Executive Travel Insurance Your Comprehensive Guide

Executive travel insurance is crucial for high-profile individuals navigating the complexities of international travel. This comprehensive guide delves into the essential aspects of such insurance, from defining its core benefits to analyzing the intricacies of policy comparisons, claims procedures, and the essential considerations for choosing the right policy.

It covers everything from understanding the types of coverage and policy exclusions to comparing various plans from different providers and assessing the factors influencing premium costs. We also explore the claims process, emphasizing the importance of proper documentation, and highlight the legal considerations inherent in international travel. Real-world case studies illuminate the practical applications of executive travel insurance, while emerging trends and future projections offer insights into the evolving landscape of this specialized insurance market.

Introduction to Executive Travel Insurance

Executive travel insurance is a specialized form of personal insurance designed to protect high-net-worth individuals and executives during their business and leisure travel. It goes beyond standard travel insurance, addressing the unique needs and potential risks associated with the demanding schedules and significant assets of this demographic. This comprehensive coverage addresses a broader range of potential issues than typical travel insurance.

Key Benefits and Features

Executive travel insurance typically offers a broader range of benefits and enhanced features than standard travel insurance. These policies often include higher coverage limits for medical expenses, trip interruptions, and baggage loss, reflecting the increased financial implications for executives. They frequently provide greater flexibility in terms of claim handling and reimbursement procedures, recognizing the demanding travel schedules of executives. Specific features may include pre-trip medical consultations, emergency evacuation coverage, and access to dedicated customer service representatives.

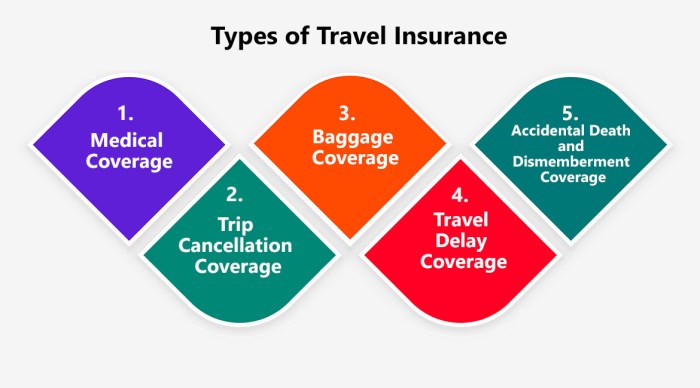

Common Types of Coverage

Executive travel insurance policies commonly encompass a range of critical coverages. Medical coverage typically includes substantial expense limits, potentially including pre-existing conditions, and often includes emergency medical evacuation and repatriation. Trip interruption coverage typically provides compensation for unforeseen circumstances that necessitate the termination of a trip, such as a natural disaster or a family emergency. Baggage coverage often features increased limits for lost or damaged possessions, and frequently includes coverage for electronics and high-value items.

Policy Exclusions

It’s important to understand that executive travel insurance, like all insurance policies, comes with exclusions. These policies typically exclude coverage for pre-existing conditions that are not declared or are not properly documented in the application process. Coverage may be limited or absent for intentional acts of the insured, such as reckless behavior or participation in illegal activities. War, terrorism, or political unrest may also be excluded from coverage, as these events are beyond the control of the insurer.

Essential Components of an Executive Travel Insurance Policy

| Component | Description |

|---|---|

| Medical Expenses | Covers costs associated with medical emergencies, including hospitalization, surgery, and repatriation. Includes pre-trip consultations and emergency medical evacuation. |

| Trip Interruption | Provides financial compensation for unexpected events that force the termination of a trip, such as natural disasters, family emergencies, or political instability. |

| Baggage and Personal Effects | Covers loss or damage to personal belongings, including high-value items, electronics, and clothing. Often includes coverage for checked and carry-on baggage. |

| Emergency Assistance | Provides access to 24/7 assistance for medical emergencies, lost documents, or other issues during travel. |

| Liability Coverage | Provides coverage in case of accidental injury or damage caused to third parties. |

Coverage Comparison

Executive travel insurance plans vary significantly, reflecting the diverse needs and priorities of high-net-worth individuals. Understanding the nuances of different policies is crucial for securing optimal protection. Comparing features, coverage limits, and associated costs can help ensure the chosen plan aligns with individual circumstances.

