Emergency Travel Insurance Corporate A Comprehensive Guide

Emergency travel insurance corporate is crucial for modern corporations. It safeguards employees during unforeseen circumstances, ensuring peace of mind and operational continuity. This guide delves into the specifics, from defining the scope and types of coverage to evaluating policy choices and managing claims.

Corporate travel insurance policies offer a vital safety net for employees, mitigating risks associated with unexpected events like medical emergencies, trip disruptions, and lost luggage. It’s more than just a benefit; it’s a strategic investment in employee well-being and company reputation.

Definition and Scope of Emergency Travel Insurance for Corporations: Emergency Travel Insurance Corporate

Corporate emergency travel insurance is a specialized insurance policy designed to protect businesses and their employees during unforeseen emergencies while traveling for work. It offers comprehensive coverage for a wide range of unexpected events, reducing financial burdens and ensuring business continuity. This policy differs significantly from individual travel insurance, focusing on the collective needs of a company’s employees.

This specialized coverage provides a safety net for corporations, mitigating risks associated with international travel and safeguarding their employees’ well-being. It extends beyond basic medical expenses to cover a spectrum of critical situations, ensuring employees can focus on recovery rather than financial concerns.

Core Features and Benefits

Corporate emergency travel insurance typically encompasses medical expenses, including evacuation, repatriation, and necessary medical treatments. It often includes provisions for lost or damaged luggage, trip cancellations due to unforeseen events, and legal expenses incurred during emergencies. A well-structured policy can provide crucial support for both employees and the company.

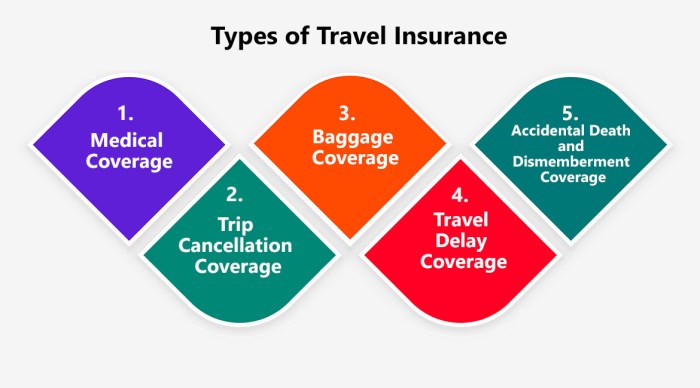

Types of Emergency Situations Covered

The coverage extends to a wide range of situations. Medical emergencies, including critical illnesses or accidents, are a primary concern. This also includes coverage for emergency medical evacuations and repatriation. Other potential emergencies include natural disasters, political unrest, and acts of terrorism, all of which can severely impact business travel. The specific circumstances and limitations vary depending on the chosen insurance provider.

Differences Between Individual and Corporate Policies

Individual travel insurance policies primarily focus on the needs of a single traveler. Corporate policies, in contrast, are tailored to cover multiple employees and address the specific requirements of business operations. The coverage often extends to a broader range of situations and has more robust financial support mechanisms for a business, reflecting the different risk profiles. Corporate policies also often include provisions for business interruption and loss of revenue, something not usually found in individual policies.

Comparison of Coverage Offered by Different Providers

Different providers offer varying levels of coverage, policy terms, and price points. Some may focus on comprehensive medical coverage, while others prioritize trip interruptions or repatriation. It’s crucial to compare different providers based on specific needs, evaluating the scope of emergency situations covered, the associated costs, and the provider’s reputation. Reviews and testimonials from previous clients can be helpful in assessing the level of support and responsiveness from the insurer.

Emergency Travel Insurance Policy Types

| Coverage Types | Exclusions | Typical Policy Costs |

|---|---|---|

| Comprehensive medical, evacuation, and repatriation | Pre-existing medical conditions, reckless behavior, and intentional self-harm | Vary based on the number of employees, trip duration, and the specific inclusions. Policies can range from a few hundred dollars per employee per year to several thousand. |

| Trip cancellation and interruption | Events not considered unforeseen or unavoidable (e.g., planned events or routine illnesses) | Usually a percentage of the total trip cost, with limits and restrictions. |

| Lost or damaged luggage | Items exceeding a certain value, intentional damage, or specific types of items. | Vary depending on the policy and the value of the lost or damaged items. |

Benefits and Advantages for Corporate Travelers

Source: orchardbenefits.ca

Emergency travel insurance for corporate employees offers a multifaceted array of benefits, extending beyond mere financial protection. It acts as a crucial safety net, mitigating potential risks and bolstering the overall well-being of employees while traveling for work. This proactive approach fosters a more productive and engaged workforce, ultimately benefiting the corporation.

