Executive Travel Insurance Comprehensive Protection

Travel insurance for executives is crucial for navigating the complexities of international travel. It goes beyond standard travel insurance, providing tailored coverage for the unique risks and responsibilities faced by high-level professionals. This guide explores the specifics of executive travel insurance, from understanding potential risks and comparing providers, to customizing policies and navigating the claims process. Protecting your valuable assets, both personal and professional, is paramount when you’re on the go, and this comprehensive resource is your key to understanding how.

This comprehensive overview covers the essential elements of executive travel insurance, from understanding the unique needs of executives to evaluating insurance providers, customizing policies, and handling claims. We’ll dissect the nuanced aspects of coverage, compare policies, and offer practical risk management strategies. We also analyze cost considerations and budgeting to ensure you make informed choices.

Executive Travel Insurance Needs

Executive travel insurance is a critical component of a comprehensive risk management strategy for individuals holding senior positions. It transcends standard travel insurance, providing a tailored level of protection addressing the unique risks and responsibilities inherent in executive international travel. This specialized coverage is designed to safeguard not only the executive’s well-being but also the company’s interests and reputation during critical global engagements.

Potential Risks and Challenges Faced by Executives

Executives undertaking international travel face a range of potential challenges that go beyond the typical traveler’s concerns. These encompass issues from unforeseen medical emergencies to disruptions in business operations. The specific risks and challenges include:

- Medical emergencies requiring extensive treatment, potentially in foreign locations with varying healthcare standards.

- Repatriation costs, especially when faced with critical illnesses or accidents that require immediate medical evacuation.

- Loss of income due to unexpected delays or cancellations of business engagements.

- Liability concerns arising from business dealings or unforeseen circumstances.

- Security risks, including political instability, crime, and terrorism, which may disrupt travel plans and require swift intervention.

- Difficulties in obtaining necessary travel documents or visas.

- Disruptions to business operations due to unexpected delays or cancellations.

- Personal property loss or damage during transit or in foreign locations.

Specific Insurance Coverages for Executives

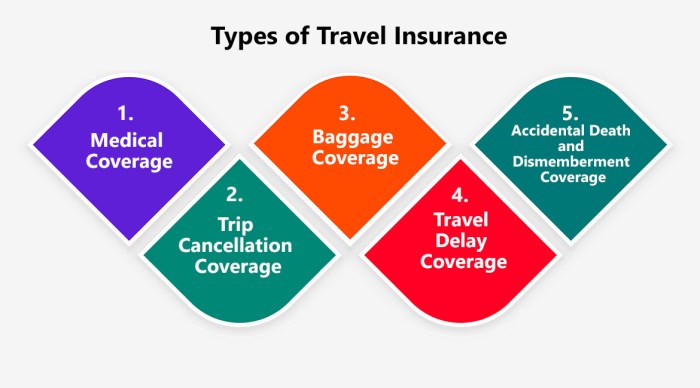

Executive travel insurance policies are specifically designed to address the aforementioned challenges, offering comprehensive coverage exceeding the scope of standard travel insurance. These specialized policies typically include:

- Higher medical expense coverage to account for the potential costs of advanced treatment and specialist care.

- Extensive medical evacuation coverage, potentially including air ambulance services to expedite return to home country for urgent care.

- Repatriation of remains, a crucial aspect of coverage in case of a fatal incident abroad.

- Liability protection for business-related incidents, including legal expenses and potential settlements.

- Loss of income benefits to compensate for missed work due to unforeseen circumstances, including medical emergencies or travel disruptions.

- Coverage for loss of important business documents or equipment.

- Emergency assistance services, including 24/7 access to travel advisors and emergency support.

Importance of Medical Emergencies and Evacuation Coverage

Medical emergencies and evacuation coverage are paramount for executives undertaking international travel. The costs associated with medical treatment and repatriation can be astronomical, especially in foreign countries. Executives may require specialized medical care, and evacuation services, including air ambulance transport, may be crucial for timely treatment.