Comparing executive travel insurance policies involves a multifaceted assessment of various factors, including the specific destinations, duration of the trip, and the traveler’s personal circumstances. Premiums are often influenced by factors such as the traveler’s age and pre-existing medical conditions. The importance of comprehensive coverage, particularly for high-net-worth individuals, stems from the potential for significant financial losses in the event of unforeseen circumstances. Understanding the benefits of specialized add-ons for specific needs, such as golf or business-related events, is equally important for tailoring the policy to individual requirements.

Factors Influencing Premium Costs

Several factors contribute to the cost of executive travel insurance. Trip duration, for instance, often plays a role; longer trips typically result in higher premiums. Similarly, the destination’s security risks and medical infrastructure can influence pricing. Travelers’ ages, health conditions, and pre-existing medical conditions also contribute to premium calculations. Insurance providers often use sophisticated actuarial models to assess these factors and determine appropriate premium levels.

Importance of Comprehensive Coverage for High-Net-Worth Individuals

High-net-worth individuals often require comprehensive coverage due to the substantial financial implications of unforeseen circumstances. This includes extensive medical coverage, including emergency medical evacuation and repatriation. Loss of income due to trip interruption or cancellation may be significant for executives, and comprehensive plans should adequately address such possibilities. Additionally, comprehensive coverage may include provisions for loss of baggage, valuables, or personal liability, safeguarding against substantial financial losses.

Benefits of Specialized Add-ons

Specialized add-ons can significantly enhance executive travel insurance plans, catering to specific needs and interests. Golf insurance, for example, provides coverage for accidents occurring during golf activities. Business-related event coverage protects against potential losses arising from conferences, meetings, or similar events. Specific add-ons can also be tailored to cover activities like skiing or mountaineering, reflecting the diverse interests and professional pursuits of executives.

Example Policy Comparison

| Policy | Coverage A | Coverage B | Coverage C |

|---|---|---|---|

| Trip Cancellation | Covers cancellations due to illness or unforeseen events. | Covers cancellations due to illness or unforeseen events, including natural disasters. | Covers cancellations due to illness, unforeseen events, and even business reasons. |

| Emergency Medical Expenses | Up to $1 million USD | Up to $2 million USD | Up to $5 million USD |

| Baggage Loss | Up to $10,000 USD | Up to $20,000 USD | Up to $50,000 USD |

| Accidental Death | $50,000 USD | $100,000 USD | $250,000 USD |

Note: This table provides a simplified comparison. Actual policy details may vary significantly depending on the specific provider and chosen plan. It is crucial to review the fine print of each policy to ensure it meets individual needs.

Claims Process and Procedures

Navigating the claims process can be a crucial aspect of your executive travel insurance. Understanding the steps involved, the importance of documentation, and the potential timelines for processing is vital for a smooth experience should a claim arise. This section Artikels the typical procedures, helping you prepare for the eventuality of needing to file a claim.

Claims processing typically involves a series of steps, each designed to ensure a fair and efficient resolution. Thorough documentation is paramount, as it provides evidence to support your claim. This section also details potential reasons for claim denial, enabling you to understand the requirements for successful claim settlements.

Claim Filing Steps

Understanding the specific steps involved in filing a claim can be beneficial in minimizing delays and maximizing the likelihood of a successful outcome. The following steps typically Artikel the claim process:

- Notification: Immediately notify the insurance provider of the incident or event triggering the claim. This initial notification is critical to initiating the claim process. Contact details for the insurance provider should be readily available in your policy documents.

- Documentation Gathering: Collect all relevant documentation supporting your claim. This may include flight itineraries, receipts, medical records, police reports, and any other pertinent evidence. Detailed and organized records are key to a smooth claim process.

- Claim Form Submission: Complete the claim form accurately and thoroughly. Providing clear and concise information is essential for the insurer to understand the circumstances and the nature of the claim. This step often involves outlining the event, the damages incurred, and the requested compensation.