A robust emergency travel insurance program translates into tangible advantages for both the employees and the organization. By safeguarding employees against unforeseen circumstances, it reduces anxieties and promotes a positive work environment. This, in turn, leads to improved employee morale and productivity, directly impacting the company’s bottom line.

Significant Advantages for Corporate Employees

A well-designed emergency travel insurance policy provides a comprehensive safety net for corporate employees during their business trips. This protection extends to a wide range of potential emergencies, from medical evacuations and lost luggage to trip cancellations and delays. Employees benefit from peace of mind, knowing that they are covered in case of unexpected events. This allows them to focus on their work tasks without the constant worry of financial burdens.

Cost Savings and Risk Mitigation for Corporations

Implementing emergency travel insurance for employees translates to significant cost savings and risk mitigation for the corporation. By preemptively addressing potential issues, the insurance helps prevent costly disruptions to business operations. The insurance policy covers medical expenses, lost or damaged belongings, and even trip cancellations, potentially saving the company from substantial financial losses. For instance, a medical emergency requiring evacuation can be significantly expensive, and the insurance mitigates this risk for the company.

Impact on Employee Morale and Productivity

Emergency travel insurance directly contributes to enhanced employee morale and productivity. Knowing they are protected in case of unforeseen circumstances, employees feel valued and supported by the organization. This sense of security reduces stress and anxiety, leading to a more focused and productive workforce. When employees are not worried about the financial implications of an emergency, they can dedicate more energy to their work responsibilities.

Maintaining a Positive Corporate Image and Reputation

Offering emergency travel insurance demonstrates a company’s commitment to employee well-being. This proactive approach enhances the corporation’s image and reputation as a responsible and caring employer. Employees are more likely to feel loyalty and commitment to a company that prioritizes their safety and security. This positive perception can attract and retain top talent.

Reducing Financial Burden on Employees

Emergency travel insurance directly alleviates the financial strain on employees in unforeseen circumstances. This is particularly valuable for employees facing medical emergencies, lost luggage, or other unexpected situations. The insurance steps in to cover expenses, relieving the employee from the worry of accumulating substantial medical bills or replacing lost belongings. This tangible support fosters a sense of appreciation and loyalty from the employees.

Advantages and Disadvantages of Emergency Travel Insurance for Corporations

| Advantages | Disadvantages |

|---|---|

| Reduced financial risk for unexpected events (medical emergencies, lost luggage, trip cancellations) | Insurance premiums can be a cost. |

| Improved employee morale and productivity | Administrative overhead for claims processing may arise. |

| Enhanced corporate image and reputation | Potential for inflated or fraudulent claims. |

| Mitigation of costly disruptions to business operations | Limited coverage options might not suit all employee needs. |

| Protection against unexpected expenses | Finding a policy that balances comprehensive coverage and cost can be challenging. |

Key Considerations for Choosing a Corporate Policy

Source: adnic.ae

Selecting the right corporate travel insurance policy is crucial for protecting your employees and safeguarding your company’s financial interests. A well-chosen policy mitigates risks associated with unexpected events during business travel, ensuring smooth operations and minimizing potential losses. Proper planning and due diligence are key to achieving optimal coverage and cost-effectiveness.

Choosing the right policy involves a thorough evaluation of various factors. A comprehensive understanding of coverage, exclusions, and customization options is paramount for making an informed decision. Evaluating different policy offerings, including their cost and customer service ratings, is also essential for ensuring the policy meets your company’s specific needs.

Comprehensive Coverage for Corporate Travel

Corporate travel often involves diverse scenarios, from routine business trips to unforeseen emergencies. A robust policy should encompass a wide range of potential issues. Comprehensive coverage extends beyond basic medical expenses to include trip interruptions, lost baggage, and even travel delays. Consideration should be given to situations like severe weather disruptions, political instability in destinations, or sudden illness, which can lead to substantial costs and operational disruptions if not adequately covered. A strong policy addresses these possibilities with clear and detailed provisions.

Importance of Policy Exclusions and Limitations, Emergency travel insurance corporate

Understanding policy exclusions and limitations is equally important as knowing the coverage. Careful scrutiny of exclusions helps prevent surprises and ensures clarity about what the policy *does not* cover. For example, pre-existing medical conditions, certain types of sports activities, or specific types of travel activities (e.g., extreme sports) might be excluded. Understanding these limitations beforehand allows for proactive planning and budgeting for any potential gaps in coverage.