“A robust medical evacuation plan is essential for executives, especially when dealing with complex medical needs or potentially life-threatening situations in remote or less developed locations.”

Examples of Critical Situations

Executives might encounter critical situations like a sudden illness requiring intensive care, an accident necessitating emergency surgery, or a natural disaster disrupting travel plans. Insurance can mitigate these situations by covering medical expenses, repatriation, and other associated costs. For instance, an executive undergoing a heart attack in a foreign country can be promptly evacuated to a home hospital for specialized care with the help of executive travel insurance.

Comparison of Travel Insurance Policies

The table below contrasts typical travel insurance policies with executive travel insurance policies, highlighting the key differentiators:

| Feature | Typical Travel Insurance | Executive Travel Insurance |

|---|---|---|

| Medical Expenses Coverage | Standard coverage limits | Higher limits, potentially including pre-existing conditions coverage |

| Medical Evacuation | Limited coverage, often excluding air ambulance | Comprehensive evacuation coverage, including air ambulance |

| Loss of Income | Limited or no coverage | Significant coverage for lost business days due to emergencies |

| Liability Coverage | Minimal or no coverage | Specific coverage for business-related liability |

| Emergency Assistance | Basic assistance | 24/7 access to dedicated travel advisors and support |

Insurance Provider Comparison

Choosing the right executive travel insurance provider is crucial for safeguarding valuable assets and ensuring seamless business operations. Factors such as comprehensive coverage, competitive pricing, and responsive customer service are paramount. This section delves into the intricacies of comparing different providers, highlighting key considerations and presenting a selection of leading players in the market.

Selecting an insurance provider involves evaluating several critical aspects. Reputable providers consistently demonstrate a strong track record of fulfilling policy obligations. Coverage options, tailored to specific executive needs, are another key factor. Finally, responsive customer service plays a pivotal role in addressing any issues or concerns swiftly and efficiently.

Key Factors in Provider Selection

Evaluating insurance providers requires a systematic approach. Understanding the company’s reputation, financial stability, and track record of claims handling is vital. The breadth and depth of coverage options available are also critical, considering the unique travel and business needs of executives. Customer service responsiveness is essential for handling emergencies or inquiries promptly.

Top Providers and Their Strengths/Weaknesses

Several insurance providers excel in the executive travel insurance market. A few prominent examples include:

- Company A: Known for its broad coverage, including extensive medical and trip interruption benefits. However, premiums might be slightly higher compared to some competitors. A strong track record of timely claim settlements.

- Company B: Offers competitive pricing with a focus on basic coverage. While not as comprehensive as Company A, it’s a suitable option for executives seeking cost-effectiveness. Customer service response time might be slower than industry leaders.

- Company C: Specializes in customized insurance solutions for high-net-worth individuals. The coverage options are highly adaptable, and the customer service is renowned for its personalized approach. Premiums tend to be higher due to the bespoke nature of the policies.

Executives often consider factors such as their travel frequency, the destination, and the value of their assets when choosing a provider. A frequent traveler might prioritize comprehensive coverage and a responsive customer service team. Executives with substantial assets might opt for providers with high coverage limits and robust financial backing.

Coverage Limits and Premiums Comparison, Travel insurance for executives

A comprehensive comparison of coverage limits and premiums across different providers is presented below. This table aids in evaluating the value proposition of each option.

| Insurance Provider | Annual Premium (USD) | Medical Expense Coverage Limit (USD) | Trip Interruption Coverage Limit (USD) | Baggage Loss Coverage Limit (USD) |

|---|---|---|---|---|

| Company A | 1200 | 500,000 | 50,000 | 10,000 |

| Company B | 800 | 250,000 | 25,000 | 5,000 |

| Company C | 2000 | 1,000,000 | 100,000 | 20,000 |

Note: Premiums and coverage limits are indicative and may vary based on individual circumstances. Consult with a financial advisor for personalized recommendations.