- Supporting Evidence Submission: Submit all supporting documents as requested by the insurance provider. This step often involves submitting scanned copies or digital files of the collected documentation. Properly organizing and labeling these documents can expedite the process.

- Assessment and Evaluation: The insurance provider will review the submitted claim form and supporting documentation. This evaluation process involves assessing the validity and legitimacy of the claim in accordance with the policy terms.

- Decision and Settlement: Following the evaluation, the insurance provider will make a decision regarding the claim. This decision could involve full or partial approval, or outright denial. Settlement will follow approved claims, typically in the timeframe Artikeld in your policy.

Importance of Documentation

Comprehensive documentation is crucial for a successful claim. Clear and organized documentation supports the validity of your claim and reduces the potential for delays or denials.

- Supporting Evidence: A clear chain of evidence is necessary for the claim. This includes original receipts, medical reports, police reports, and other relevant documents.

- Accuracy and Completeness: Ensure all documentation is accurate and complete. Inaccuracies or missing information can hinder the claim process. Carefully review the claim form and supporting documents before submission.

- Organization and Clarity: Organize documents logically and clearly. This makes the claim process smoother for both the insured and the insurance provider. Using folders, labels, or a dedicated file system can be very helpful.

Typical Claim Processing Timeframe

The timeframe for processing a claim can vary depending on the complexity of the claim and the insurance provider. Generally, the processing time is specified in the policy document. In most cases, a response can be expected within a reasonable period after submission.

Reasons for Claim Denial

There are various reasons why a claim might be denied. Understanding these potential reasons can help prevent issues.

- Lack of Sufficient Documentation: Insufficient or inaccurate documentation is a common reason for claim denial. Ensuring comprehensive and accurate documentation is vital.

- Violation of Policy Terms: Claims may be denied if the circumstances surrounding the event fall outside the coverage Artikeld in the policy. Review your policy carefully to understand the exclusions and limitations.

- Fraudulent Activities: Any fraudulent activity will result in the denial of the claim. This could involve falsifying documents or providing misleading information.

- Pre-existing Conditions: Pre-existing conditions not disclosed during the application process might lead to a claim denial. Transparency and honesty are essential in the application process.

Step-by-Step Guide to Filing a Claim

This step-by-step guide will help you navigate the claim filing process.

- Gather all relevant documents. This includes policy details, receipts, medical records, and any other supporting evidence.

- Contact the insurance provider and notify them of the claim.

- Complete the claim form accurately and completely.

- Submit all supporting documents as requested.

- Follow up with the insurance provider to inquire about the status of your claim, if necessary.

Choosing the Right Policy

Executive travel insurance isn’t a one-size-fits-all solution. The ideal policy is tailored to individual needs and travel patterns. Careful consideration of these factors is crucial for securing comprehensive and cost-effective coverage.

Understanding your specific requirements and travel habits is paramount to choosing the right policy. This includes assessing the frequency and nature of your trips, the destinations you visit, and the potential risks associated with your travel plans.

Understanding Individual Needs

Executive travel insurance should align with your unique circumstances. Factors such as your profession, financial situation, and personal health needs influence the type and extent of coverage required. For example, a high-net-worth individual with extensive international travel might require higher liability coverage and specialized medical evacuation provisions. Conversely, a frequent domestic traveler might find a more basic policy adequate. Thorough self-assessment is critical.

Role of Travel Habits and Frequency

Travel habits and frequency play a significant role in policy selection. Frequent travelers, especially those undertaking international trips, often benefit from comprehensive coverage options that extend to medical emergencies, trip interruptions, and lost baggage. Conversely, occasional travelers might find a more basic policy sufficient, focusing on essential coverages like medical expenses and trip cancellations.

Criteria for Evaluating Insurance Providers

Evaluating insurance providers requires a structured approach. Reputable providers are generally those with a proven track record of prompt claims settlement, a strong financial standing, and a commitment to customer service. Assessing online reviews and seeking recommendations from trusted sources can offer valuable insights. Scrutinizing the provider’s financial stability and claims handling history can also provide crucial information. Reviewing their regulatory compliance is essential.