Policy Customization for Diverse Corporate Needs

Different corporations have varying travel patterns, employee profiles, and risk tolerances. A one-size-fits-all approach to insurance is often inadequate. Customization allows the policy to align with specific business needs. Factors such as the frequency of travel, destination areas, and employee demographics significantly influence the optimal coverage package. For example, a company frequently traveling to high-risk areas might require a policy with enhanced emergency evacuation provisions.

Strategies for Evaluating and Comparing Policy Offerings

Evaluating and comparing different policy offerings requires a structured approach. A comparative analysis should consider factors such as coverage amounts, premiums, and customer service ratings. Companies should also consider the reputation and financial stability of the insurance provider. Furthermore, carefully review the policy’s terms and conditions, seeking clarification on any ambiguous aspects. A clear understanding of the claims process and the insurer’s responsiveness to claims is also vital.

Comparative Analysis of Insurance Providers

| Insurance Provider | Coverage (Example) | Cost (Example) | Customer Service Rating (Example) |

|---|---|---|---|

| Company A | Comprehensive medical, trip interruption, lost luggage | $150 per employee per year | 4.5 out of 5 |

| Company B | Basic medical, limited trip interruption | $100 per employee per year | 4.0 out of 5 |

| Company C | Enhanced medical, trip cancellation, emergency evacuation | $200 per employee per year | 4.8 out of 5 |

Note: This table provides illustrative examples only and is not a comprehensive comparison. Actual coverage, costs, and ratings will vary depending on the specific policy and the individual circumstances.

Claims Process and Administration

A smooth and efficient claims process is crucial for maintaining traveler satisfaction and minimizing disruption during unforeseen circumstances. This section details the steps involved in filing a claim, ensuring transparency and a clear path to resolution.

The process for handling claims under a corporate travel insurance policy is designed to be straightforward and time-sensitive. Prompt action and accurate documentation are essential for expediting the claim approval and reimbursement.

Claim Filing Steps

Understanding the steps involved in filing a claim streamlines the process for both the insurance provider and the traveler. A clear protocol ensures that all necessary information is collected and processed efficiently.

- Initial Contact and Reporting: The traveler should immediately notify the designated claim representative or the insurance company’s customer service department about the emergency. A clear description of the situation and the supporting evidence, such as medical reports or police reports, should be provided as soon as possible. Early notification facilitates prompt investigation and assessment.

- Documentation Gathering: Comprehensive documentation is critical for processing the claim. This may include medical records, receipts, police reports, travel itineraries, and any other supporting evidence relevant to the claim. Insurance companies typically provide a detailed list of required documents upon request.

- Claim Submission: The traveler must submit the necessary documentation to the designated claim representative. A standardized claim form should be utilized to ensure all required information is included. Submitting a completed claim form, along with supporting documentation, initiates the claim processing phase.

- Claim Assessment: The insurance company will assess the claim based on the provided documentation and policy terms. This process may involve contacting medical providers, reviewing travel records, or verifying the validity of the incurred expenses. The claim assessment period can vary depending on the complexity of the situation.

- Decision and Payment: Upon assessment, the insurance company will decide whether to approve or deny the claim. Approved claims will be processed for payment, and the reimbursement amount will be communicated to the traveler. Payment timelines are often Artikeld in the policy documents.

Documentation Requirements and Timelines

Clear documentation standards and timeframes are essential for efficient claim processing. The insurance company needs specific information to evaluate the claim fairly and quickly.

- Policy details: Policy number, coverage details, and any specific clauses related to the incident.

- Incident report: Details about the nature of the emergency, dates, and locations involved.

- Medical records: Relevant medical records from hospitals or clinics, including diagnoses, treatment details, and estimated costs.

- Receipts and invoices: Supporting documents to verify expenses incurred, such as receipts for medical bills, transportation costs, or accommodation.

- Travel itinerary: Documentation of the travel schedule, including flight details, hotel bookings, and other travel arrangements.

Claim Representatives’ Role

Claim representatives play a vital role in guiding travelers through the claim process. Their support ensures that claims are handled efficiently and effectively.

- Guidance and support: Claim representatives provide guidance and support to travelers, helping them understand the claim process and gather the necessary documentation. They also answer questions and address concerns during the claim filing and processing.

- Communication: They act as a primary point of contact, maintaining open communication with travelers about the status of their claims. Regular updates and timely responses are essential.