Insurance Policies & Coverage Details

Executive travel insurance policies offer a range of coverage options designed to protect individuals against unforeseen circumstances. Understanding these nuances is crucial for executives to ensure their trips are adequately protected, minimizing financial and personal risks. Careful consideration of specific clauses and exclusions within the policy is essential for obtaining the best possible coverage.

Trip Interruption Coverage

This coverage addresses situations where a trip must be prematurely terminated due to unforeseen events. It typically covers expenses related to unused portions of the trip, such as non-refundable accommodations or cancelled flights. For example, if a hurricane forces an executive to cut short a business trip to a conference, trip interruption coverage could reimburse the cost of unused hotel nights and airfare. This coverage often has limitations, such as a waiting period before benefits are payable and specific reasons for interruption that are not covered. Policy wording dictates whether a pre-existing medical condition qualifies as a covered reason for interruption.

Baggage Loss and Delay Coverage

This crucial aspect of travel insurance safeguards against the loss or damage of personal belongings during a trip. Executives often carry essential documents, equipment, and professional attire, so this coverage is vital. For instance, if an executive’s luggage is lost or delayed during a business trip, this coverage could help with the cost of replacing or re-acquiring essential items. Policy limits are often specified, meaning there are maximum amounts for reimbursement for lost or damaged items.

Medical Expense Coverage

Medical expenses during travel are a significant concern, particularly for executives traveling internationally. Coverage for unexpected medical emergencies, including hospitalization, doctor’s visits, and ambulance transportation, can be crucial. A significant example would be an executive experiencing a sudden illness while traveling abroad. Coverage would cover the cost of medical treatment, repatriation, and necessary accommodations. The policy will often specify maximum amounts for medical expenses and the extent of coverage for pre-existing conditions.

Liability Coverage

This section protects the executive against potential legal liabilities that may arise during their trip. This is particularly relevant for executives on business trips who may be exposed to legal risks. A clear example is if an executive causes damage to property during their travel. The policy would potentially cover the legal fees and any financial obligations associated with the incident.

Legal Assistance Coverage

This is an often overlooked but vital component of executive travel insurance. It provides support in case of legal issues encountered while abroad, such as disputes or arrests. An executive facing unforeseen legal problems while on a business trip overseas would benefit from this coverage. This support may include legal counsel, translation services, and assistance with communication with authorities.

Interpreting the Fine Print

Carefully reviewing the policy’s fine print is paramount. Understanding terms like “pre-existing conditions,” “waiting periods,” and “maximum coverage amounts” is critical for knowing the policy’s limitations. The policy should Artikel specific scenarios for reimbursement, providing examples of how the coverage applies in practice. A thorough review of the policy wording is necessary to avoid misunderstandings and ensure that coverage is in line with anticipated needs.

Common Exclusions and Limitations

| Exclusion/Limitation | Description |

|---|---|

| Pre-existing Conditions | Policies often exclude coverage for pre-existing medical conditions. |

| Acts of War or Terrorism | Coverage may not apply to situations caused by war or acts of terrorism. |

| Personal Misconduct | Actions resulting from intentional misconduct may not be covered. |

| Specific Activities | Certain high-risk activities, such as extreme sports, might be excluded. |

| Travel outside Specified Areas | Coverage may not apply to travel outside the Artikeld areas. |

Policy Customization and Add-ons

Tailoring travel insurance to the unique needs of executives is crucial. A one-size-fits-all approach often falls short of addressing the specific risks and requirements of high-level professionals. This section details the process of customizing policies, considering industry-specific needs, and selecting supplementary coverages for enhanced protection.

Executives frequently face risks not encountered by the general traveler. This necessitates a customizable approach to insurance, allowing for tailored coverage to address unique circumstances. By carefully considering individual needs and industry-specific requirements, businesses can ensure their executives are adequately protected during international travel.

Customizing Policies to Meet Individual Needs

Executives’ travel patterns and responsibilities often vary significantly. Consequently, insurance policies must be adaptable to accommodate individual needs and circumstances. The process involves discussing travel frequency, destinations, duration of stays, and specific activities planned. This comprehensive evaluation allows for the creation of a policy precisely aligned with the executive’s individual travel needs. Careful consideration of each executive’s specific travel schedule and the nature of their work is critical.