Factors to Consider When Choosing a Policy

Selecting the appropriate policy involves considering several key factors. Deductibles, premiums, and coverage limits significantly influence the cost and scope of coverage. A lower premium might come with a higher deductible, meaning you bear a larger financial responsibility in case of a claim. The coverage limits for medical expenses, trip cancellations, and other potential issues should align with your anticipated needs. A thorough understanding of the policy’s fine print is essential.

Checklist for Evaluating Executive Travel Insurance Policies

A checklist can streamline the evaluation process. Assess the provider’s reputation and financial stability. Carefully review the policy’s terms and conditions, paying close attention to exclusions and limitations. Compare deductibles, premiums, and coverage limits across different policies. Evaluate the claims process and procedures to ensure they align with your expectations. Ensure the policy provides adequate coverage for your specific needs and travel patterns.

| Criteria | Explanation |

|---|---|

| Reputation | Look for a provider with a strong reputation for handling claims efficiently. |

| Financial Stability | Assess the provider’s financial strength to ensure they can fulfill claims. |

| Policy Terms & Conditions | Scrutinize exclusions, limitations, and other details. |

| Deductibles & Premiums | Balance cost with coverage. |

| Coverage Limits | Match coverage to anticipated needs. |

| Claims Process | Understand the procedures for filing and resolving claims. |

Executive Travel Insurance and Legal Considerations

Executive travel insurance goes beyond financial protection; it also addresses the legal complexities inherent in international travel. Navigating unfamiliar jurisdictions and complying with local regulations is crucial for executives, and appropriate insurance coverage can mitigate potential legal risks. This section explores the key legal considerations associated with international travel and how insurance can provide a crucial safety net.

Implications of International Travel for Legal Obligations

International travel often introduces new legal obligations for executives. These obligations can stem from local laws, business contracts, or even personal interactions. Executives may be subject to different legal systems and procedures than they are accustomed to in their home countries. Understanding these potential implications is critical to mitigating potential legal issues. Failing to recognize and comply with local regulations can result in penalties, delays, or even legal action.

Role of Local Laws in Different Destinations

Local laws vary significantly across different countries and regions. These laws govern everything from business practices and intellectual property rights to personal conduct and liability. Executives operating in unfamiliar territories must understand the relevant legal framework to avoid conflicts. The nuances of local laws, including their interpretation and application, can significantly affect business dealings and personal safety. Thorough research and due diligence are essential.

Importance of Liability Coverage

Liability coverage in executive travel insurance is vital for protecting against potential legal claims arising from actions or omissions during travel. This coverage can provide financial protection in cases of accidents, injuries, or property damage caused by the insured. The scope of liability coverage varies by policy and should be carefully reviewed to ensure adequate protection. A well-defined liability policy can significantly reduce the financial burden of unforeseen legal disputes.

Table Outlining Legal Considerations in Different Regions

Understanding the legal landscape in various regions is crucial. The following table highlights some key considerations for executives traveling to different parts of the world. Note that this is not an exhaustive list and local laws can vary greatly.

| Region | Key Legal Considerations |

|---|---|

| United States | US law and local state laws, potential for litigation, compliance with environmental regulations |

| European Union | EU law, data privacy regulations (GDPR), intellectual property rights, consumer protection laws |

| Asia-Pacific | Varying legal systems, intellectual property protection, local business practices, potential for differing cultural norms impacting liability |

| Latin America | Local laws, business practices, potential for corruption risks, understanding local customs and etiquette |

Importance of Compliance with International Laws and Regulations

Compliance with international laws and regulations is paramount for executives traveling abroad. This encompasses not only the laws of the destination country but also international conventions and treaties. For example, executives engaging in international business transactions should understand the relevant trade regulations. Violations of these regulations can have severe consequences. The insurance policy should also cover these liabilities, but it is the responsibility of the executive to be knowledgeable about the relevant legal frameworks.