- Problem resolution: Claim representatives actively work to resolve any issues or ambiguities that may arise during the claim process.

Claims Handling Procedures

Different types of emergencies require specific handling procedures. The insurance company has protocols for each type of claim to ensure timely and appropriate action.

- Medical emergencies: Medical emergencies require immediate attention, and the claim process typically involves medical records, receipts, and physician reports.

- Lost or stolen belongings: Lost or stolen belongings require detailed documentation of the items, the circumstances of the loss, and supporting evidence like police reports. Insurance policies often have specific clauses related to this.

- Trip interruptions: Trip interruptions, such as due to weather or unforeseen events, necessitate documentation of the reason for the interruption and any incurred costs, including alternative transportation or accommodation.

Best Practices for Streamlining Claims

Implementing best practices enhances the efficiency and satisfaction of the claims process.

- Establish a dedicated claims hotline: A dedicated claims hotline or email address provides a direct line for travelers to contact for assistance.

- Provide clear communication: Transparent communication about timelines and requirements throughout the claim process builds trust and confidence.

- Utilize technology: Utilizing digital platforms and online portals streamlines the claims submission and tracking process.

Claims Process Table

| Step | Description | Deadline | Required Documentation |

|---|---|---|---|

| Initial Contact | Report emergency to claim representative | Immediately | Brief description of emergency |

| Documentation Gathering | Collect all necessary documents | Within 24-72 hours | Medical records, receipts, police reports |

| Claim Submission | Submit completed claim form and documents | Within 7 days of emergency | Completed claim form, supporting documents |

| Assessment | Insurance company evaluates claim | Within 10-14 business days | All submitted documentation |

| Decision & Payment | Approval or denial and payment | Within 20-30 business days | Approved claim form |

Risk Assessment and Mitigation Strategies

Effective emergency travel insurance for corporations requires a proactive approach to risk assessment. Understanding potential pitfalls and implementing mitigation strategies is crucial for safeguarding employees and minimizing financial exposure during business trips. A robust risk assessment process allows businesses to tailor insurance policies to specific needs and proactively address potential issues.

Tailoring policies to the unique risk profile of a company is essential. A company that primarily operates in stable, developed regions will have different risks than a company that frequently sends employees to emerging markets. Understanding these risks and developing strategies to minimize them can greatly improve the effectiveness of emergency travel insurance.

Potential Risks Associated with Corporate Travel

Identifying potential risks is the first step in a comprehensive risk management strategy. Corporate travel exposes employees to a variety of hazards, from natural disasters and political instability to medical emergencies and personal safety concerns. These risks vary depending on the destination, duration of travel, and nature of the employee’s work. Factors such as remote locations, security concerns in specific regions, and the individual’s personal health conditions can significantly impact the risk profile.

Risk Assessment Methodology for Tailored Policies

Risk assessments provide a structured approach to evaluate the potential hazards associated with corporate travel. These assessments should consider factors like the destination’s security rating, travel duration, the employee’s specific job role and health conditions, and the overall travel itinerary. By meticulously evaluating these variables, companies can gain a deeper understanding of the specific risks their employees face and tailor insurance policies accordingly.

Predictive Modeling for Corporate Travel Risk

Predictive modeling, using statistical analysis and historical data, can assist in assessing potential risks. For example, analyzing past travel incidents, news reports on destinations, and even social media sentiment can provide valuable insights. This approach allows companies to forecast potential risks and proactively implement preventive measures, ultimately leading to safer and more secure travel experiences. By analyzing historical data, corporations can identify trends and patterns in potential risks, enabling them to create more accurate and effective risk profiles.

Proactive Measures for Minimizing Risks During Employee Travel

Proactive measures are crucial for minimizing risks. These measures should be integrated into the company’s travel policy and communicated effectively to employees. Robust travel protocols, including pre-trip briefings, destination-specific safety guidelines, and emergency contact information, can significantly reduce the likelihood of unforeseen events.

Examples of Preventative Measures

- Pre-trip briefings: Providing employees with detailed information about the destination, including potential safety risks, local laws, and emergency contact numbers.

- Travel advisories: Staying informed about current travel advisories and warnings issued by governmental bodies or reputable travel organizations. This includes staying updated on potential security threats, natural disasters, and health concerns.

- Emergency contact lists: Establishing a clear and accessible emergency contact list for employees, including company contacts, family members, and local emergency services.

- Travel insurance policy communication: Communicating the specific details of the emergency travel insurance policy to employees, outlining coverage limits, procedures for filing claims, and the importance of adherence to policy stipulations.