Considering Industry Requirements and Job Responsibilities

Certain industries, such as finance or technology, may present unique risks. For example, executives in the technology sector often attend international conferences or visit clients abroad. Their policies may need specific coverage for data breaches or cyber risks that may arise during travel. Understanding the industry-specific hazards allows for the inclusion of relevant clauses within the policy. Executives’ roles also dictate the types of risks they face. A CEO, for instance, may require more comprehensive coverage than a mid-level manager due to their increased responsibility and exposure.

Selecting Add-on Coverages for Enhanced Protection

Several add-on coverages can enhance the protection offered by a standard executive travel insurance policy. Travel assistance services, such as emergency medical evacuation and lost baggage reimbursement, are vital additions. Personal liability coverage is also important to protect against potential claims arising from accidental injuries or property damage. Adding these protections offers a layer of extra security for executives during their travels. For instance, a sudden illness or accident could result in significant financial strain if not covered.

Benefits of Purchasing Supplemental Coverages

Supplemental coverages provide an extra layer of security, mitigating potential financial losses associated with unforeseen circumstances. These include trip interruption, medical emergencies, and lost or damaged luggage. The benefits of these supplementary coverages are multifaceted, offering peace of mind and financial protection. For example, trip cancellation or interruption due to unforeseen circumstances can result in significant financial losses if not covered.

Customizable Options and Associated Costs

| Customizable Option | Description | Estimated Cost (USD) |

|---|---|---|

| Emergency Medical Evacuation | Coverage for repatriation in case of serious illness or injury. | $50-$200 per trip |

| Lost/Damaged Baggage | Compensation for lost or damaged luggage. | $50-$150 per trip |

| Trip Interruption | Coverage for trip cancellations or interruptions due to unforeseen events. | $100-$300 per trip |

| Personal Liability | Coverage for accidental injury or property damage to others. | $50-$100 per trip |

Note: Costs are estimates and may vary based on individual circumstances and the chosen insurance provider.

Claims Process and Procedures

Navigating the claims process can be a crucial aspect of executive travel insurance. Understanding the steps involved and the support provided by the insurance provider can significantly ease the process and ensure timely resolution. This section details the typical claims procedure, including steps for medical expenses, lost baggage, and trip interruptions, alongside examples of successful and unsuccessful claims.

Typical Claims Process

The claims process typically begins with a formal notification to the insurance provider. This initial step involves documenting the event and gathering relevant supporting information. The provider will then assess the claim against the policy terms and conditions, determining coverage eligibility. This evaluation often involves a thorough review of submitted documentation.

Medical Expense Claims

Medical expenses arising from a covered event during travel require a detailed claim form, along with supporting documentation. This includes medical bills, receipts, doctor’s notes, and, if applicable, a statement from the attending physician. The insurance provider will verify the necessity and appropriateness of the medical treatment. A critical aspect of a successful medical claim is adhering to the provider’s guidelines for documentation.

Lost Baggage Claims

Lost or damaged baggage claims typically involve documenting the loss, including a detailed inventory of the lost items and receipts for purchases. The insurance provider may require a police report or other official documentation to validate the claim. A key factor in a successful claim is demonstrating the value of the lost or damaged items, using supporting evidence.

Trip Interruption Claims

Trip interruptions, whether due to unforeseen circumstances or covered events, require clear documentation of the reason for the interruption. Supporting evidence might include flight confirmations, travel itineraries, and official notifications from authorities. The provider will assess the validity of the interruption and whether it meets the policy’s coverage criteria.

Role of the Insurance Provider

Insurance providers play a vital role in supporting executives during the claims process. This involves providing clear instructions, necessary forms, and communication channels. Effective communication and prompt responses from the provider are crucial during the claim resolution. The provider should also offer assistance in navigating the bureaucratic aspects of the claim, if necessary.