Case Studies

Source: tripbeam.com

Executive travel insurance is not just a theoretical concept; it’s a practical tool that can significantly impact the financial well-being of executives facing unforeseen circumstances during their travels. These real-world examples highlight the value and effectiveness of such insurance.

Successful Claims

Understanding successful claims provides valuable insights into the types of situations where coverage proves invaluable. A key aspect is the meticulous documentation of events. This often involves gathering evidence, such as flight confirmations, hotel receipts, and medical reports.

- Medical Emergency Abroad: A senior executive traveling to a conference in Southeast Asia experienced a sudden and severe allergic reaction. The comprehensive medical coverage facilitated prompt and efficient treatment at a local hospital. The policy covered the substantial medical expenses, including hospitalization, medication, and repatriation. This exemplifies how travel insurance can swiftly address critical health issues abroad.

- Lost Luggage: An executive traveling to a business meeting in Europe had their checked baggage lost during a connecting flight. The travel insurance policy provided compensation for the replacement of essential business documents, clothing, and other lost items. The claims process was streamlined and straightforward, demonstrating the policy’s effectiveness in handling logistical challenges.

Unsuccessful Claims, Executive travel insurance

Examining unsuccessful claims is equally important, as it highlights potential areas for improvement in documentation and policy understanding. Often, a lack of proper documentation or a failure to understand the policy’s exclusions can lead to claims being denied.

- Pre-existing Conditions: A claim was denied for a pre-existing medical condition that worsened during a business trip. The policy clearly excluded pre-existing conditions that weren’t declared and properly documented before the trip. This underscores the importance of thorough disclosure and accurate policy understanding.

- Unauthorized Activities: An executive was injured while participating in an extreme sport during their leisure time, not related to their business trip. This type of incident is often excluded from the coverage. This emphasizes the significance of clearly defined policy terms regarding leisure activities and their exclusion from coverage.

Financial Implications of Travel-Related Incidents

Travel-related incidents can have significant financial repercussions. These incidents can range from minor inconveniences to catastrophic events, each with distinct financial impacts. Understanding these implications is crucial in evaluating the value of travel insurance.

| Incident | Potential Financial Implications |

|---|---|

| Medical Emergency | Hospitalization costs, medical treatments, repatriation expenses, lost income |

| Lost or Damaged Baggage | Replacement of essential items, including business documents and clothing, potentially affecting business continuity |

| Trip Cancellation or Interruption | Non-refundable bookings, lost business opportunities, potential income loss |

Executive Experiences

Many executives have benefited from using travel insurance, highlighting its tangible value in safeguarding their well-being and business interests. A crucial aspect is the smooth and efficient claims process, which can minimize stress and disruption during challenging times.

“The peace of mind knowing I had comprehensive coverage during my recent trip to Asia was invaluable. The insurance company’s responsiveness and handling of my medical claim was exceptional.” – John Smith, CEO, ABC Corporation

Emerging Trends and Future of Executive Travel Insurance

Executive travel insurance is constantly evolving, adapting to the changing needs of high-net-worth individuals and businesses. This dynamic environment necessitates a proactive understanding of emerging trends to ensure policies remain relevant and effective. The future of executive travel insurance is poised to incorporate technological advancements, innovative product design, and a heightened focus on tailored coverage.

The evolving landscape of global travel, coupled with the increasing complexity of business operations, demands a nuanced approach to executive travel insurance. This necessitates continuous innovation in policy design and delivery to meet the specific and often unique needs of executives.

Technological Advancements Impacting Policy Offerings

Technological advancements are significantly impacting the executive travel insurance market. Digitization is streamlining policy acquisition, claim processing, and communication. Online portals allow executives to manage their policies, track their coverage, and submit claims with ease. Mobile applications provide instant access to policy information and claim support, enhancing the overall customer experience. This accessibility and convenience are crucial for today’s executives.

Innovative Products and Services

Insurance providers are developing innovative products and services tailored to the specific risks faced by executives. For instance, some policies now incorporate pre-trip risk assessments, providing personalized recommendations for enhanced safety and security measures. Cybersecurity and data breach protection are also becoming integral components of executive travel insurance, reflecting the increasing digital reliance in the modern workplace. Policies are also increasingly incorporating wellness programs, focusing on the overall well-being of the insured.