- Mandatory safety training: Implementing safety training programs for employees traveling to high-risk areas, including awareness of potential threats and emergency response procedures.

Risk Mitigation Strategies and Examples

| Potential Risk | Mitigation Strategy | Example |

|---|---|---|

| Natural Disaster | Travel advisories, alternate routing options, and backup plans. | Providing employees traveling to hurricane-prone regions with evacuation routes and contact numbers. |

| Medical Emergency | Comprehensive medical insurance coverage, pre-trip health assessments, and emergency evacuation plans. | Ensuring that employees have comprehensive medical insurance that covers emergency evacuation to a hospital or a medical facility. |

| Political Instability | Regular monitoring of political situations in the destination, alternative travel arrangements, and clear communication channels. | Maintaining regular communication with employees traveling to politically unstable areas and establishing contingency plans for sudden changes in the travel itinerary. |

| Personal Safety | Local safety guidelines, security briefings, and clear communication channels. | Providing employees traveling to high-crime areas with security briefings and emergency contact numbers. |

Case Studies and Real-World Examples

Understanding the practical benefits of emergency travel insurance requires looking at real-world scenarios. This section explores how such policies have protected corporate travelers and mitigated the financial impact of unforeseen events. It illustrates the value of proactive planning and the crucial role insurance plays in safeguarding employees during business trips.

Illustrative Scenarios of Insurance Benefits

Emergency travel insurance policies can significantly mitigate the financial and logistical challenges faced by corporate travelers during unexpected events. These scenarios demonstrate how insurance can offer critical support in various situations.

- Medical Emergencies: A senior executive traveling to a remote location for a crucial business meeting experienced a sudden, severe illness requiring immediate hospitalization. The high cost of medical care in a foreign country would have been a significant burden without insurance coverage. The policy’s comprehensive medical expense coverage, including repatriation, enabled swift and cost-effective medical attention, allowing the executive to recover and return to work without undue financial stress. The insurance payment also covered necessary medication and follow-up care.

- Natural Disasters: A team of engineers deployed to a region struck by a severe earthquake found their hotel and worksite severely damaged. Without insurance, they faced the prospect of lost wages, accommodation expenses, and the logistical challenge of returning home. The policy’s coverage for trip interruption, loss of belongings, and emergency evacuation facilitated their safe return, ensuring they received prompt compensation for expenses. The insurance provided a crucial buffer against the unpredictable and costly consequences of a natural disaster.

- Security Incidents: A group of sales representatives traveling to a politically volatile region experienced a violent demonstration disrupting their scheduled meetings. The policy’s coverage for emergency evacuation, travel disruption, and security-related expenses enabled a swift and safe return to their home country. The insurance also compensated for lost income and additional expenses incurred during the unforeseen situation.

Financial Implications of Emergencies Without Insurance

The financial repercussions of emergencies without insurance coverage can be substantial. Consider the case of a key employee involved in a serious accident during a business trip. The associated medical costs, lost wages, and repatriation expenses could easily bankrupt a business if not for adequate insurance protection. The absence of insurance would not only impact the employee’s well-being but also the company’s ability to maintain its operations. Furthermore, the time lost in dealing with the crisis could result in significant operational delays and lost revenue.

Success Stories from Corporations

Many corporations have recognized the value of emergency travel insurance for their employees, leading to positive outcomes. One company experienced a significant decrease in employee medical expenses and lost productivity after implementing a comprehensive travel insurance program. Another company reported significant cost savings related to repatriation and emergency assistance following several incidents of employee medical emergencies during business trips.

Case Study Table

| Case Study | Type of Emergency | Insurance Coverage | Outcome |

|---|---|---|---|

| Executive Illness | Sudden illness in a foreign country | Medical expenses, repatriation | Prompt medical care, swift return to work without financial burden. |

| Team Earthquake | Natural disaster disrupting travel | Trip interruption, loss of belongings, emergency evacuation | Safe return, compensation for expenses. |

| Sales Representatives Protest | Security incident, violent demonstration | Emergency evacuation, travel disruption, security-related expenses | Swift and safe return, compensation for lost income. |

Wrap-Up

Source: sixtymarketing.com

In conclusion, emergency travel insurance corporate provides a powerful tool for corporations to protect their employees and maintain a positive image. By understanding the various aspects, from policy selection to claim procedures, businesses can proactively mitigate risks and ensure smooth operations, even during challenging travel situations. This comprehensive guide offers practical insights to help corporations make informed decisions and safeguard their valuable assets – their employees.