Examples of Claims Outcomes

Successful claims often involve accurate documentation, adherence to policy stipulations, and swift communication with the provider. Unsuccessful claims frequently result from incomplete documentation, failure to meet policy requirements, or lack of timely communication. For instance, a claim for a delayed flight might be unsuccessful if the executive did not immediately contact the provider and properly document the delay.

Step-by-Step Guide to Filing a Claim

This table Artikels the essential steps and required documentation for filing a claim:

| Step | Description | Required Documentation |

|---|---|---|

| 1. Notify the Insurance Provider | Contact the provider via phone or designated online portal to initiate the claim process. | Policy number, contact information, date of travel |

| 2. Gather Documentation | Collect all relevant documents supporting the claim (medical bills, police reports, flight confirmations, etc.). | Medical bills, receipts, doctor’s notes, travel itinerary, flight confirmations, police report (if applicable) |

| 3. Complete Claim Form | Fill out the claim form accurately and completely, providing all necessary details. | Completed claim form with all required information |

| 4. Submit Documentation | Submit the claim form and all supporting documentation to the insurance provider via the designated method. | All gathered documentation, including the completed claim form |

| 5. Follow Up | Monitor the claim status and follow up with the provider if needed. | Provider’s communication channels and contact information |

Risk Management Strategies for Executives

Source: joinexec.com

Effective risk management is crucial for executives undertaking international travel. Proactive measures can significantly mitigate potential threats and ensure a safe and productive trip. Understanding and implementing these strategies is paramount for minimizing disruption and maximizing the return on travel investment.

A comprehensive approach to risk management involves a proactive assessment of potential dangers, coupled with preventative measures and contingency plans. This includes not only personal safety and security but also adhering to local regulations and maintaining a high level of awareness.

Preventative Measures for Minimizing Travel Risks

Proactive measures are essential to reduce potential risks during international travel. These steps can significantly enhance the safety and security of executive travel.

- Thorough Research and Preparation: Extensive research about the destination, including local laws, customs, and potential safety concerns, is vital. This preparation allows executives to anticipate and address potential issues effectively.

- Comprehensive Travel Insurance: A robust travel insurance policy tailored to executive needs provides essential financial protection against unforeseen circumstances, such as medical emergencies, trip cancellations, or lost luggage.

- Communicating Travel Plans: Inform trusted contacts of your itinerary, including arrival and departure times, hotel locations, and planned activities. This enables swift communication in case of an emergency.

- Staying Informed on Travel Advisories: Regularly check government travel advisories for updated information on potential risks and safety concerns. This allows for timely adjustments to travel plans, if necessary.

Maintaining Personal Safety and Security During International Travel

Maintaining personal safety and security during international travel requires vigilance and awareness.

- Be Aware of Surroundings: Maintaining situational awareness is crucial. This includes being mindful of your surroundings, avoiding isolated areas at night, and being cautious about who you interact with.

- Using Secure Transportation: Choose reputable transportation services, and be cautious about hitchhiking or using unregistered taxis. Utilizing pre-booked transportation, such as ride-sharing services, or established airport transfers can increase safety.

- Protecting Valuables: Employ secure methods to protect valuable belongings, such as using hotel safes or discreetly storing items during activities. Avoid flashing expensive jewelry or displaying large sums of cash.

- Maintaining Discreet Communication: Avoid discussing sensitive information, such as financial details or business plans, in public places. Use encrypted messaging or secure communication channels when discussing sensitive topics.

Importance of Obtaining Necessary Travel Documents and Visas

Proper documentation is paramount for a smooth and compliant travel experience.

- Valid Passports and Visas: Ensuring that passports and necessary visas are valid and up-to-date is essential for avoiding travel delays or denials at border crossings.

- Copies of Important Documents: Make copies of passports, visas, and other important documents, and keep them separate from the originals. This ensures you have backup copies in case of loss or theft.

- Understanding Local Regulations: Familiarize yourself with local regulations and customs to avoid any potential legal issues. This includes customs procedures and local laws.