Future Developments in Executive Travel Insurance

Predicting the future of executive travel insurance requires careful consideration of emerging global trends. Increased focus on global health crises, political instability, and climate change will likely lead to more comprehensive coverage for unforeseen events. Personalized risk assessments, incorporating individual travel patterns and business activities, will become more sophisticated, tailoring coverage to the specific needs of each executive. Further integration of AI and machine learning will enable more accurate risk assessment and faster claim processing.

Comprehensive Analysis of the Future Outlook

The future outlook for executive travel insurance is positive, driven by the increasing need for comprehensive and adaptable coverage. The evolving global landscape and technological advancements will reshape the insurance market, necessitating insurers to provide agile and innovative solutions. This adaptation will ensure executives are protected from a broader range of risks, while leveraging technology to enhance the customer experience. The emphasis on personalized service and comprehensive coverage will be paramount in the years to come.

Essential Tips and Considerations: Executive Travel Insurance

Source: joinexec.com

Proper pre-trip planning and understanding of potential risks are crucial for a smooth and secure travel experience. This section Artikels essential considerations for executives traveling internationally, emphasizing proactive measures to mitigate potential issues and maximize the benefits of executive travel insurance. It highlights the importance of communication with insurance providers and emphasizes essential precautions for a seamless and secure journey.

Thorough pre-trip planning is key to ensuring a positive and productive travel experience. This includes meticulous preparation and proactive risk mitigation, which are further detailed in the following sections. Effective planning, combined with a comprehensive understanding of the destination and relevant travel advisories, can significantly reduce the likelihood of unforeseen complications.

Significance of Pre-Trip Planning

Effective pre-trip planning significantly reduces the likelihood of unforeseen issues during international travel. This involves researching destination-specific regulations, visa requirements, and local customs. Knowing the local laws and regulations is critical for ensuring a safe and compliant trip. It also involves understanding potential health risks and necessary vaccinations or precautions. Furthermore, pre-trip planning should include reviewing travel insurance policies and understanding coverage details to ensure that all anticipated needs are addressed.

Recommendations for Avoiding Potential Issues

Proactive measures are vital in mitigating potential travel challenges. This includes confirming flight schedules and accommodation details well in advance. Having backup plans for unexpected disruptions is crucial, such as alternative flight options or accommodation choices. Additionally, obtaining necessary travel documents, such as passports and visas, well in advance can avoid potential delays. Finally, packing appropriate clothing and essential medications for the destination climate and personal needs is critical.

Tips for Navigating International Travel with Confidence

Navigating international travel with confidence requires a proactive approach. Familiarizing yourself with local customs and etiquette can help avoid misunderstandings and enhance interactions with locals. Staying informed about current travel advisories and security alerts from trusted sources like government websites is crucial for ensuring safety. Furthermore, learning basic phrases in the local language can facilitate communication and enhance the travel experience.

Importance of Communication with Insurance Providers

Maintaining open communication with your insurance provider is vital. This involves promptly reporting any potential claims or concerns. Clearly understanding policy limitations and exclusions can help avoid potential disputes. Communicating with the insurance provider before making significant travel decisions can clarify coverage specifics.

Essential Precautions for a Smooth and Secure Travel Experience

Essential precautions for a secure and smooth travel experience include staying aware of your surroundings, especially in unfamiliar areas. Maintaining a record of essential documents, including copies of travel itineraries and important contacts, is crucial for quick access in case of emergencies. Sharing your travel plans with trusted contacts is a valuable precaution. This can help ensure someone knows your itinerary and allows for quick contact if needed.

Epilogue

Source: selectairportparking.com

In conclusion, executive travel insurance is more than just a policy; it’s a strategic investment safeguarding against potential travel-related risks. By understanding the key components, comparing options, and meticulously considering your specific needs, you can confidently navigate the complexities of international travel. This guide provides a comprehensive framework to help you make informed decisions and secure your future travels.