scope of coverage and limitations. Understanding these details prevents surprises and ensures that the policy aligns with the business’s needs. Specific wording regarding the scope of coverage, exclusions, and limitations are critical to avoid unforeseen issues.

Common Policy Terms and Their Implications

Policy terms often have implications that are not immediately apparent. Understanding these terms is essential to evaluate the policy’s overall value and coverage.

| Policy Term | Implications |

|---|---|

| Coverage Limits | These specify the maximum amount the insurer will pay for a particular claim. Knowing the limits for medical expenses, lost baggage, trip cancellations, and other events is crucial. |

| Exclusions | These Artikel situations where the policy does not provide coverage. Understanding these exclusions is critical to identifying potential gaps in protection. For example, pre-existing conditions may not be covered. |

| Waiting Periods | These are timeframes before coverage begins. For medical claims, this could involve a period before the insurer starts paying. |

| Deductibles | These are the amounts you must pay out-of-pocket before the insurance company pays a claim. A higher deductible can mean lower premiums but higher out-of-pocket expenses in the event of a claim. |

| Claim Procedures | These Artikel the steps required to file a claim. Understanding these procedures is vital in the event of a claim. A clear and detailed process can streamline the claim process. |

Examples of Comprehensive Business Travel Insurance Policies

Comprehensive policies often cover a wide range of potential risks, including medical emergencies, trip cancellations, lost baggage, and liability. A well-rounded policy will have a detailed description of the coverage for each of these situations. These policies provide broad protection, suitable for companies with significant travel needs.

Medical Coverage Options

Medical coverage options vary significantly between policies. Understanding the different types of medical coverage is essential for selecting a policy that meets your specific needs.

- Basic Medical Coverage: This type of coverage provides fundamental medical assistance during the trip, often with predefined coverage limits.

- Comprehensive Medical Coverage: This type of coverage typically provides broader medical assistance, including coverage for pre-existing conditions, emergency evacuation, and other extensive medical needs.

- International Medical Coverage: This type of coverage specifically caters to medical needs while traveling internationally. This often involves considerations for different healthcare systems and potential costs.

Reviewing Policy Documents

A thorough review of the policy documents is crucial to ensure clarity and completeness.

- Clarity: Pay close attention to the wording of each clause. If any terms are unclear, contact the insurance provider for clarification.

- Completeness: Verify that the policy covers all the aspects of your travel needs. Ensure all anticipated circumstances are addressed within the policy.

Understanding the Claims Process for Business Travel Insurance

Navigating the claims process for business travel insurance can feel daunting. However, a clear understanding of the steps involved and the required documentation can significantly streamline the process. This section details the claim procedure, potential pitfalls, and what to expect throughout the claims journey.

The claims process for business travel insurance policies varies slightly between providers. While each company has its own specific guidelines, a standard framework usually involves reporting the incident, gathering necessary documents, and awaiting the insurance company’s review and decision. Knowing these steps in advance can help expedite the claim resolution.

Claim Filing Procedure

Understanding the claim filing process is crucial for a smooth resolution. A well-structured approach, encompassing reporting the incident and gathering supporting documentation, will greatly improve the chances of a timely and favorable outcome.

- Initial Report: Immediately after the covered event, contact your insurance provider to report the claim. Provide details about the incident, including the date, time, location, and a brief description of the circumstances. Keep detailed records of all communications with the insurer, including dates and times.

- Gathering Documentation: Thorough documentation is paramount. This may include police reports, medical records, receipts for expenses incurred, flight confirmations, and hotel bookings. Ensure all documents are clearly labeled and organized.

- Completing Claim Forms: The insurer will provide claim forms that require detailed information. Accuracy and completeness in these forms are vital. Provide all necessary information, ensuring the details align with the original incident report.

- Waiting for Review: The insurer will review the claim, possibly requesting additional documentation or clarifications. Be prepared to answer any questions and provide further supporting evidence to expedite the process.

- Receiving a Decision: The insurer will eventually issue a decision on the claim. This decision may be approval, denial, or a request for further information. Review the decision carefully and understand the rationale behind it.

Required Documentation for Claims

The necessary documentation varies depending on the nature of the claim. However, some commonly required documents include proof of the covered event, supporting evidence for the incurred expenses, and details regarding the travel itinerary.

- Proof of Covered Event: This could be a police report, medical records, or a letter from a relevant authority. The evidence must convincingly demonstrate the event that triggered the claim.

- Supporting Expenses: Receipts, invoices, and bills detailing the costs incurred due to the covered event are essential. This is crucial for expenses such as medical bills, lost baggage costs, or emergency evacuation.

- Travel Itinerary: Details of the trip, including flight confirmations, hotel bookings, and travel insurance policy details, help determine the scope of the coverage.

- Policy Documents: A copy of the relevant insurance policy, including the policy number and the insured’s details, must be provided. This will facilitate the verification process.

Common Reasons for Claim Denial

Understanding the potential reasons for claim denial allows you to take proactive steps to mitigate such issues.

- Non-Coverage: The event might not fall under the terms and conditions of the policy. A careful review of the policy terms is essential to understand the coverage limits.

- Incomplete Documentation: Missing or insufficient documentation can lead to a claim denial. Ensuring all required documents are provided completely and accurately is crucial.

- Fraudulent Claims: Deliberate misrepresentation or falsification of information can result in claim denial. Honesty and transparency are essential throughout the process.