Proactive Risk Assessment Strategies

Proactive risk assessment strategies are crucial for anticipating and mitigating potential travel risks.

- Identifying Potential Risks: Thoroughly research potential risks and vulnerabilities related to the destination, including political instability, natural disasters, or local crime rates. This will enable effective preparation and mitigation strategies.

- Developing Contingency Plans: Develop contingency plans for various potential scenarios, such as medical emergencies, flight delays, or lost luggage. Having a plan will help executives respond effectively and efficiently to unforeseen circumstances.

- Regular Monitoring: Maintain regular monitoring of travel advisories, local news, and social media for updated information. This allows for flexibility and adjustments to travel plans if necessary.

Staying Informed About Travel Advisories and Local Regulations

Staying informed is vital for mitigating potential travel risks.

“Regularly checking travel advisories and local regulations is essential for a safe and successful trip.”

Cost Considerations and Budget Planning: Travel Insurance For Executives

Executive travel insurance premiums vary significantly based on factors like destination, duration of stay, coverage limits, and pre-existing conditions. Understanding these costs and planning accordingly is crucial for avoiding financial strain during a trip. Careful budgeting and cost optimization strategies can ensure adequate protection without unnecessary expense.

Analyzing Executive Travel Insurance Policy Costs

Executive travel insurance policies often come with a range of coverage options, influencing the premium amount. Policies tailored for specific industries or professions, such as those for high-level executives in the finance sector, may command higher premiums due to the potential for greater risks. Understanding the specifics of different plans is essential for informed decision-making.

Budgeting for Travel Insurance Premiums and Potential Claims

A comprehensive budget plan should incorporate the estimated premium costs for the chosen policy. It’s wise to factor in potential claim costs as well, as unexpected events can occur. Adequate reserves should be allocated for unforeseen circumstances, allowing for prompt resolution without undue financial burden. Contingency funds can address claims related to medical emergencies or trip disruptions.

Strategies for Optimizing Travel Insurance Costs

Several strategies can help reduce travel insurance costs without compromising essential coverage. Negotiating with insurance providers for bundled discounts, or considering policies with lower coverage limits for non-critical areas, can prove beneficial. Evaluating the extent of coverage needed for different trip scenarios can lead to cost optimization. Choosing a policy that aligns with individual needs and risk tolerance is vital.

Detailed Breakdown of Potential Expenses Related to Travel Insurance

Travel insurance expenses encompass the premium itself, and potential expenses related to claims. Medical emergencies, trip cancellations, or lost baggage can all trigger claims, leading to out-of-pocket expenses. Understanding the different components of the premium is key. Policy deductibles, co-pays, and other associated costs should be carefully assessed.

Example Insurance Plan Costs

| Insurance Plan | Premium (USD) | Coverage Details |

|---|---|---|

| Basic Executive Plan | $500 | Covers medical emergencies, trip cancellations, and lost baggage up to $10,000. |

| Comprehensive Executive Plan | $1,200 | Covers the same as the basic plan, plus extended medical coverage, trip interruption, and additional liability protection up to $50,000. |

| Luxury Executive Plan | $2,500 | Covers the same as the comprehensive plan, plus concierge services, enhanced baggage coverage, and global emergency evacuation assistance. |

This table provides a simplified example of insurance plan costs. Actual premiums will vary depending on individual circumstances. Always consult with the insurance provider for accurate and personalized cost estimations.

End of Discussion

In conclusion, securing travel insurance for executives is a vital step in protecting your well-being and career while traveling. This comprehensive guide provides a framework for understanding the unique needs and considerations involved, empowering you to make informed decisions. From risk assessment to policy customization and claims management, we’ve explored the full spectrum of executive travel insurance. Remember, proactive planning and a thorough understanding of your policy are essential for a smooth and secure travel experience. We’ve examined the intricacies of coverage, comparison of providers, and cost optimization to equip you with the knowledge needed to confidently navigate your next business trip.