- Pre-Existing Conditions: Some policies may exclude coverage for pre-existing medical conditions that manifest during the trip.

Examples of Successful and Unsuccessful Claims

Examples of successful and unsuccessful claims can offer valuable insights.

- Successful Claim Example: A business traveler’s flight was delayed due to severe weather. The traveler submitted detailed documentation, including flight confirmations, hotel receipts, and receipts for meals and accommodation. The claim was approved promptly.

- Unsuccessful Claim Example: A business traveler made a claim for lost luggage but did not submit receipts for purchased items. The insurer denied the claim due to insufficient documentation.

Claim Settlement Timeframe

The timeframe for claim settlement can vary based on the complexity of the claim and the insurer’s internal procedures.

- Typical Timeframe: The average timeframe for claim settlement is typically within 30-60 days, although this can vary depending on the insurer.

Tips for Negotiating Business Travel Insurance Quotes

Securing the best possible business travel insurance coverage often involves more than simply accepting the initial quote. Strategic negotiation can lead to significant savings without compromising essential protections. Understanding the factors influencing pricing and the nuances of policy terms is key to maximizing value.

Effective negotiation hinges on a thorough understanding of your needs, the insurance market, and the specifics of each policy. By presenting a well-reasoned case and leveraging available discounts, you can often secure a more favorable premium.

Strategies for Negotiating Favorable Premiums

Negotiation tactics can yield substantial savings. A proactive approach, combined with knowledge of policy terms, can lead to a more competitive price. This includes understanding the factors influencing pricing and the specific terms of the policies under consideration.

- Demonstrate Value: Highlight the value you bring to the insurance provider. Quantify your travel frequency and potential for claims. For example, if you travel extensively for a company with a proven track record of profitability, you might negotiate a reduced premium. Similarly, if your travel schedule is predictable and follows a consistent pattern, you may be eligible for a more favorable rate.

- Compare Policies: Thoroughly research and compare quotes from different insurers. Identify areas where policies offer comparable coverage at different price points. Look for policies with similar coverage levels at lower premiums, demonstrating a clear cost-effectiveness advantage.

- Bundle Services: If possible, explore options for bundling travel insurance with other services offered by the insurer, such as hotel bookings or rental car services. A bundled package often allows for negotiation of a more comprehensive, discounted price for the combined services.

Comparing Negotiation Tactics and Potential Outcomes

Different negotiation tactics can have varied outcomes. Careful consideration of your specific circumstances is crucial when selecting the most appropriate strategy.

| Negotiation Tactic | Potential Outcome | Example |

|---|---|---|

| Highlighting travel frequency and pattern | Reduced premiums for consistent travelers | A business executive traveling to the same three cities quarterly might negotiate a lower premium. |

| Requesting discounts based on prior claims history | Reduced premiums for low-risk profiles | A business professional with no prior claims might negotiate a lower premium based on a history of responsible travel. |

| Leveraging group rates or employee discounts | Significant premium reductions for large groups | Companies with extensive travel needs might negotiate significantly lower premiums by utilizing group rates. |

| Comparing multiple quotes and policies | Identifying better value and coverage | Thorough comparison of policies from multiple providers often uncovers hidden savings or more comprehensive coverage options. |

Understanding Cancellation Terms, Business travel insurance quotes

Cancellation terms are crucial in business travel insurance. Understanding these terms is essential to avoid unexpected costs or penalties when your travel plans change. This involves recognizing the specific conditions under which you can cancel your policy without incurring financial penalties.

- Review Cancellation Policy: Thoroughly review the cancellation policy for the specific business travel insurance plan. Understand the terms and conditions for cancelling the policy and any associated penalties.

- Analyze Cancellation Window: Pay attention to the cancellation window. This specifies the time frame within which you can cancel your policy without penalty.

- Evaluate Refund Policy: Be aware of the refund policy. Understand the conditions under which a full or partial refund may be available for cancelled trips.

Identifying and Leveraging Discounts

Discounts can significantly reduce the cost of business travel insurance. Insurers often offer various discounts, such as those for group policies or employees.

- Check for Group Discounts: If you are traveling with a group, inquire about group discounts, which often provide substantial savings compared to individual policies.

- Look for Employee Discounts: Check for employee discounts if your employer offers travel insurance as part of employee benefits.

- Review Insurer Promotions: Be aware of any promotions or discounts that insurers may offer from time to time.

Presenting Your Needs Effectively

Clearly communicating your needs is crucial for a successful negotiation. Present your travel patterns, anticipated expenses, and preferred coverage options to the insurer. Tailoring your approach to the specific insurer and the nature of your business can be crucial for a positive outcome.

- Document Your Travel Needs: Clearly document your travel plans and expected expenses, including details about your itinerary and any special requirements.

- Highlight Your Business Profile: Present your business profile, highlighting your company’s reputation and travel frequency.

- Provide Specific Details: Ensure you provide specific details about your needs and desired coverage, such as preferred trip duration or necessary medical expenses.

End of Discussion

Source: co.za

In conclusion, securing the right business travel insurance is essential for safeguarding your ventures. This guide has provided a roadmap for understanding the need for insurance, comparing quotes from various providers, and evaluating specific policies. By considering factors such as destination, trip duration, and traveler profile, you can select the most suitable policy. Remember to carefully review policy terms, understand the claims process, and leverage negotiation strategies to secure favorable premiums. With this comprehensive approach, you’re well-equipped to make informed decisions and protect your business investments during your travels.